Cryptocurrencies are a form of digital assets that can be invested or traded through a digital platform and can be stored on it as well. These assets are stored in a digital wallet and can be easily accessed through a private key which is a unique code that makes it difficult to be copied. Investment in cryptocurrencies and Virtual Digital Assets (VDAs) has seen growing momentum in recent years and become quite attractive. Seeing this growing demand for these dynamic investment options, the government in the budget for FY 2022-23 has laid out a clear plan of taxation on these assets.

Before the budget of FY 2022-23, cryptocurrencies were taxed in line with similar investments like shares due to the lack of any clear direction. To remove any ambiguity, the recent budget introduced section 115BBH. The details of taxation of cryptocurrencies under this section provide that,

Before the budget of FY 2022-23, cryptocurrencies were taxed in line with similar investments like shares due to the lack of any clear direction. To remove any ambiguity, the recent budget introduced section 115BBH. The details of taxation of cryptocurrencies under this section provide that,

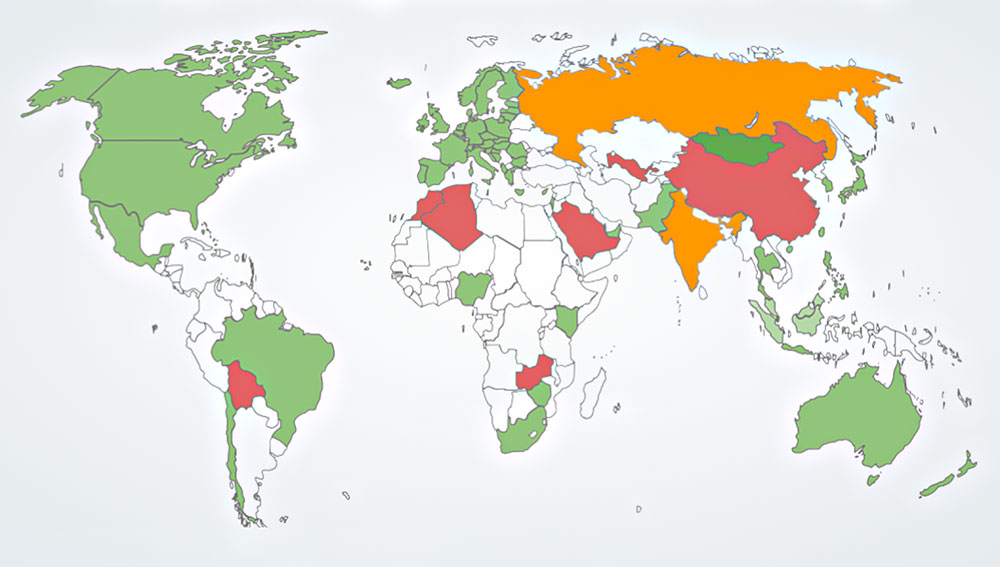

Taxation on cryptocurrencies across the world is different based on their internal policies and treatment of cryptos as an asset or currency. Some of the examples of taxation on cryptos and other VDAs across the world are highlighted below.

Taxation on cryptocurrencies across the world is different based on their internal policies and treatment of cryptos as an asset or currency. Some of the examples of taxation on cryptos and other VDAs across the world are highlighted below.

In the USA, UK, and Canada, cryptocurrencies are treated as capital assets and not currency. Therefore, they are subject to capital gains tax and taxed at the applicable tax rates in the individual countries. If these assets are treated as stocks in trade then they are taxed as per the applicable provisions on business income.

In Dubai, gains from cryptocurrency are tax-free as there is no system of personal tax or taxes on personal income.

In this country too individuals holding cryptocurrency for a long term are not subject to any income tax, businesses however will have to pay tax at the applicable rates.

China altogether rejects cryptocurrencies as legal tender and plans to launch its own digital currency. As they are not recognized as legal tender, taxation is out of the picture.

Similar to China, Russia also does not recognize cryptocurrency as legal tender and therefore does not have any taxes framed for the same.

The tax treatment for the cryptos as announced by the government was a bit different than what was generally perceived. Most experts believed that VDAs would be taxed in the nature of capital assets and the treatment would be similar to taxation on shares and mutual funds. However, with the growing demand for VDAs on the global front, this amendment is still welcomed as it provides a definite answer to the constant ambiguity of taxation on cryptocurrencies and similar assets. By aligning the taxation of cryptocurrencies with that of lottery winnings, gambling, and horse racing, the government has sent a clear message of discouraging the majority of retail investors. This move is with a view to caution investors and traders of the highly volatile nature of cryptocurrencies and the nascent stage at which the awareness relating to them is in the country. Let us know your views on the Indian taxation laws on cryptocurrencies and other similar VDAs. Are they on the right track or do we need changes to the same in the times to come? Also, check out the digital currency real-time simulated trading options available through Bookmap Truedata pricing for Binance, Bitfinex + 20 more crypto exchanges. Disclaimer - This article talks about cryptocurrencies. Truedata Bookmap allows you to analyse and track digital currencies. Crypto products are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.

The second half of the year is always buzzing with excitement of festivals, fami...

Taxation is one of the key points to consider while making any career or investm...

The Union Budget 2025 created a huge buzz due to its changes in the income tax s...