Fundamental analysis and technical analysis are the basis or the starting point for investment in any company. This requires a detailed evaluation of the company’s financial statements and its key ratios along with a keen observation of the price and volume movement of the stock in the market. One of the primary financial ratios that provide an outlook on the company’s financial position is EPS which is often reviewed not only by analysts but also investors and other stakeholders like lenders, creditors, etc. Given here is the meaning of EPS and related details of this term. Read More: How to buy your first stock?

Fundamental analysis and technical analysis are the basis or the starting point for investment in any company. This requires a detailed evaluation of the company’s financial statements and its key ratios along with a keen observation of the price and volume movement of the stock in the market. One of the primary financial ratios that provide an outlook on the company’s financial position is EPS which is often reviewed not only by analysts but also investors and other stakeholders like lenders, creditors, etc. Given here is the meaning of EPS and related details of this term. Read More: How to buy your first stock?

EPS stands for "Earnings Per Share" and is a financial metric that measures the profitability of a company. To explain in simple terms, EPS is the measure of how much profit a company makes for each share of its stock. Stocks provide a part of ownership in a company and can be traded in stock markets. EPS tells investors how much money they would earn if they own one share of a company. EPS can be an important parameter for comparing two companies within the same industry to ascertain a better investment option between them. There are various ways of reporting EPS and thereby, EPS can be reported for a single financial year, or it can be calculated on a trailing twelve months (TTM) basis, which takes into account the company's earnings over the past twelve months. EPS can also be reported on a diluted basis, which factors in the potential dilution of outstanding shares from stock options, warrants, and other securities that can be converted into shares.

EPS stands for "Earnings Per Share" and is a financial metric that measures the profitability of a company. To explain in simple terms, EPS is the measure of how much profit a company makes for each share of its stock. Stocks provide a part of ownership in a company and can be traded in stock markets. EPS tells investors how much money they would earn if they own one share of a company. EPS can be an important parameter for comparing two companies within the same industry to ascertain a better investment option between them. There are various ways of reporting EPS and thereby, EPS can be reported for a single financial year, or it can be calculated on a trailing twelve months (TTM) basis, which takes into account the company's earnings over the past twelve months. EPS can also be reported on a diluted basis, which factors in the potential dilution of outstanding shares from stock options, warrants, and other securities that can be converted into shares.

