When you think about trading, the first thing that comes to your mind is money. There are tonnes of questions that arise in your mind which definitely involve money - how much money should you invest? How much time should you take to expand your investment profit? Which are the shares you would make the most money in? However, you tend to overlook an important aspect - your money management technique. This aspect is one of the most crucial factors in establishing a flourishing trading profession. Blending the money management technique with a strong marketing strategy would make a formula for robust long-term sustainability in the field of trading. Another tip to keep in mind is to alienate yourself emotionally from trading. Make sure to build a trading system based on confidence and a stress-free environment. So, before we dive in to learn about some of the essential tips and techniques that can come in handy to help you manage your money - let us understand what exactly money management is?

When you think about trading, the first thing that comes to your mind is money. There are tonnes of questions that arise in your mind which definitely involve money - how much money should you invest? How much time should you take to expand your investment profit? Which are the shares you would make the most money in? However, you tend to overlook an important aspect - your money management technique. This aspect is one of the most crucial factors in establishing a flourishing trading profession. Blending the money management technique with a strong marketing strategy would make a formula for robust long-term sustainability in the field of trading. Another tip to keep in mind is to alienate yourself emotionally from trading. Make sure to build a trading system based on confidence and a stress-free environment. So, before we dive in to learn about some of the essential tips and techniques that can come in handy to help you manage your money - let us understand what exactly money management is?

Money Management is the skill of controlling capital by utilizing secure capital risk management. Apart from trading psychology, you need to keep an eye on money management. Freshers in trading often ignore it and run behind only profits and technical interpretation. It is essential to remind yourself repeatedly in the stock market to keep an eye on other traders. In addition to this, competing against other traders requires knowing yourself, your financial statement, and your capital risks.

Money Management is the skill of controlling capital by utilizing secure capital risk management. Apart from trading psychology, you need to keep an eye on money management. Freshers in trading often ignore it and run behind only profits and technical interpretation. It is essential to remind yourself repeatedly in the stock market to keep an eye on other traders. In addition to this, competing against other traders requires knowing yourself, your financial statement, and your capital risks.

Trading begins with discipline and keeping your impulsive emotions in check. Money management techniques further complement this step by helping you decide the amount of money you should invest in trading, cutting your losses, and fixing the time when you should step away with the money still in your account. If you wish to be in the trading system for the long term, you should overview the capital risk involved. It is also essential to consider the pros and cons of the techniques you are choosing - some methods would help in your growth, and some would help manage the risks. It would also be best if you were sure about your purpose, as it would help you decide on entering or exiting a trade - further complicating your chances of evaluating discipline. Although holding a money management system in place demands the merchant to be disciplined and adhere to it, estimating its effectiveness is also required. Once you have set the path to your strategy and have followed it for a specific period, you should invest in a stock. You should assess the loss you have incurred and the profits achieved. Assess the strategy in blend with an overall summary of your dealing plan in general. Generally, slow and steady is the most suitable course for freshers. Over time, they can adjust the technique to provide more extensive trade sizes and more substantial withdrawals as earnings multiply. Even if a tradesperson has exceptional professional or structural interpretation abilities and can generate an 80%-success valuation on stocks, unintended failures from the lack of choosing a money management technique can cause a loss of 20% of trades to clear out the player's account. An investment of time and effort in vital money management skills can hold a dealer profitable even if the chances of winning are 50%. Management of your money should always be refining and growing.

Trading begins with discipline and keeping your impulsive emotions in check. Money management techniques further complement this step by helping you decide the amount of money you should invest in trading, cutting your losses, and fixing the time when you should step away with the money still in your account. If you wish to be in the trading system for the long term, you should overview the capital risk involved. It is also essential to consider the pros and cons of the techniques you are choosing - some methods would help in your growth, and some would help manage the risks. It would also be best if you were sure about your purpose, as it would help you decide on entering or exiting a trade - further complicating your chances of evaluating discipline. Although holding a money management system in place demands the merchant to be disciplined and adhere to it, estimating its effectiveness is also required. Once you have set the path to your strategy and have followed it for a specific period, you should invest in a stock. You should assess the loss you have incurred and the profits achieved. Assess the strategy in blend with an overall summary of your dealing plan in general. Generally, slow and steady is the most suitable course for freshers. Over time, they can adjust the technique to provide more extensive trade sizes and more substantial withdrawals as earnings multiply. Even if a tradesperson has exceptional professional or structural interpretation abilities and can generate an 80%-success valuation on stocks, unintended failures from the lack of choosing a money management technique can cause a loss of 20% of trades to clear out the player's account. An investment of time and effort in vital money management skills can hold a dealer profitable even if the chances of winning are 50%. Management of your money should always be refining and growing.

