The term stock is the starting point to invest or trade in stock markets. While most investors may use the terms shares and stocks interchangeably, did you know they are actually different? Yes, you heard that right. There are a few basic pointers that highlight the differences between these terms. Check out this blog to know the true meaning of the terms shares and stocks and the key differences between them.

Read More: Stocks or Mutual Funds - Which is better?

Shares represent the single unit of equity capital of the company and also provide ownership to the shareholders to the extent of shares held by them. This implies that when one buys shares, they become part owners, holding a piece of the company's equity. These shares of the listed companies are then traded on the stock exchanges like the NSE and BSE. Shareholders of the company are entitled to voting rights as well as a share of the company profits in the form of dividends. However, it's essential to note that the performance of these shares is influenced by various factors such as market trends, economic conditions, and the company's success.

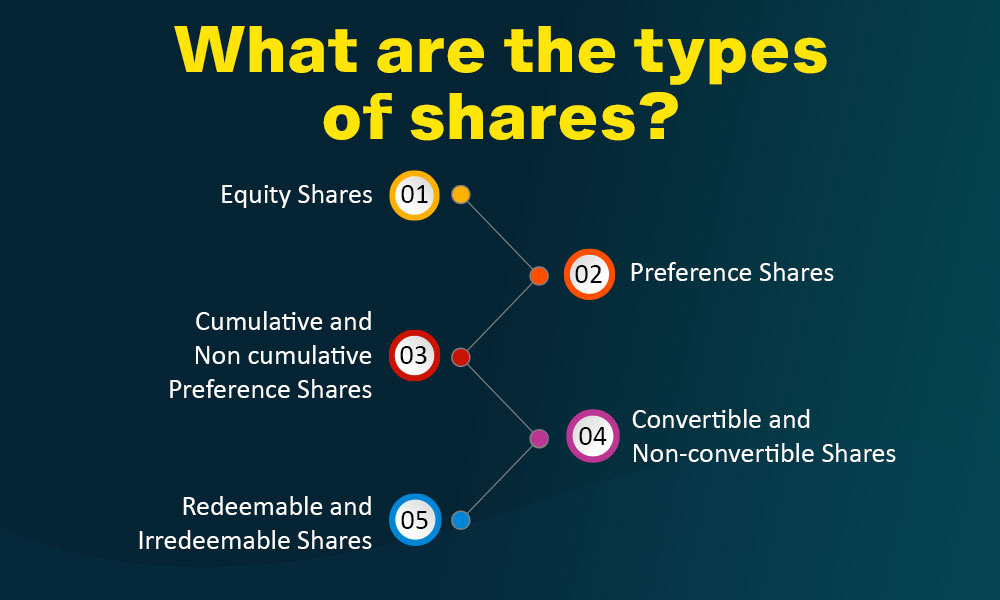

Some of the types of shares and their details are mentioned below.

Equity shares represent ownership in a company and give shareholders voting rights in decision-making processes.

Shareholders of equity shares are entitled to a portion of the company's profits in the form of dividends.

However, they also bear the risk of losses if the company performs poorly.

In the event of the company's liquidation, equity shareholders have a residual claim on the company's assets after all debts and other obligations are settled.

Preference shares, as the name suggests, come with certain preferences over equity shares.

Preference shareholders receive a fixed dividend before equity shareholders, and in the case of liquidation, they have a higher claim on assets compared to equity shareholders.

However, preference shareholders generally do not have voting rights or they may have limited voting rights.

Cumulative preference shares accumulate any unpaid dividends, which must be paid before equity shareholders receive any dividends in subsequent years.

Non-cumulative preference shares do not accumulate unpaid dividends.

Convertible shares can be converted into equity shares after a certain period, providing shareholders with the option to participate in the company's growth.

Non-convertible shares cannot be converted into equity shares.

Redeemable shares can be bought back by the company after a specified period, returning the principal amount to the shareholder.

Irredeemable shares cannot be bought back by the company.

Stocks, in the context of a company's holdings, refer to the aggregate of shares issued by that company. They represent a person's ownership in one or more companies and are a compilation of individual shares held by an investor, whether an individual or entity. While a company's shares are finite, there is no limit to the amount of stock an individual can hold in their portfolio, which may include shares from multiple companies. For instance, if Mr. A owns 100 shares of Company X out of a total of 10,000 shares, he holds 10% of the stock in Company X. Simultaneously, if he also owns 250 shares of Company Y, which has a total of 5000 shares, he holds 5% of the stock in Company Y. Thus, in Mr. A's portfolio, he has accumulated 10% stock of Company X and 5% stock of Company Y, showcasing his diverse ownership in different companies.

