The year 2023 is about to end in a month and it is almost time to set your new financial goals for the upcoming year. But wait, what about the goals that you had for 2023? Have you managed to meet them? If your answer is no, then let me take you through an effective budgeting strategy that can help you manage your finances more efficiently and thereby take you to the finishing line for your financial goals. This is the 50/30/20 budgeting technique that is popular even after decades of it being in use. Check out this blog to know all about it and how to implement it for successful budgeting and financial planning. Read More: What is Life Stage Investing?

The year 2023 is about to end in a month and it is almost time to set your new financial goals for the upcoming year. But wait, what about the goals that you had for 2023? Have you managed to meet them? If your answer is no, then let me take you through an effective budgeting strategy that can help you manage your finances more efficiently and thereby take you to the finishing line for your financial goals. This is the 50/30/20 budgeting technique that is popular even after decades of it being in use. Check out this blog to know all about it and how to implement it for successful budgeting and financial planning. Read More: What is Life Stage Investing?

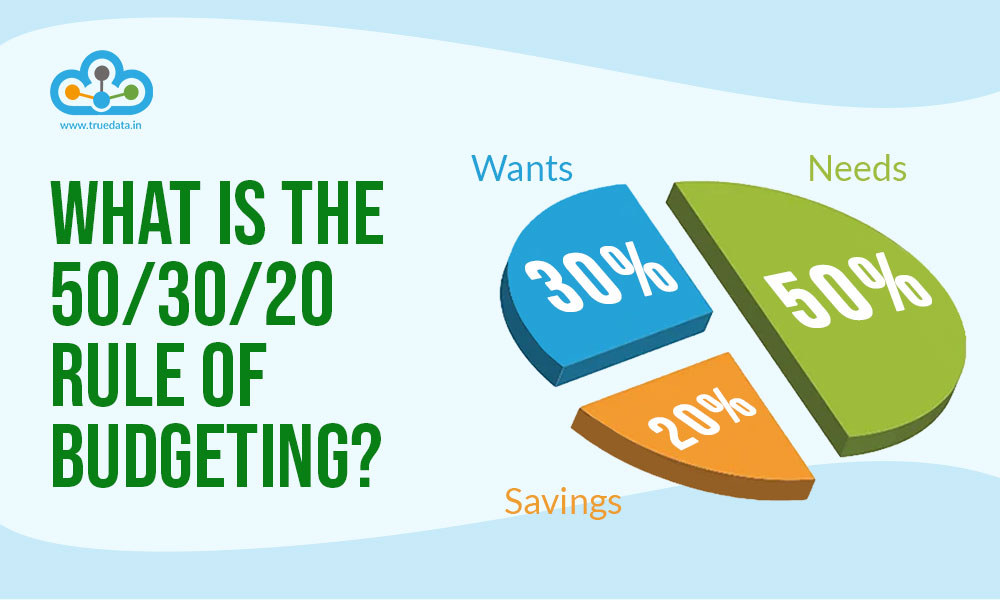

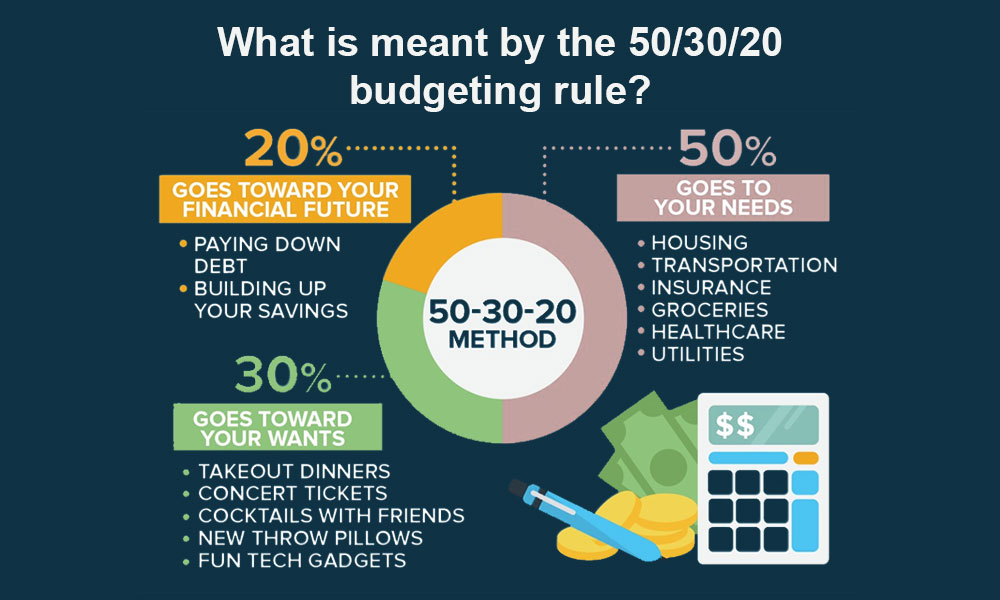

The 50/30/20 budgeting rule is a widely acknowledged and direct method for handling personal finances. In adhering to this approach, an individual designates their post-tax income into three primary categories, namely, 50% for necessities, 30% for desires, and 20% for savings. This implies that a substantial portion of their earnings, precisely half, is reserved for indispensable expenses like housing, utilities, groceries, and transportation, essentially, their needs. The subsequent 30% is discretionary and can be spent on non-essential items such as dining