Before investing your time, money, and effort in a technique, you need to ask yourself which category you fit in? Every person is different, and so there is a difference in trading psychology as well. It would be best if you approached the business with a technique that suits your personality. So, are you the conservative one wishing for stable returns and taking low risks? Or are you the aggressive one wanting higher geometric growth and taking high risks? Depending on the answer to this question, you can dive into the investment - the greater the risk you take, the more are the chances of your potential return.

Before investing your time, money, and effort in a technique, you need to ask yourself which category you fit in? Every person is different, and so there is a difference in trading psychology as well. It would be best if you approached the business with a technique that suits your personality. So, are you the conservative one wishing for stable returns and taking low risks? Or are you the aggressive one wanting higher geometric growth and taking high risks? Depending on the answer to this question, you can dive into the investment - the greater the risk you take, the more are the chances of your potential return.

You can focus on several elements to increase the efficiency of your money management system when trading. Keep reading about a few of the most extensively practiced ones.

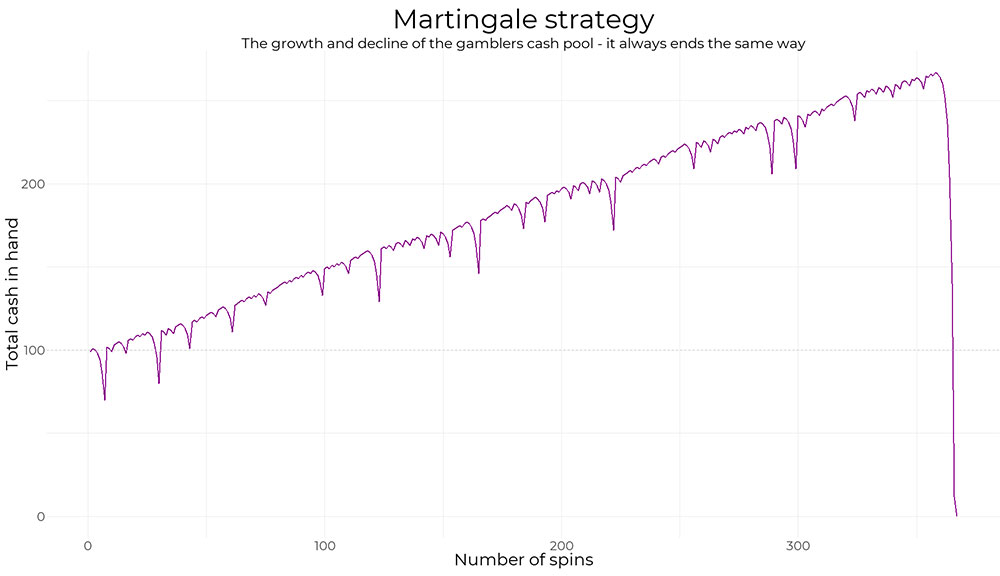

The trading system you choose should empower you to begin at a modest rate and develop significantly, merely that it needs progressing position areas while you are in a failing streak. The Martingale technique is adopted by high-risk traders who are willing to increase the money invested when they start losing - highly relying on doubling up the failing bets. If the doubled chance is also a loss, the method redoubles the risk, and it goes on. It's principally based on the player's inconsistency; it can work only for long-term professional players who already have plenty of capital with them.

The trading system you choose should empower you to begin at a modest rate and develop significantly, merely that it needs progressing position areas while you are in a failing streak. The Martingale technique is adopted by high-risk traders who are willing to increase the money invested when they start losing - highly relying on doubling up the failing bets. If the doubled chance is also a loss, the method redoubles the risk, and it goes on. It's principally based on the player's inconsistency; it can work only for long-term professional players who already have plenty of capital with them.