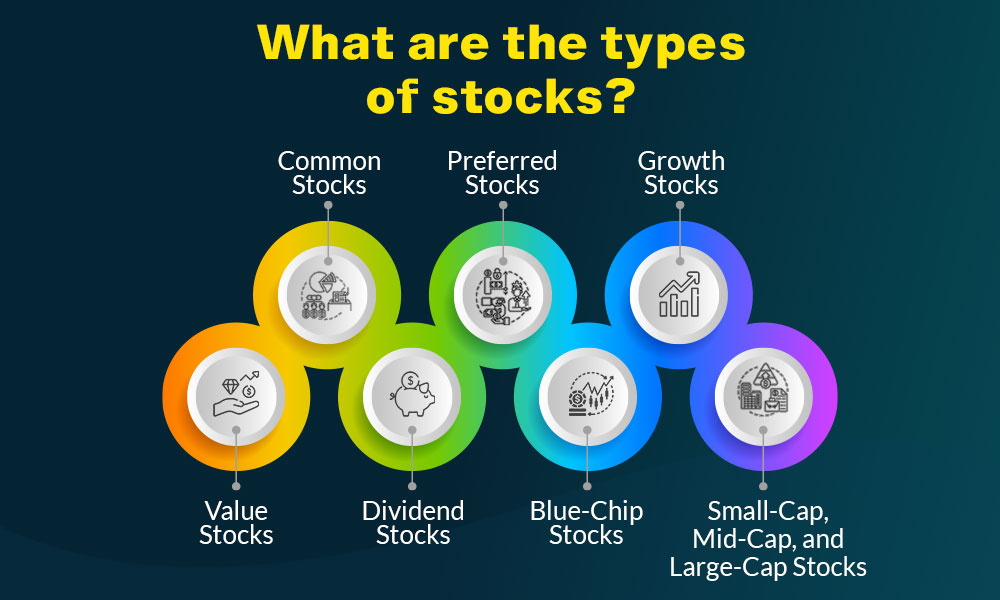

Stocks can be classified into various types depending on the type of company, the type of returns given by the stocks and more. The various types of stocks are discussed below.

Common stocks are the most prevalent type of stock and represent ownership in a company. Shareholders of common stocks have voting rights in company decisions and may receive dividends. However, in the event of liquidation, common shareholders have a residual claim on the company's assets after all debts and other obligations are settled. The value of common stocks can be volatile and is influenced by market conditions and the company's performance.

Preferred stocks come with certain preferences over common stocks. Shareholders of preferred stocks receive fixed dividends before common shareholders, providing a steady income stream. However, preferred shareholders typically do not have voting rights or have limited voting rights. In the event of liquidation, they have a higher claim on the company's assets compared to common shareholders.

Growth stocks are shares of companies that are expected to grow at an above-average rate compared to other companies in the market. These companies often reinvest their earnings into expansion and innovation rather than paying dividends. While growth stocks can offer capital appreciation, they may carry higher risk due to their reliance on future earnings.

Value stocks are shares of companies that are considered undervalued based on fundamental analysis. These companies may have strong financials, but their stock prices may not reflect their intrinsic value. Investors in value stocks aim to capitalise on potential price corrections and expect the market to recognize the true worth of these stocks over time.

Dividend Stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends. These stocks are favoured by income-oriented investors seeking a steady income stream. Dividend stocks can provide a reliable source of passive income in addition to potential capital appreciation.

Blue-chip stocks belong to well-established, financially stable, and reputable companies with a history of consistent performance. These stocks are considered relatively safe investments and are often characterised by a track record of stability, dividend payments, and a strong market presence. Blue-chip stocks are suitable for investors seeking stability and long-term growth.

Stocks are also categorised based on the market capitalization of the issuing company. Small-cap stocks belong to smaller companies, mid-cap stocks to medium-sized companies, and large-cap stocks to large, well-established companies. Each category carries its own risk and return profile, with small-cap stocks often offering higher growth potential but accompanied by higher volatility.