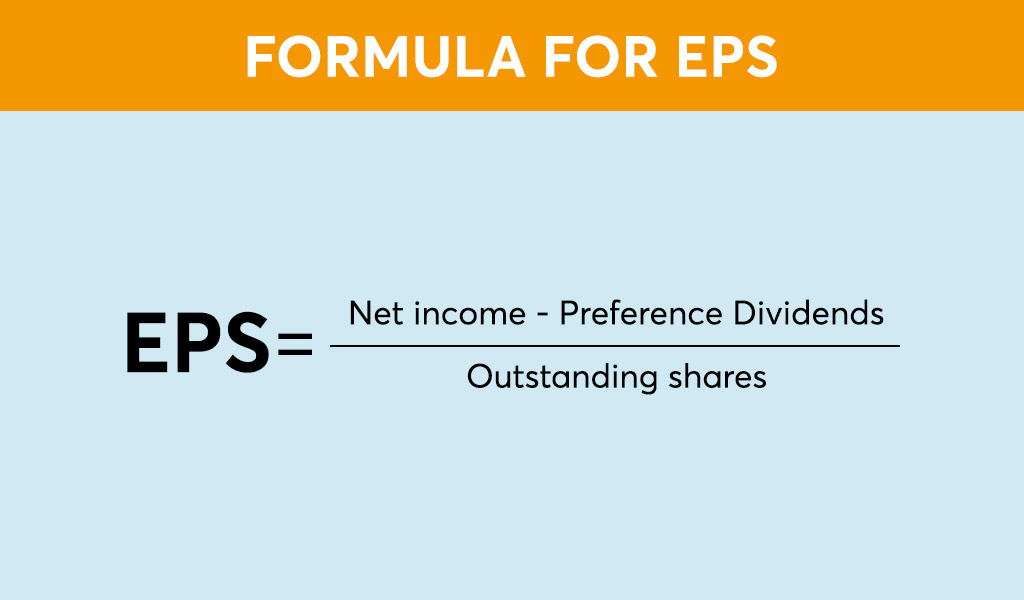

EPS is calculated by dividing a company's net profit by the total number of outstanding shares of the company. There are two essential components of calculating EPS namely, the net income and the number of outstanding shares of a company. Net income is the amount of money that a company earns after paying all its expenses, taxes, and dividends. Dividends are the share of profits disbursed among the shareholders. Finally, outstanding shares are the total number of shares that a company has issued and are owned by investors. The formula for EPS is given below.  Let us understand the calculation of EPS in a better manner through the following example. Consider a company called XYZ Ltd. which has a net profit of Rs. 10,00,00,000 in a financial year. The company has 1,00,00,000 outstanding shares of company, and it has paid Rs. 1,00,00,000 crore in dividends to its preferred shareholders. To calculate the EPS of XYZ Ltd., we would use the following formula: EPS = (Net Profit - Preferred Dividends) / Total Number of Outstanding Shares = (Rs. 10,00,00,000 - Rs. 1,00,00,000) / 1,00,00,000 = Rs. 9 This means that the EPS of XYZ Ltd. is Rs. 9. For each share of XYZ Ltd. that is owned by a shareholder, the company has earned Rs. 9 in profit.

Let us understand the calculation of EPS in a better manner through the following example. Consider a company called XYZ Ltd. which has a net profit of Rs. 10,00,00,000 in a financial year. The company has 1,00,00,000 outstanding shares of company, and it has paid Rs. 1,00,00,000 crore in dividends to its preferred shareholders. To calculate the EPS of XYZ Ltd., we would use the following formula: EPS = (Net Profit - Preferred Dividends) / Total Number of Outstanding Shares = (Rs. 10,00,00,000 - Rs. 1,00,00,000) / 1,00,00,000 = Rs. 9 This means that the EPS of XYZ Ltd. is Rs. 9. For each share of XYZ Ltd. that is owned by a shareholder, the company has earned Rs. 9 in profit.

