Stock trading has been part of the country for decades. But the amount of exposure and interest that is being shown towards stock trading now is quite high. This increased interest can be attributed to growing investor awareness, ample time to study and take an interest in the stock markets due to the lockdowns and work-from-home options, as well as a search for alternate income or passive income sources in the face of job losses or increased cost of living. Tapping into the increased buzz around stock trading, there have been many gaming apps that allow users to trade using dummy funds or have an experience of stock trading without using actual funds. However, with the order of the NSE, this is now going to be put on hold.

Check out all the details of the NSE order and why it was issued.

Let us begin with the meaning of a cease and desist order and how it will impact the stock gaming apps. A cease and desist order is an order to stop any illegal or alleged illegal activity (cease) and not let it resume. This order can be issued to any Individual, Organization, Company, or other Entity. The cease and desist order indicates that if the said activity is not stopped, the defaulting entity is liable for legal action against them. A cease and desist order usually sent by a public authority is indicative of future legal action or judicial action if the provisions of the order are not met.

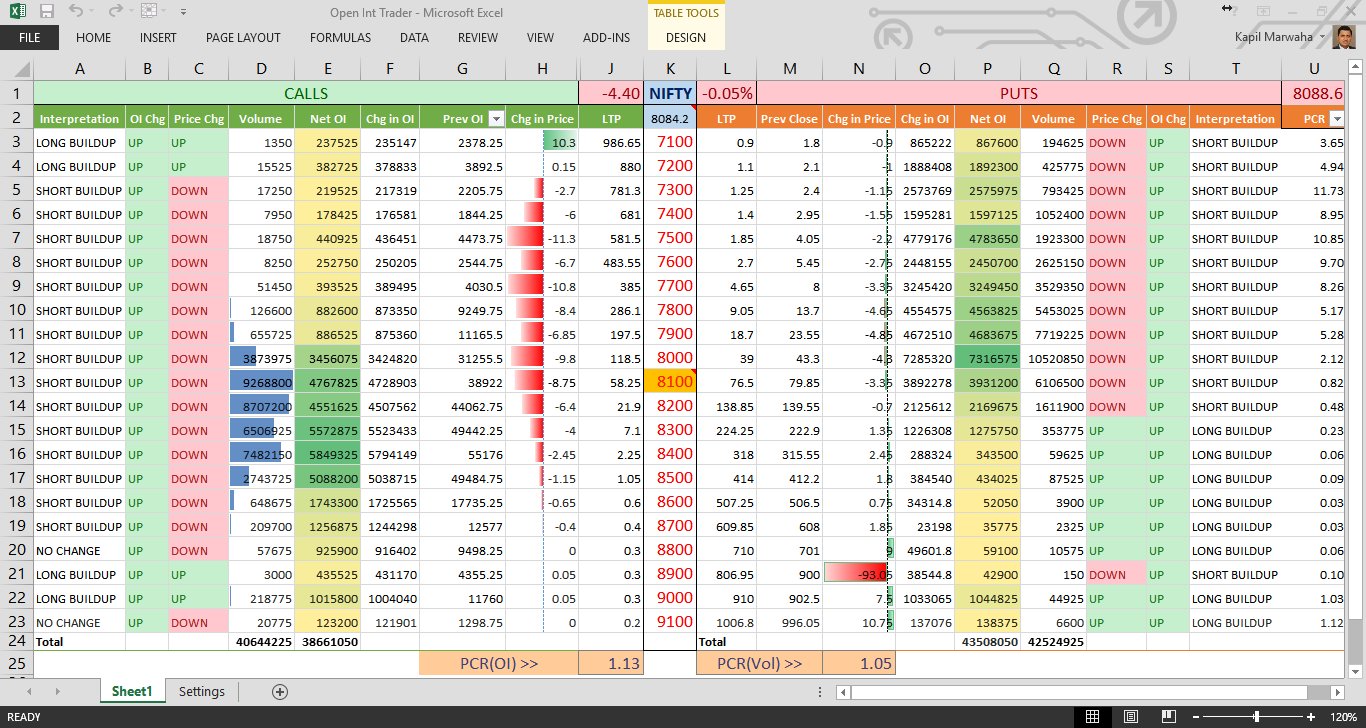

The NSE Data and Analytics Limited has issued an order of cease to approximately half a dozen stock gaming platforms which was reported in the Yourstory article dated October 22, 2022. As per this order, the NSE prohibits these stock gaming apps from using any of its data for gaming or simulating real-time stock trading. Under the order, NSE stated that these apps were providing data that was deceptively similar to that belonging to NSE and was used for commercial purposes, virtual trading, and gaming. These apps also misrepresented that such data was provided by the authority of NSE data on their website and mobile gaming applications.