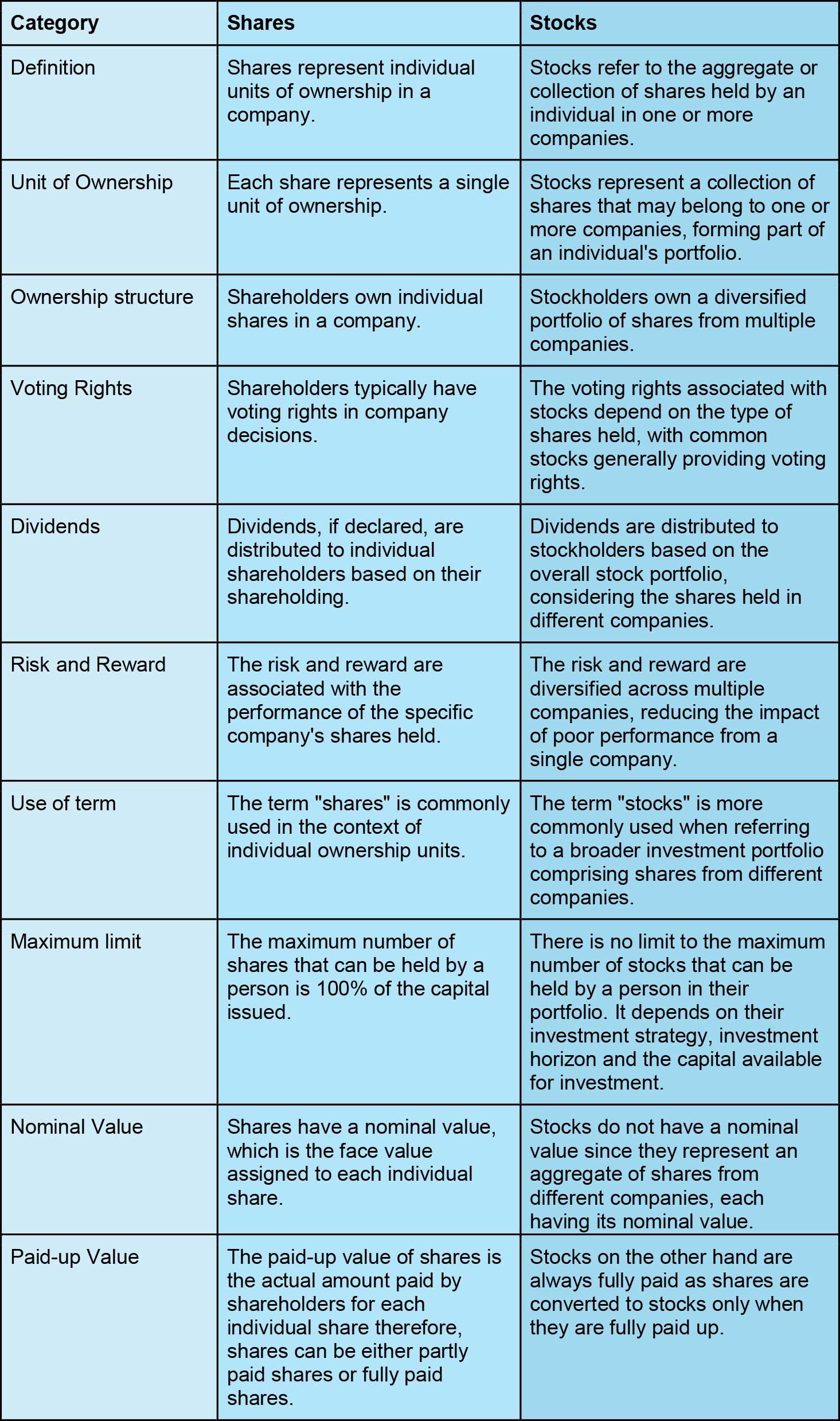

Some of the key differences between shares and stocks are tabled hereunder.

While shares represent direct ownership in a specific company, stocks encompass a broader portfolio of shares thereby providing investors with diversification and a more comprehensive approach to wealth accumulation. Therefore, understanding the distinctions between shares and stocks is crucial for investors to navigate the financial markets effectively.

We hope this blog was able to highlight the fine lines of differences between shares and stocks and enhance your understanding of stock markets a bit further. Let us know if you have any queries or need further information on this topic and we will take it up.

Till then Happy Reading!

Mr. Warren Buffet has a very famous quote: 'If you don't find a way to make mone...

Like starting any new venture, the first step in stock investments is knowing t...

In our previous article, we saw the importance of working capital in keeping the...