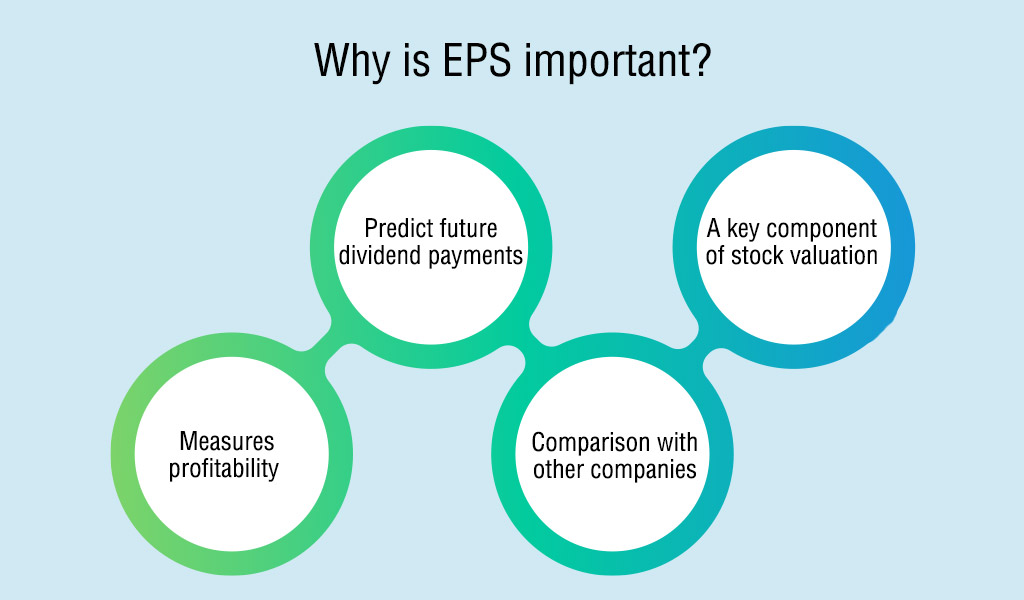

As mentioned above, EPS is an important financial metric that is used to analyse the financial position or the health of a company. Some of the key reasons that make the calculation and analysis of EPS important are highlighted below.

As mentioned above, EPS is an important financial metric that is used to analyse the financial position or the health of a company. Some of the key reasons that make the calculation and analysis of EPS important are highlighted below.

EPS measures the profitability of a company by showing how much profit is generated for each outstanding share of the company. A higher EPS value indicates that a company is more profitable and has the potential to generate greater returns for its shareholders.

Companies that pay dividends to their shareholders often use EPS to determine how much to pay out. A higher EPS value may mean that the company can afford to pay a higher dividend to its shareholders.

EPS allows investors to compare the financial performance of different companies in the same industry. This can help investors make informed decisions and effective comparisons of investment options.

EPS is a key component in the calculation of many stock valuation metrics, such as the price-to-earnings (P/E) ratio. This ratio is used to determine the value of a company's stock in relation to its earnings. A higher P/E ratio indicates that investors are willing to pay more for each unit of earnings generated by the company.

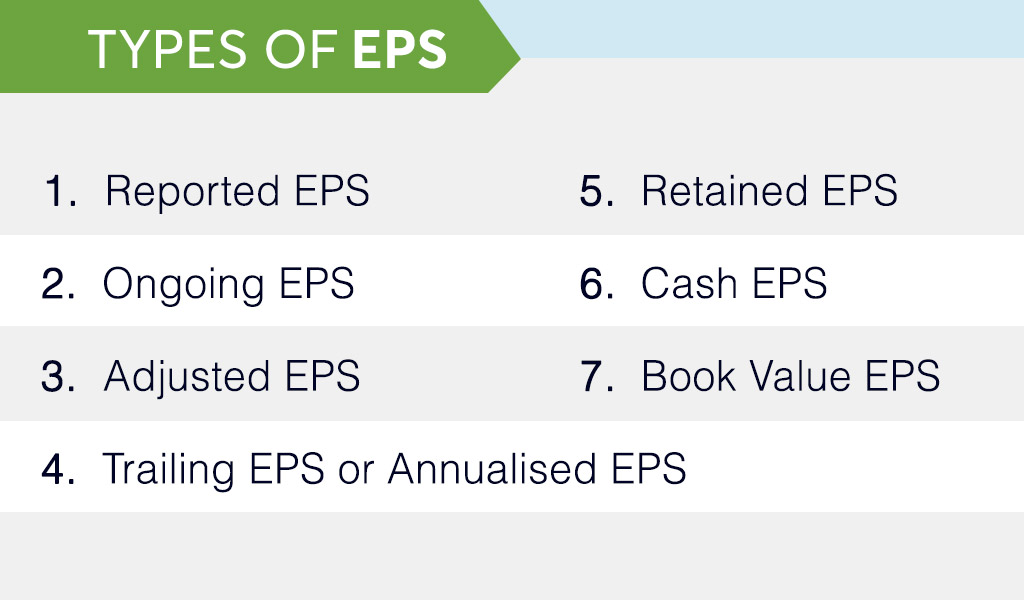

While EPS can be essentially classified into two main categories namely the basic EPS and diluted EPS, there are many other types of EPS that are used to analyse the company’s financial data. These types of EPS and their basic meaning are given below.

While EPS can be essentially classified into two main categories namely the basic EPS and diluted EPS, there are many other types of EPS that are used to analyse the company’s financial data. These types of EPS and their basic meaning are given below.