Therefore, NSE is seeking Rs. 10,00,00,000 in damages from these stock gaming apps for loss of reputation, loss of revenue, and damages on account of violating the intellectual property rights of the NSE.

The boom of the stock trading gaming apps is on the backdrop of a general increased interest in stock trading. These apps allow traders to trade on these apps using fake money but real-time data from NSE and gain hands-on experience in stock trading learning the tricks of the trade along the way. The vast potential of new investors and traders that can come to their platform to take advantage of this experience was the driving force behind many startups in this genre and the Venture Capitals backing them.

However, stock markets are regulated markets with detailed guidelines from SEBI relating to the code of conduct and what falls under the purview of unauthorised actions. As per SEBI (Investment Advisers) Regulations, 2013, no person is authorised to organise or offer any gaming platform, investment/trading schemes or leagues of stock trading related to any securities traded in the stock markets. Therefore, these stock gaming apps, which have been present for quite some time, were in direct violation of the SEBI rules and regulations.

SEBI has initiated a regulatory sandbox where businesses can test their ideas and business models and seek approval for the same for commercial purposes. However, the current issue is outside the purview of such an initiative.

Though the exchanges charge data vendors & certain members of the stock exchanges for the data, they provide their data feed to brokerage firms, free of cost, for their online platforms, and to enable ease of trading for the ultimate consumers. As per SEBI & the stock exchanges, brokers can provide data for educational and training purposes but the use of their data for commercial gaming purposes is banned. This data is also used by many analysts and members on social media sites to share trading tips and tricks, which often results in losses to many retail clients who get lured by the prospects of seemingly making ‘easy money’. This still falls outside the purview of the SEBI regulation as these analysts are not charging any fees for their knowledge. However, here too, when money comes into the picture, there are a whole set of more regulations that get implemented where they have to register with SEBI and abide by its guidelines.

The NSE order asks the stock gaming portals to stop using the NSE data with immediate effect. This would impact the purpose for which these platforms were initiated and will hugely impact their business model. Furthermore, NSE has also asked these portals to disclose the sources through which they received the NSE data. All this does imply that the NSE is striving hard to ensure that the SEBI order is implemented in true spirit by all parties involved.

The idea behind these stock gaming portals is to tap into the growing excitement around stock trading. These portals carry out gambling, betting, and speculation games and, at the same time profit from them under the garb of being an educational platform. This rampant disregard for the SEBI guidelines and misguiding innocent traders under the guise of being authorised from reputed channels needs to be checked and curbed to protect the interest of the end consumer. The crackdown of NSE seems to have been long due and although this business has the benefit of tapping into a huge customer base, the only way going forward is through proper channels and approvals from the regulatory bodies.

So what do you think of the NSE order? Is it appropriate and what the market needs right now? And what about the stock-gaming portals? Should they be continued or should they be a complete no? Is it right for SEBI and stock exchanges to be so strict or should they be lenient?

Do let us know through your comments hereunder. Happy reading!

We at TrueData, respect the regulations and orders issued by SEBI and the stock exchanges from time to time. We do not support or provide market data for any kind of Gaming / Virtual trading / Simulation usage, as per NSE/SEBI guidelines. If you have such requirements, please take approvals from NSE & SEBI before approaching us.

The data provided by TrueData is for the personal use of traders & investors and must stay within the regulations as laid down by SEBI / Exchanges from time to time. The exchanges do update us on any violations on these aspects and expect the same from their data vendors. Based on such updates / other information, TrueData does retain the right to terminate the subscription of any person or platform that is found to have misused or violated any terms, conditions or regulations, or if the stock exchanges have raised any objection relating to them.

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Indian Stock market has two leading stock exchanges - BSE (Bombay Stock Exchange...