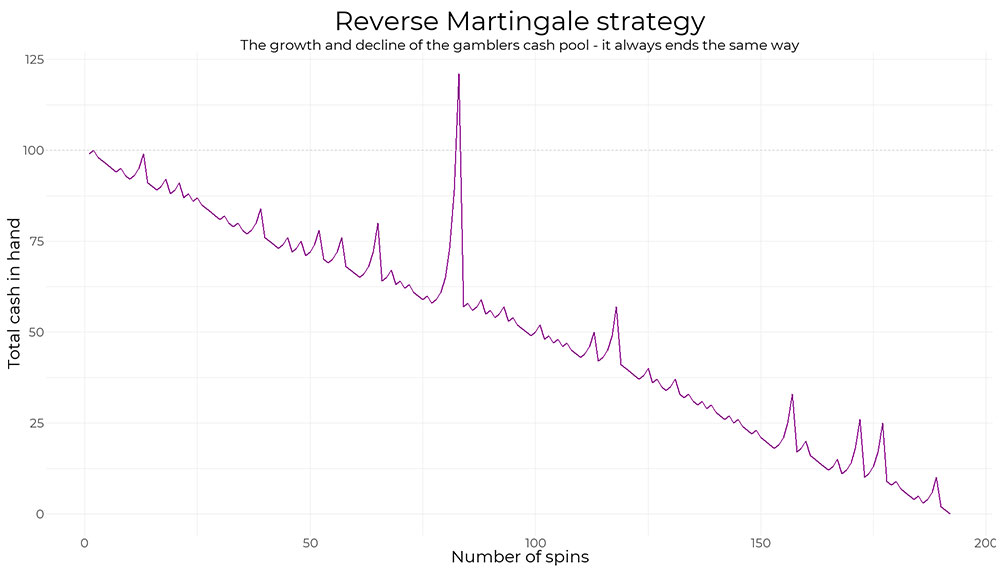

This method is the complete opposite of Martingale's technique. Keeping the new profits or losses in mind, a trader needs to modify the invested position areas' size, raising the risk when profiting and lowering it when failing. Most of the money management systems use the Reverse-Martingale method. They will manage the uncertainty by building a much more diminutive drawdown, creating it much simpler to retrieve. It protects the privileges and restricts the falling streaks. The Reverse-Martingale's chief antagonist is the asymmetrical purchase - gradual decline in the capacity to overcome a loss.

This method is the complete opposite of Martingale's technique. Keeping the new profits or losses in mind, a trader needs to modify the invested position areas' size, raising the risk when profiting and lowering it when failing. Most of the money management systems use the Reverse-Martingale method. They will manage the uncertainty by building a much more diminutive drawdown, creating it much simpler to retrieve. It protects the privileges and restricts the falling streaks. The Reverse-Martingale's chief antagonist is the asymmetrical purchase - gradual decline in the capacity to overcome a loss.

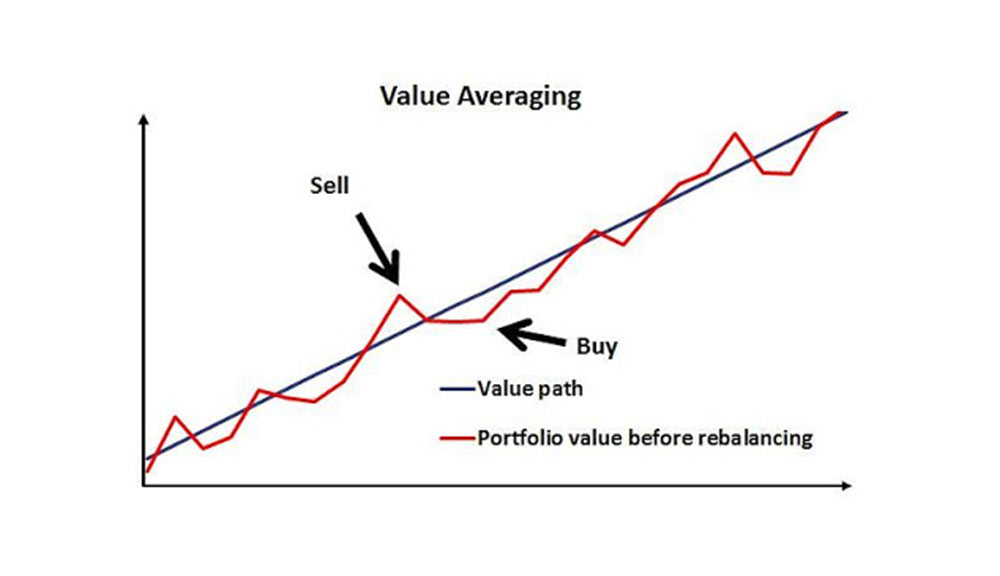

Value averaging is an already developed financing approach with a combined profit factor. It is carried out by spending a set amount to achieve a targeted case price. Following this method, a tradesperson would determine a target price to fund, then set the monthly recurrent additions to sustain that target. This method does not attempt to predict the market's variation but alternately tries to benefit from those inconsistencies. It does not permit the state of the market to determine the financing choices. Strategically, averaging systems urge investors to stay in business when values are squashed; however, it also makes them purchase at high rates.

