If you have even a remote interest in the share market, you would have heard the term market capitalisation quite often. But do you know that along with market capitalization, there is also another concept of free-float market capitalization? Confused? Do not worry we have got you covered. Read on to know the meaning of market capitalization and free float market capitalization, their differences and other key details. Read More: Why do companies list on stock exchanges? What are the benefits?

If you have even a remote interest in the share market, you would have heard the term market capitalisation quite often. But do you know that along with market capitalization, there is also another concept of free-float market capitalization? Confused? Do not worry we have got you covered. Read on to know the meaning of market capitalization and free float market capitalization, their differences and other key details. Read More: Why do companies list on stock exchanges? What are the benefits?

Market capitalization, often referred to as "market cap," is a measure used to quantify the total value or size of a publicly traded company in the stock markets. It is calculated by multiplying the current market price of a company's outstanding shares by the total number of shares outstanding. In simple terms, market capitalization represents the total worth of a company's equity as determined by the stock market. The mathematical formula to calculate market capitalization is, Market Capitalization = Current Stock Price × Total Number of Outstanding Shares Market cap is often categorised into different segments:

Market capitalization, often referred to as "market cap," is a measure used to quantify the total value or size of a publicly traded company in the stock markets. It is calculated by multiplying the current market price of a company's outstanding shares by the total number of shares outstanding. In simple terms, market capitalization represents the total worth of a company's equity as determined by the stock market. The mathematical formula to calculate market capitalization is, Market Capitalization = Current Stock Price × Total Number of Outstanding Shares Market cap is often categorised into different segments:

Free-float market capitalization refers to the total value of a company's outstanding shares that are available for trading in the stock market. In other words, it represents the value of a company's shares that are not held by controlling stakeholders, promoters, or locked-in investors. Free-float market capitalization is often used to assess the true market value of a company, as it excludes shares that are not actively traded and provides a more accurate representation of the stock's liquidity and investor interest. Stocks with a higher free-float market capitalization tend to have better liquidity and narrower bid-ask spreads, making them more attractive for short-term trading or investment. The free-float methodology is widely recognized globally as the best way to compute equity indices. It involves calculating the index based on the free-float market capitalization of all the companies in it. To find the free-float market capitalization for these companies, specific Investability Weight Factors (IWFs) are applied to their total market capitalization. This method aims to lessen the impact of any single company's role in the index, considering only its actual tradable shares. This reduces the influence of large promoters or strategic holdings, which are usually not tradable. This adjustment ensures that the index truly reflects investment opportunities. The mathematical formula to calculate free-float market capitalization is, Free-Float Market Capitalization = Current Stock Price × Number of Free-Float Shares Where, Number of Free-Float Shares = Total Outstanding Shares - number of shares held by promoters, strategic investors, government, or any other locked-in entities.

Free-float market capitalization refers to the total value of a company's outstanding shares that are available for trading in the stock market. In other words, it represents the value of a company's shares that are not held by controlling stakeholders, promoters, or locked-in investors. Free-float market capitalization is often used to assess the true market value of a company, as it excludes shares that are not actively traded and provides a more accurate representation of the stock's liquidity and investor interest. Stocks with a higher free-float market capitalization tend to have better liquidity and narrower bid-ask spreads, making them more attractive for short-term trading or investment. The free-float methodology is widely recognized globally as the best way to compute equity indices. It involves calculating the index based on the free-float market capitalization of all the companies in it. To find the free-float market capitalization for these companies, specific Investability Weight Factors (IWFs) are applied to their total market capitalization. This method aims to lessen the impact of any single company's role in the index, considering only its actual tradable shares. This reduces the influence of large promoters or strategic holdings, which are usually not tradable. This adjustment ensures that the index truly reflects investment opportunities. The mathematical formula to calculate free-float market capitalization is, Free-Float Market Capitalization = Current Stock Price × Number of Free-Float Shares Where, Number of Free-Float Shares = Total Outstanding Shares - number of shares held by promoters, strategic investors, government, or any other locked-in entities.

When calculating free-float market capitalization, several categories of shareholdings are excluded because they are not easily traded or represent control of the company. These include,

When calculating free-float market capitalization, several categories of shareholdings are excluded because they are not easily traded or represent control of the company. These include,

The free-float factor is a multiplier used to adjust the total market capitalization of a company to arrive at its free-float market capitalization. For example, a free-float factor of 0.60 means that only 60% of the total market capitalization will be considered for calculation.

