We often hear the news that Sensex has soared to new heights and or has seen a steep fall. It is the reaction of the stock markets to any news whether it is on the micro or macro level. The word Sensex belongs to the BSE (Bombay Stock Exchange) and is studied by traders and inventors not only in India but also across the world to understand the position of the Indian stock markets on a daily basis. So what is this BSE and why is it an important Stock Exchange? Given below are the answers to these questions.

BSE is on the famous Dalal Street in Mumbai and is the oldest stock exchange in Asia which was established in 1875. It was the first stock exchange to be recognized by the Securities Contract (Regulation) Act, 1957, and is home to about 6000 companies that are listed on this exchange. This stock exchange sees a tremendous volume of transactions on a daily basis and provides investment and trading in various market segments like capital markets, futures and options, derivative markets, and currencies.

Some of the key milestones of this exchange are highlighted below.

The Native Share & Stock Brokers Association was formed in 1875

In 1876, the country’s first equity index, S&P BSE SENSEX, was launched

In 1990, the Sensex closed above 1000 points

In 1995, the BSE online trading system (BOLT) was introduced

In 2000, BSE Index crossed 6000 points and India also saw the launch of equity derivatives in the market.

2001 saw the launch of Index options on BSE

In 2003, BSE shifted to a free-float methodology

2005 saw the incorporation of Bombay Stock Exchange Limited.

In Jan 2010, the Market timings were changed and revised to 9 am to 3.30 pm

Companies listed on BSE crossed the landmark of Rs. 10,000 crores in market capitalization.

13th October 2015, BSE got the merit of being the fastest exchange in the world with a speed of 6 microseconds.

BSE set up India INX, India’s first international stock exchange in 2016.

In February 2017, BSE India became the 1st listed stock exchange in India.

In 2018, the BSE building received its trademark.

2019 saw the BSE breach the 40000 mark, making history.

In 2021, BSE breached the 50,000 mark and is currently above 60,000 points.

BSE is synonymous with stock markets in India and across the world and therefore, companies aim to list on the two main exchanges in India, BSE, and NSE. By being listed on these exchanges, companies get the benefit of higher exposure to potential investors. On the other hand, investors get access to lucrative securities that can be a good addition to their investment portfolio, liquidity is not usually an issue and the volume of trades on BSE is tremendous.

Companies can raise funds through the issue of equity or debt securities in a faster and better manner through BSE. Also, BSE and all the participants in it are regulated by SEBI through stringent rules and regulations that ensure a secure environment for investors and every other participant. In case of any violation, such a party is liable for penal implications that can involve fines, jail time, or both.

While BSE stands for Bombay Stock Exchange, NSE on the other hand stands for National Stock Exchange. Both are the major stock exchanges of India and handle transactions with crores on a daily basis. However, the key differences between the two are highlighted below.

| BSE | NSE |

|---|---|

| BSE is the oldest stock exchange not only in India but also in Asia and was established in 1875. | NSE is the largest stock exchange in the country and was founded in 1992. |