Reported EPS is the earnings per share figure that a company reports on its financial statements. It is calculated by dividing the net income for the period by the total number of outstanding shares of common stock.

Ongoing EPS, also known as recurring EPS, is a measure of a company's earnings that excludes one-time or non-recurring items such as gains or losses from the sale of assets, restructuring charges, or other extraordinary items. This metric provides a more accurate picture of a company's underlying earnings power.

Adjusted EPS is similar to ongoing EPS, but it also excludes the impact of certain accounting adjustments or other items that are not indicative of a company's ongoing profitability. These adjustments can include changes in accounting methods, the amortization of intangible assets, or the effects of currency fluctuations.

Trailing EPS is the earnings per share figure for the past 12 months. It is calculated by adding up the net income for the four most recent quarters and dividing that number by the total number of outstanding shares of common stock.

Retained EPS is the earnings per share that are retained by the company instead of being distributed to shareholders as dividends. This figure represents the amount of earnings that a company reinvests in its business to support future growth.

Cash EPS is a measure of a company's earnings that is based on its cash flow rather than its net income. It is calculated by adding back non-cash expenses such as depreciation and amortization to net income and then dividing the result by the total number of outstanding shares of common stock.

Book Value EPS is a measure of a company's earnings that is based on its book value, which is the value of its assets minus its liabilities. It is calculated by dividing the book value of the company by the total number of outstanding shares of common stock. This figure represents the amount of earnings that a company generates from its assets.

EPS is a complex financial metric that can be influenced by a variety of internal and external factors, including the company's performance, capital structure, and macroeconomic conditions. Some of the key factors that have a direct impact on the EPS of a company are highlighted below.

EPS is a complex financial metric that can be influenced by a variety of internal and external factors, including the company's performance, capital structure, and macroeconomic conditions. Some of the key factors that have a direct impact on the EPS of a company are highlighted below.

Companies that experience revenue growth tend to have higher EPS because their net income increases. Revenue growth can be achieved through factors such as expanding product lines, acquiring new customers, or entering new markets.

A company's profit margins, or the percentage of revenue that is left over after deducting expenses, can significantly affect EPS. Companies with higher profit margins generally have higher EPS because they generate more earnings for each dollar of revenue.

Share buybacks, in which a company repurchases some of its outstanding shares, can increase EPS by reducing the number of outstanding shares. This increases the earnings available to each share of common stock.

Stock options and convertible securities can dilute the ownership of existing shareholders and reduce EPS. When companies issue new shares to convertibles or exercise stock options, it increases the total number of shares outstanding, which can decrease the earnings available for each share of common stock.

Interest expense, or the cost of borrowing money, is a charge to the company’s profits. Therefore, an increase in the interest cost will have a direct impact on the bottom line and therefore its EPS.

Similar to interest expenses, taxes are also a charge on the company’s profits. Therefore, the amount of taxes a company pays can also affect EPS. Higher taxes can reduce a company's net income and therefore its EPS.

For multinational companies, changes in foreign exchange rates can impact EPS as they can affect the translation of foreign currency earnings into the company's reporting currency.