Entities that are considered non-free float and therefore subtracted from the total shareholding to arrive at the free-float portion include:

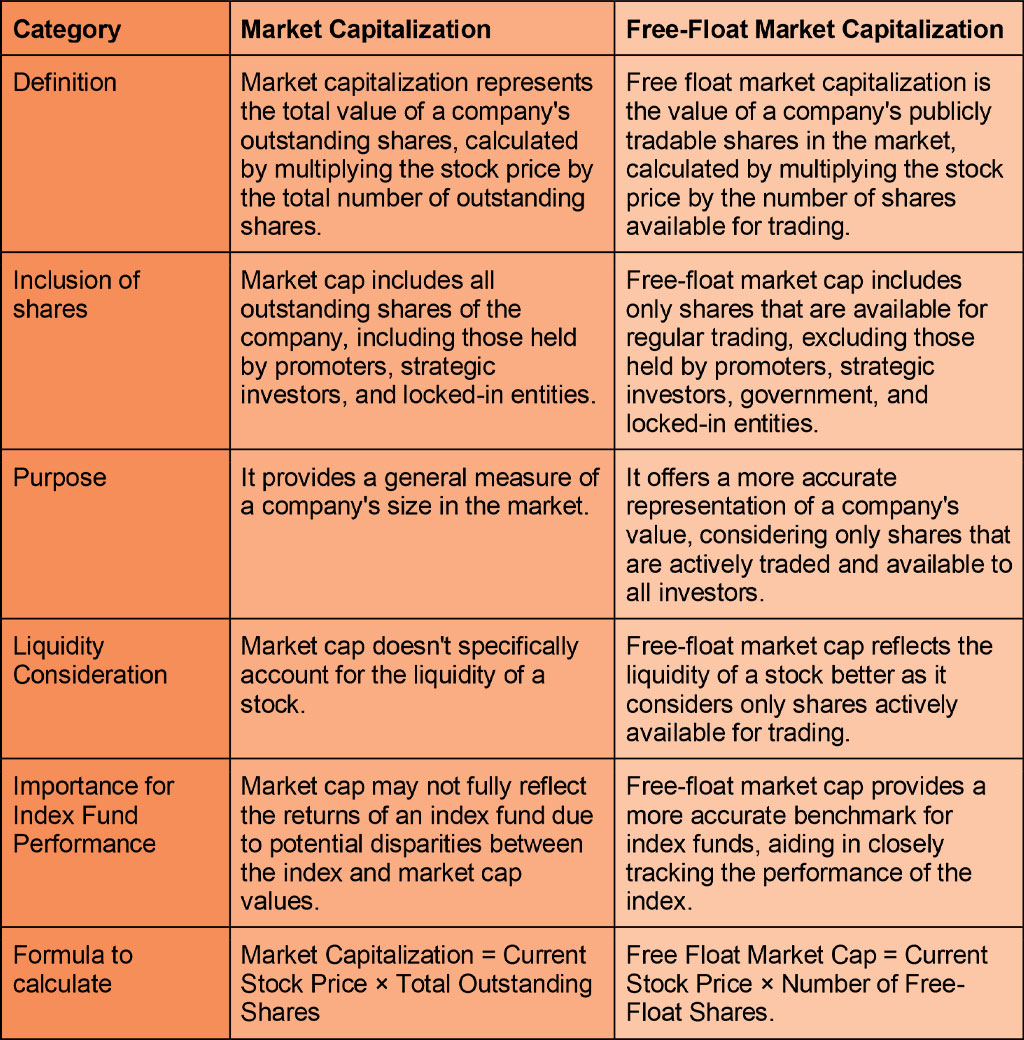

The key differences between market capitalization and free-float market capitalization are tabled hereunder.

Market capitalization and free-float market capitalization are important concepts to understand the potential size of the company as well as the true market value of the company. There is no standard answer to the question of preference between the two as they both serve different purposes. Free-float market capitalization is often considered more accurate for assessing a company's true market value, especially in cases where significant portions of shares are held by insiders and not available for trading. On the other hand, regular market capitalization can still be useful for understanding a company's overall size and potential influence, but it might not fully reflect its actual tradable value. Similarly, from an investor's perspective, free-float market capitalization is generally preferable due to its accuracy in investment assessment and alignment with liquidity considerations. For companies listed on a stock exchange, free-float market capitalization offers benefits in attracting investors, accurately reflecting their value, and potentially leading to better representation in indices. However, both metrics have their place and can provide valuable insights depending on the context.

Market capitalization and free-float market capitalization are important concepts to understand the potential size of the company as well as the true market value of the company. There is no standard answer to the question of preference between the two as they both serve different purposes. Free-float market capitalization is often considered more accurate for assessing a company's true market value, especially in cases where significant portions of shares are held by insiders and not available for trading. On the other hand, regular market capitalization can still be useful for understanding a company's overall size and potential influence, but it might not fully reflect its actual tradable value. Similarly, from an investor's perspective, free-float market capitalization is generally preferable due to its accuracy in investment assessment and alignment with liquidity considerations. For companies listed on a stock exchange, free-float market capitalization offers benefits in attracting investors, accurately reflecting their value, and potentially leading to better representation in indices. However, both metrics have their place and can provide valuable insights depending on the context.

Market capitalization or full market capitalization is broadly used to determine the categorization of a company on an index while free-float market capitalization is used to represent the truer picture of a company as compared to its full market capitalization. These concepts are crucial in understanding the valuation and performance of the company as well as helping investors make suitable investment decisions. We hope this blog was able to provide a better understanding of these concepts and thereby help you in shaping your portfolio. Let us know if you have any questions related to this concept or need further information on the same. Till then Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

In the world of high-speed trading, success often hinges on capitalising on even...

The world of trading is constantly evolving with the use of advanced technology ...