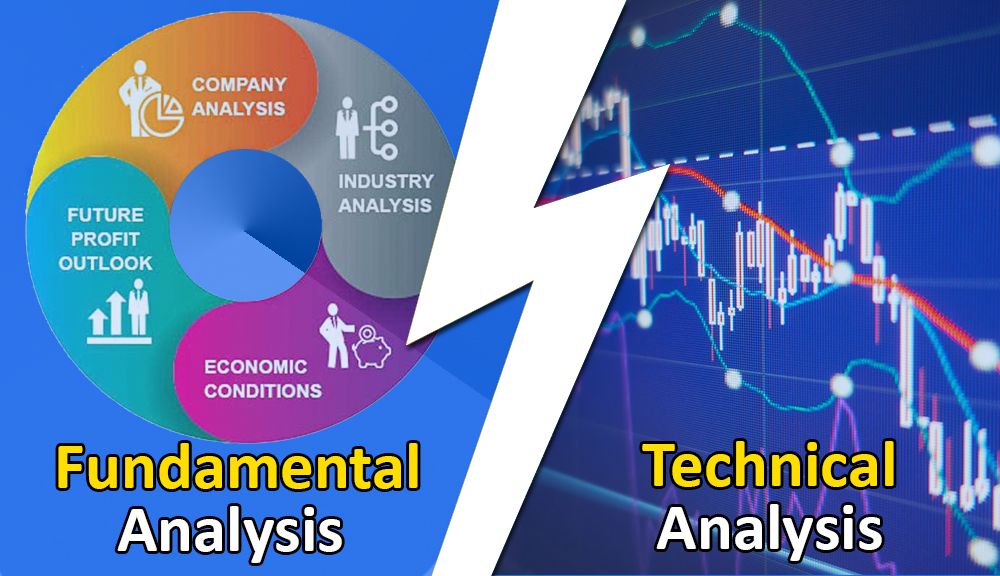

For analyzing the stock markets, Fundamental Analysis and Technical Analysis are the two major methods.

However, both methods are at the opposite ends of the band. Still, both of them are used for researching and forecasting future trends in stock prices. Therefore, most of the new investors and traders have lots of questions.

Like, What is Fundamental Analysis and Technical Analysis of Stock? Which is better Fundamental Analysis and Technical Analysis? So, today let us find the answer to these questions.

Therefore, let us start by understanding the Fundamental Analysis and Technical Analysis.

Fundamental Analysis is the practice of analyzing securities by determining the “basic value” of the stock. So, a detailed inspection of the basic factors has a direct effect on the economy, industry, and the company. In addition, you can identify the opportunities, where the value of the share varies from its current market price.

Technical analysis is a method of determining the “future price” of the stock. So, with the help of charts, you can recognize the patterns and the trends. So, you can determine the share price based on the interaction of demand and supply forces operating in the market.

1. This method is to examine the security and to find the inherent value for long-term investment opportunities. Investors use this method, so they can increase the value of their stocks in the long term.

2. Fundamental Analysis aims at determining the true core value of the stock.

3. The decisions are based on the information available. The statistics evaluated are financial statements, management processes, etc. These are some of the factors that may have an impact on the company's stock prices in the future.

4. You need past and present data for analysis.

5. You can determine the intrinsic value of the stock by analyzing an income statement, balance sheet, return on equity, etc.

6. You can decide the future price of the stock based on past and present performance and success of the company.

1. Technical Analysis is a method of evaluating and forecasting the price of a security in the future. It is based on the price movement and volume of transactions. Therefore helps us in identifying the potential of stock in the future.

2. You can use the Technical Analysis method for analyzing short-term trading. Because this helps in identifying the right time to enter or exit the market.

3. The decisions are based on market trends and the current prices of the stocks. You can calculate the price movements of the stocks by using past charts, patterns, and trends.

4. Technical Analysis requires only the present data for analysis.

5. Similarly, future price trends are analyzed based on chart patterns, technical indicators, etc.

6. You can use charts and indicators to depict the future prices of the stocks.

So, let's check out the conclusion of Fundamental Analysis and Technical Analysis.

In Technical Analysis the trader needs to develop their strategies. Therefore, they need to be flexible with them based on the situation. Because markets behave differently at different times an all-rounder right strategy may not always work.

Investors use Fundamental Analysis so that the value of their stocks increases in the long term. There are differences between Fundamental Analysis and Technical Analysis, but both play an important role in investment goals.

Thestock market never stands still, and prices swing constantly with every new h...

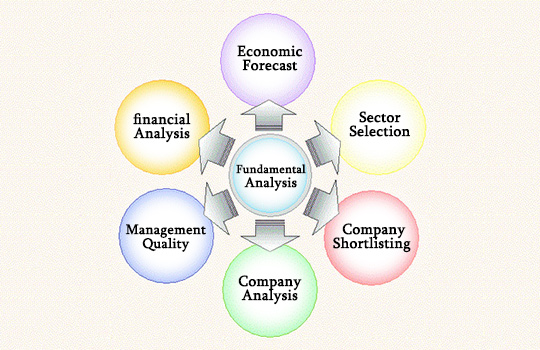

When we talk about fundamental analysis of stocks, it primarily involves analysi...

Unless you are living under a rock, you cannot miss the increasing use of AI in...