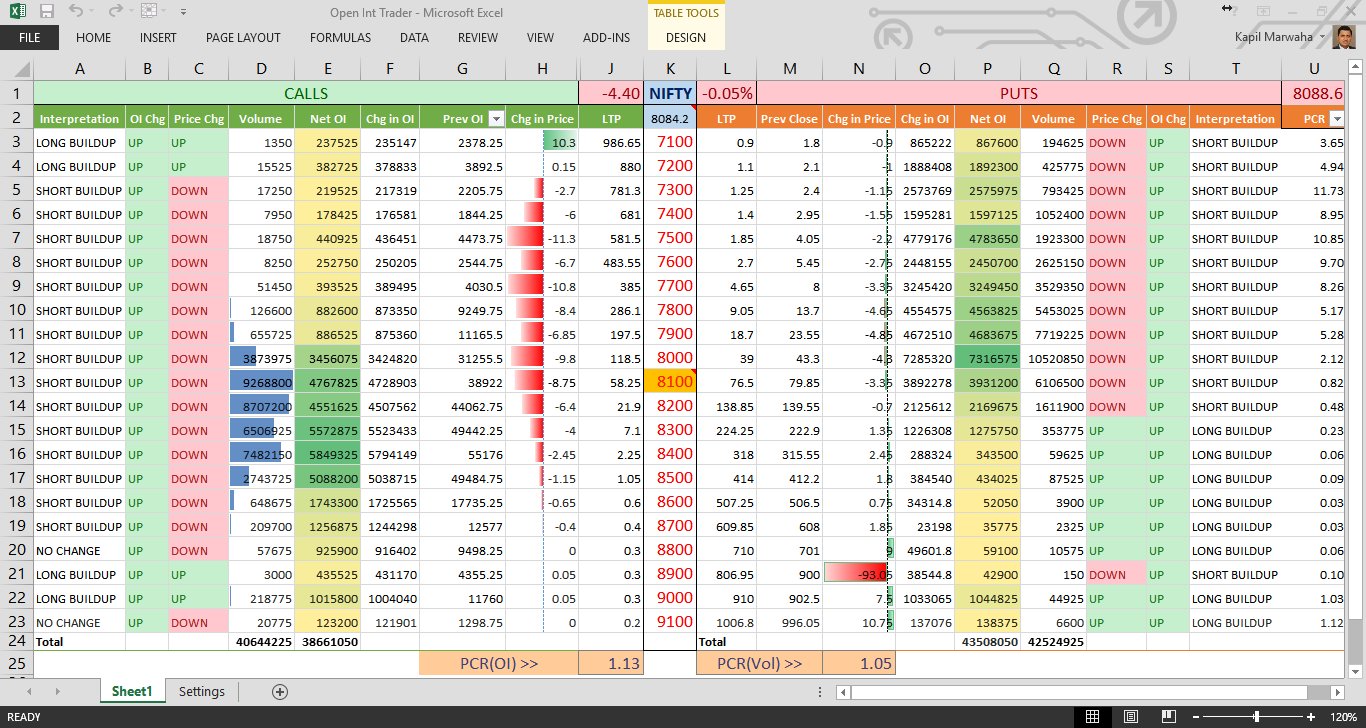

| BSE has a benchmark index Sensex which is the acronym for ‘sensitivity index’ | The benchmark index of NSE is Nifty. |

| Sensex consists of 30 top companies in India that are listed on it. | Nifty is made up of 50 top companies in India on the basis of free-float market capitalization. |

| BSE has relatively lower liquidity as compared to NSE | NSE being the largest stock exchange in India has higher liquidity than BSE |

The benefits of listing on BSE are multiple for companies and investors alike. A few of the key benefits are mentioned hereunder.

BSE is a regulated stock exchange which implies that all the transactions and listings are subject to higher scrutiny. The provisions laid down by SEBI ensure that all the trades are executed and settled in a systematic and secure manner. Any discrepancies or deviations from the rules are met with strict actions toward the defaulting party.

It is widely believed that BSE or Sensex sets the tone for trading during the day or for the upcoming market trend. This gives the investors a fair idea of how to frame their investment strategy and thereby create a portfolio that suits their needs. Investors get the benefit of choosing from over 6000 companies to invest in or trade based on their risk-return perceptions and investment horizons.

The stock prices of securities listed on BSE is based on the function of demand and supply and can be easily tracked by every participant in real-time. This transparency of pricing increases the credibility of the exchange as well as allows the investors and traders to make spot trades based on the ever-evolving market cycles and ultimately benefit their portfolio.

Before being listed on BSE, companies have to meet a series of requirements set by SEBI and the Companies Act, 2013. These requirements are to ensure the investors that the financial statements of such companies represent the true and fair view of the company. The numerous compliances further increase the credibility of the companies and improve their credit ratings. This translates into better options to raise finances through the open market or lenders, VCs, institutional investors, etc.

The need for finance is not felt by companies alone. Retail investors need loans too, to meet their short-term or long-term obligations. However, many are unable to get timely finance due to a lack of collateral. The benefit of investing in shares is that they can also be used as collateral for loans.

There are many indices on BSE where investors and traders are active daily. The top 5 indices of BSE and their current levels are tabled below.

| Index | Level |

|---|---|

| S&P BSE Sensex | 60613.70 |

| S&P BSE Sensex Next 50 | 49962.51 |

| S&P BSE SmallCap | 28889.48 |

| S&P BSE SmallCap | 25427.98 |

| S&P BSE 500 | 24630.73 |

The top companies that are traded on BSE and their market capitalization are tabled below.

| Companies | Market Capitalization (Rs. in crores) |

|---|---|

| Reliance Industries Limited | 1741711.25 |

| Tata Consultancy Services Limited | 1173091.87 |

| HDFC Bank Limited | 850209.12 |

| ICICI Bank Limited | 634841.14 |

| Infosys Limited | 632121.02 |

BSE and NSE are both strong pillars of the Indian stock markets. The global outlook for Indian stock markets is quite bright despite the multiple challenges that we face. BSE is also quite volatile but in the long term equity markets are known to only grow. BSE began from humble beginnings to see heights of over 60,000 and become one of the most globally followed stock exchanges.

So how did you find these insights into BSE and the many milestones it has achieved in over 140 years? Let us know if you need any more information about BSE or any company listed on it.

TrueData provides BSE API data.

Read More: Performance of Indian Stock Indices in Comparison with Other Indexes

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

As 2025 draws to a close, we stand at the threshold of a new year filled with fr...