out, shopping, entertainment, and personal indulgences, representing their wants. The remaining 20% is specifically allocated for savings, carefully planned investments and addressing outstanding debts. This disciplined budgeting strategy offers a balanced approach, enabling individuals to fulfil immediate financial obligations while still enjoying lifestyle choices. By creating a clear framework for financial planning, this strategy instils a sense of control over one's finances, fostering a prudent approach to expenditures. Moreover, this method facilitates the establishment of a robust financial safety net for the future, promoting enduring financial stability and resilience in the face of uncertainties.

The 50/30/20 budgeting rule is a widely acknowledged and direct method for handling personal finances. In adhering to this approach, an individual designates their post-tax income into three primary categories, namely, 50% for necessities, 30% for desires, and 20% for savings. This implies that a substantial portion of their earnings, precisely half, is reserved for indispensable expenses like housing, utilities, groceries, and transportation, essentially, their needs. The subsequent 30% is discretionary and can be spent on non-essential items such as dining out, shopping, entertainment, and personal indulgences, representing their wants. The remaining 20% is specifically allocated for savings, carefully planned investments and addressing outstanding debts. This disciplined budgeting strategy offers a balanced approach, enabling individuals to fulfil immediate financial obligations while still enjoying lifestyle choices. By creating a clear framework for financial planning, this strategy instils a sense of control over one's finances, fostering a prudent approach to expenditures. Moreover, this method facilitates the establishment of a robust financial safety net for the future, promoting enduring financial stability and resilience in the face of uncertainties.