Value averaging is an already developed financing approach with a combined profit factor. It is carried out by spending a set amount to achieve a targeted case price. Following this method, a tradesperson would determine a target price to fund, then set the monthly recurrent additions to sustain that target. This method does not attempt to predict the market's variation but alternately tries to benefit from those inconsistencies. It does not permit the state of the market to determine the financing choices. Strategically, averaging systems urge investors to stay in business when values are squashed; however, it also makes them purchase at high rates.

Maintaining discipline or following rules is not an easy task - until and unless you are a robot. Humans commit mistakes, and trading is no different - it often happens that you end up making the wrong decisions. To implement discipline in your trading business, you can try using the stop-loss order. It is an order to purchase or trade property as soon as it strikes a negotiated amount, identified as the stop price. The order remains inactive in the trader's network until the stock price reaches the stop, and then it executes the order. This step helps minimize the loss incurred and in locking the profit.

Maintaining discipline or following rules is not an easy task - until and unless you are a robot. Humans commit mistakes, and trading is no different - it often happens that you end up making the wrong decisions. To implement discipline in your trading business, you can try using the stop-loss order. It is an order to purchase or trade property as soon as it strikes a negotiated amount, identified as the stop price. The order remains inactive in the trader's network until the stock price reaches the stop, and then it executes the order. This step helps minimize the loss incurred and in locking the profit.

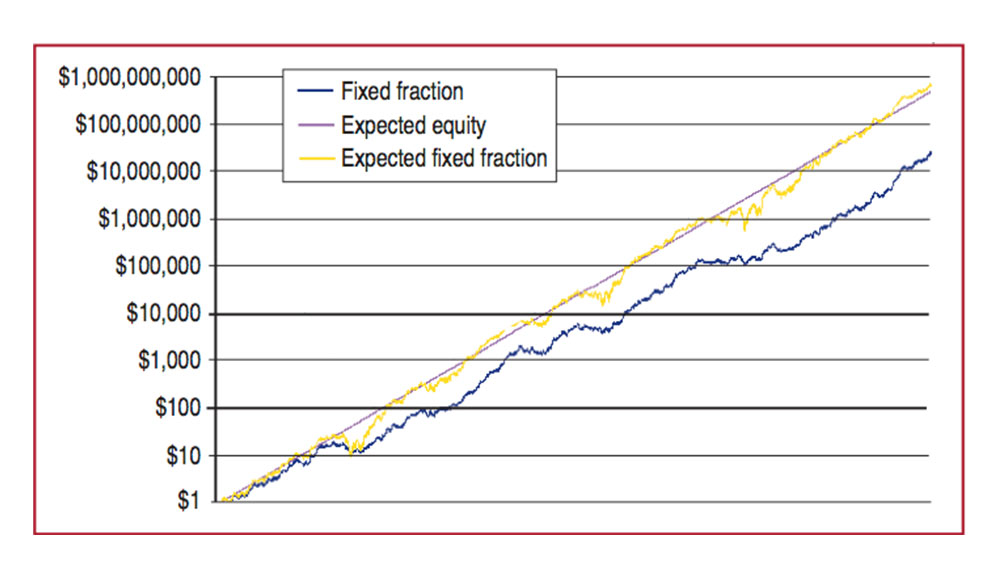

Ralph Vince developed fixed Fractional position sizing in his book called "Portfolio Management Formulas" (John Wiley & Sons, New York, 1990). The Fixed Fractional represents the business trade uncertainty as a portion of the equity. This model directly includes the trade risk factors. The Fixed Fractional model's idea is that the number of traded units is based on the trade risk. The risk is the same interest or portion of the record equity per trade. By always risking the identical interest/area size, the threatened fixed fraction remains proportionate to equity while rising and falling. If a trader will incur a loss, the trade risk is described as the principal amount. Since the trade size stays proportionate to the equity, it is apparently tricky to go completely bankrupt, so the entire ruin's authorized risk is zero.