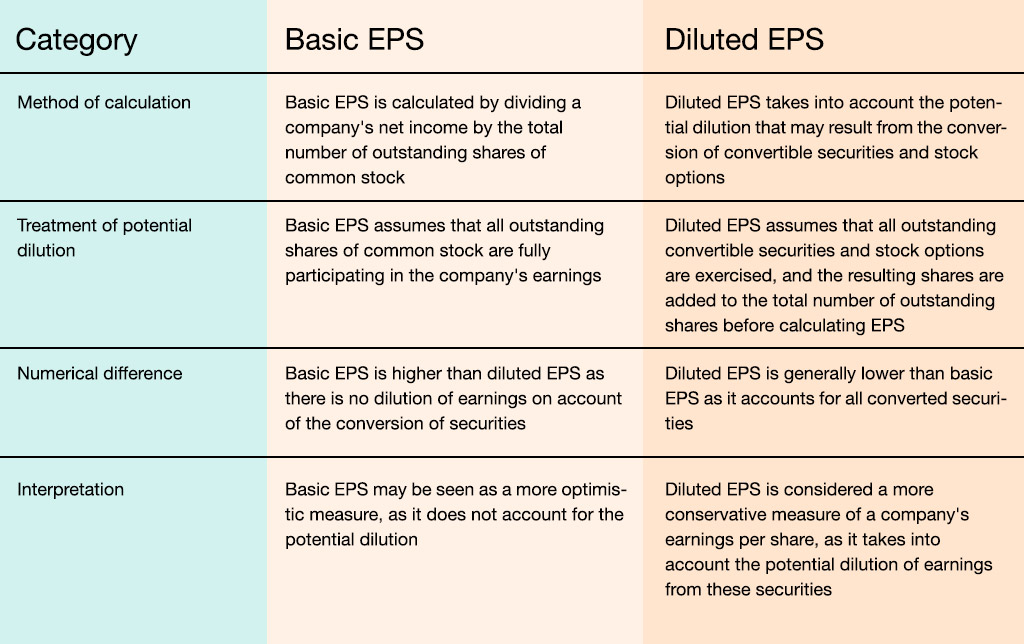

EPS is primarily classified into two categories namely, basic EPS and diluted EPS. The meaning of these terms is given below.

Basic EPS is calculated by dividing the net income available to common shareholders by the weighted average number of common shares outstanding during a specific period. Basic EPS does not take into account any dilution from the issuance of potentially dilutive securities such as stock options or convertible bonds.

Diluted EPS (Earnings Per Share) is a financial metric that represents the earnings of a company per share of its outstanding stock, including all potential shares that could be converted into common stock, such as stock options, convertible bonds, and preferred shares. Diluted EPS is calculated by dividing the company's net income, minus any preferred dividends, by the weighted average number of shares outstanding, including both common shares and potential common shares. Diluted EPS is an important metric because it provides investors with a more accurate measure of a company's earnings per share, taking into account the potential dilution that could occur if all convertible securities were converted into common shares.

While EPS is a widely used financial metric for evaluating the profitability of a company, there are several limitations to consider:

While EPS is a widely used financial metric for evaluating the profitability of a company, there are several limitations to consider:

Company can manipulate the EPS by making significant changes in the accounting methods, share buybacks, and other financial decisions. Therefore, it cannot be considered to be the sole parameter to analyse the company’s data.

EPS may not be a useful metric for comparing companies across different industries, as companies in different industries may have different levels of capital requirements, growth potential, and profitability.

EPS is based solely on a company's net income and number of outstanding shares and does not take into account the quality of earnings. For example, a company may have high EPS due to accounting practices that inflate earnings, such as aggressive revenue recognition or one-time gains.

A company may have high EPS, but if it is not earning a return that exceeds its cost of capital, it may not be creating value for shareholders. EPS does not account for the cost of capital in its analysis and can therefore be misleading.

EPS is one of the many points of reference that is included in the checklist to review the financial data of a company. As mentioned above, there can be multiple types of EPS and their different interpretations enabling the stakeholders to understand the financial statements in a better manner. However, considering its various limitations, it is prudent to use EPS in correlation with other parameters and financial ratios to get an accurate analysis of the company data. We hope this article was informative enough to provide all the relevant details of EPS and its importance for various stakeholders of the financial data. Let us know if you have any queries relating to EPS or need any information on other important financial ratios usually analysed by investors, creditors, and other analysts. Till then Happy Reading!

Thefinancial statements of a company are the mirror that reflects its financial ...

Share prices of a company are affected by numerous external and internal factors...

The term stock is the starting point to invest or trade instock markets. While m...