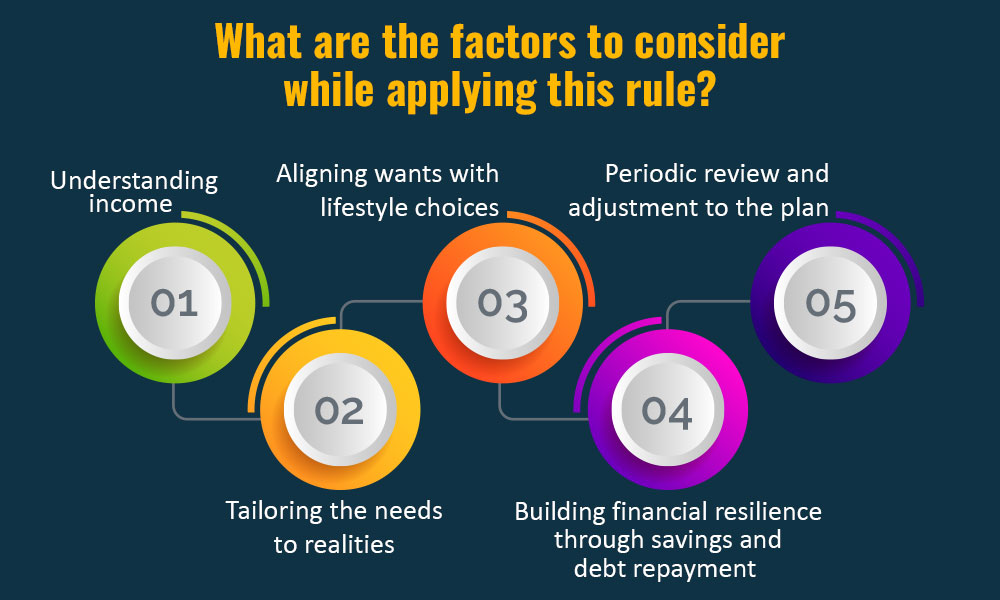

The 50/30/20 budgeting technique is quite simple to implement but needs a clear understanding of the concept. Here are a few factors that can be used to understand the concept better and thereby its successful implementation.

The 50/30/20 budgeting technique is quite simple to implement but needs a clear understanding of the concept. Here are a few factors that can be used to understand the concept better and thereby its successful implementation.

To effectively apply the 50/30/20 budgeting rule, individuals should begin by gaining a comprehensive understanding of their income. This involves calculating the after-tax income accurately, taking into account any deductions or variations in earnings. A clear understanding of income forms the cornerstone for successful implementation, allowing individuals to allocate specific amounts to needs, wants, and savings with precision.

The needs category, constituting 50% of the budget, necessitates careful consideration and customization to local realities. This involves factoring in the cost of living in the specific region. Essential expenses such as rent or mortgage payments, utilities, groceries, and transportation should be tailored to local conditions. Housing costs, which can vary significantly across cities, underscore the importance of adapting this portion of the budget to the economic context of one's location. Additionally, accounting for healthcare expenses and insurance premiums ensures a holistic approach to addressing fundamental needs.

In the wants category, comprising 30% of the budget, successful implementation hinges on aligning discretionary spending with individual lifestyle choices. Recognizing that the cost of living varies across Indian cities, individuals should customize this portion of the budget to reflect personal preferences and priorities. Whether it's dining out, entertainment, or personal hobbies, this category allows for flexibility while maintaining a balance between enjoyment and fiscal responsibility.

The remaining 20% of the budget is dedicated to savings and debt repayment. For this portion of the budgeting strategy, building financial resilience involves prioritising the creation of an emergency fund to cover unforeseen expenses. Long-term savings for significant life goals, such as education or homeownership, should also be a focus within this category. Addressing outstanding debts, including loans or credit card balances, is crucial for fostering financial health and stability.

Recognizing the dynamic economic landscape in our country, individuals must embrace the practice of periodic reviews and adjustments to their budgets. Regular evaluations allow for the adaptation of the financial plan to changing circumstances, ensuring that the 50/30/20 budgeting rule remains relevant and effective. This flexibility is vital for navigating economic changes, inflation, and evolving personal financial goals, contributing to the sustainability and success of the budgeting strategy.

Now that we have seen how to implement the 50/30/20 budgeting rule successfully, let us now focus on its relevance and importance even today at the grassroots level of managing individual finances.

Now that we have seen how to implement the 50/30/20 budgeting rule successfully, let us now focus on its relevance and importance even today at the grassroots level of managing individual finances.

The 50/30/20 budgeting rule is one of the most traditional yet very dynamic approaches to managing personal finances. It allows a person to remain focused on their financial plan at the same time allowing the room for necessary changes as and when needed. Using this budgeting technique from an early stage, preferably at the start of your career, empowers you to manage your finances with utmost efficiency and clarity thereby helping you to reach your financial goals in due time. We hope this blog was able to help you understand the concept of financial planning in a more simpler yet refined manner. Let us know if you have any queries or need further information relating to this topic. Till then Happy Reading!

If you are a shareholder of a company, you would have seen its annual reports co...

In the uncertain times that we live in, the financial security of families is fr...

Imagine you are a fresher and at the start of your career. What you don’t ...