Ralph Vince developed fixed Fractional position sizing in his book called "Portfolio Management Formulas" (John Wiley & Sons, New York, 1990). The Fixed Fractional represents the business trade uncertainty as a portion of the equity. This model directly includes the trade risk factors. The Fixed Fractional model's idea is that the number of traded units is based on the trade risk. The risk is the same interest or portion of the record equity per trade. By always risking the identical interest/area size, the threatened fixed fraction remains proportionate to equity while rising and falling. If a trader will incur a loss, the trade risk is described as the principal amount. Since the trade size stays proportionate to the equity, it is apparently tricky to go completely bankrupt, so the entire ruin's authorized risk is zero.

Consider it essential to find a money management system apt for your capital. If you intend to stay for a long-time, it is better to keep your mind prepared for incurring losses - today or tomorrow; it is bound to happen. Your money management technique will help you in bouncing back from the failure and withstand the damage. To be successful, you must genuinely believe in the risks you are taking. Many businesspeople state they accept the risks associated with their business and then slump apart as soon as they see the first indication of adverse action against their trade position. Once you have verified that your approach has an advantage and can be traded consistently, it is an opportunity to add money management to your list.

Did you know there are more than 8,50,000 HNIs in India, and this number is expe...

Ask a new investor, what are the top factors to consider while buying stock, an...

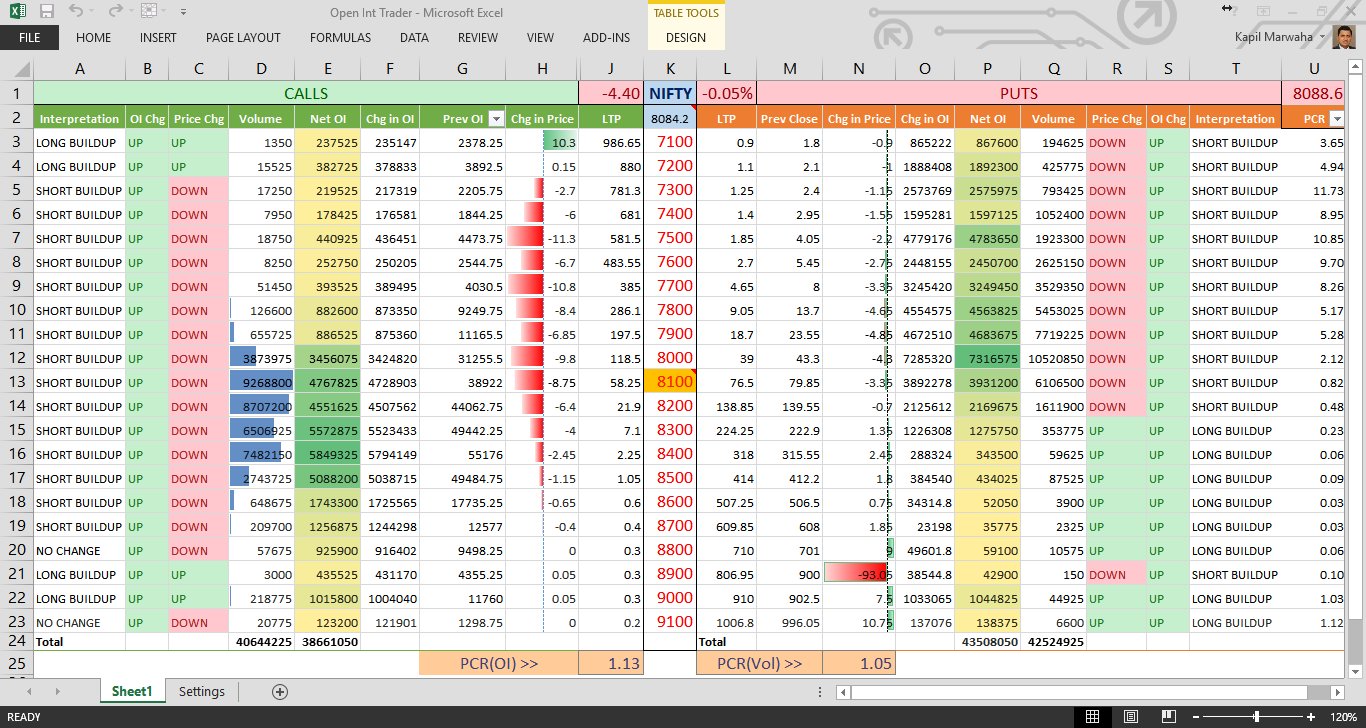

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...