Stock market investments have been on the rise in the recent past however, market volatility has been one of the many reasons that have still kept the majority of Indians away from stock markets. To safeguard investors from such volatility, SEBI has put in place certain index-based market-wide circuit breakers that essentially halt market trading in the face of extreme volatility.

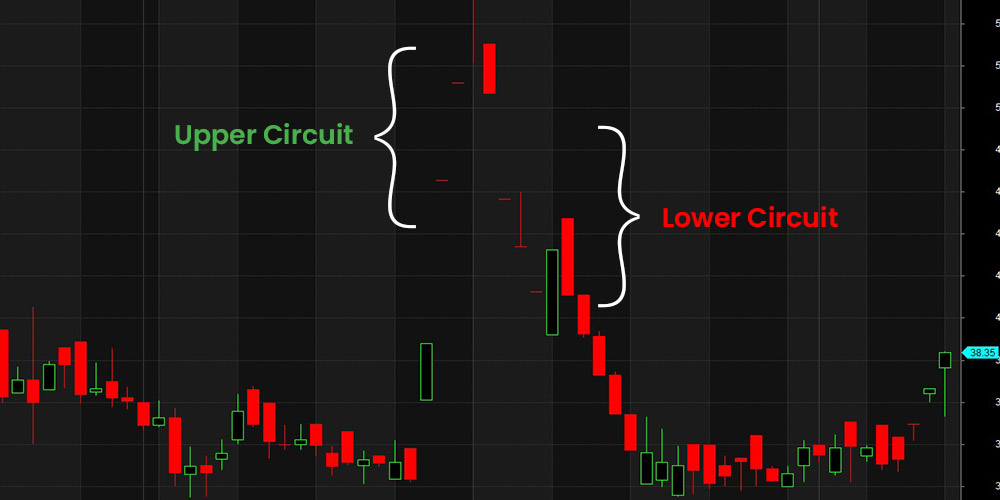

Circuit breakers are the upper and lower limits set on individual stocks and indices which when breached will halt the market trading depending on the level of breach. The upper and lower limits for the indices are set as per the SEBI circular and amendment to the same in 2013.

These limits are not standard for stocks and can range between 2% to 20% depending on the levels at which they are traded and the market conditions. On the other hand for indices, these breakers are set in three levels namely 10%, 15%, and 20%. The circuit breaker limits will be imposed both on NSE and BSE irrespective of which is breached earlier. In such cases, trading is stopped across all categories of securities like stocks and derivatives for the stipulated time. This fail-safe mechanism allows investors to react to market fluctuations in a rational manner rather than making rash decisions.

Once the trading is halted, it will be followed by a 15-minute pre-auction session. This session is the cooling period during which the opening price for the stock or indices is decided based on their demand and the number of participants for the same. The final price, for the indices or the stock as the case may be, is then reflected when the normal trading is returned.

The circuit limits set for the indices as per SEBI guidelines as well as the cooling-off period in each case are tabled below.

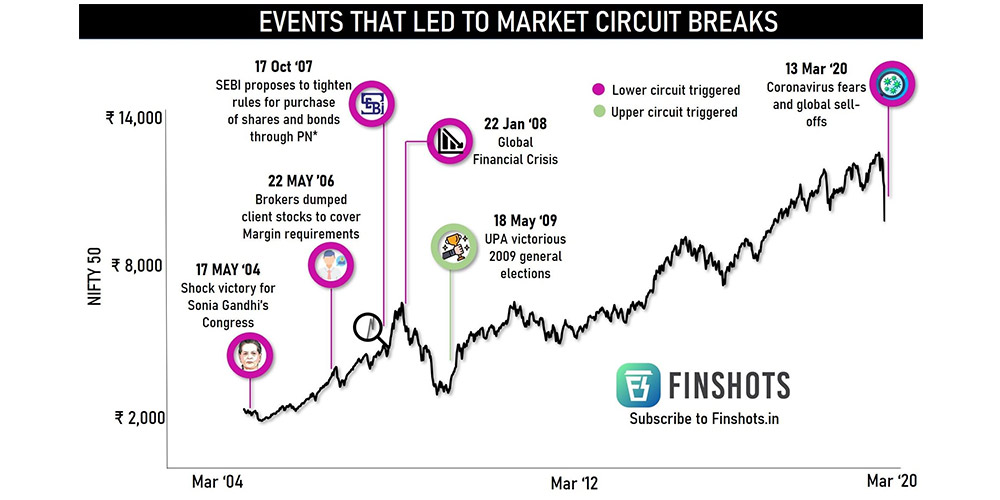

Since the time circuit breakers have been implemented in the Indian stock markets, they have been put in effect on more than one occasion. On May 17th, 2004 the Sensex crashed by 842 points during intraday trading which halted the trading session twice a day. Such incidents were again seen on 22nd May 2006, 17th October 2007, and 22nd January 2008 which resulted in trading being halted. On 18th May 2009, the markets saw the upper circuit being hit twice on account of the UPA government winning the Lok Sabha Elections. The indices hit the circuit breakers again after a gap of 12 years in March 2020 due to the pandemic and the economic slowdown in China. The markets hit a lower circuit by falling over 10% on these occasions and the trading was suspended for 45 minutes.

The system of circuit breakers in the stock exchanges was introduced with a view to safeguard the investors from extreme market volatility and allow them to review their investment decisions without any state of panic. The upper and lower circuit is often hit for individual stocks and the trading for the same is suspended depending on the level of breach. However, when the market indices hit upper or lower circuits, the investor frenzy is quite high. In such cases, it is the small or retail investors or beginners in stock markets who often bear the worst brunt of such volatility. Therefore, a thorough understanding of the market and price trends is quite essential to have a virtually bulletproof investment portfolio that can tide over the majority of the market volatility.

Let us know what you think of the SEBI rules relating to circuit breakers and if you have personally faced any situation where you have benefited from them.

The stock market in India has fascinated general Indian masses for long, perhap...

Options trading is a dynamic and complex arena, filled with intricacies like opt...

Terminology of Stock Market What Is a Stock Market? A stock market is a place w...