-and-VD-(volume-delta)-on-1min,-5min-and-15min-bars.webp)

The world of trading is like a maze with a constant race to find the optimum trading opportunities and create a successful trading portfolio. This involves using multiple trading strategies and indicators based on the trading plan and the individual risk appetite of any trader. Among the many trading indicators, let us focus on volume delta and cumulative volume delta in this article. Know all about these indicators and their importance in charts of different timeframes.

Volume delta is a technical analysis tool that traders use to assess the relationship between price movements and volume in the financial markets. The concept of volume delta (VD) is based on the idea that changes in trading volume can provide important insights into market sentiment. It measures the net difference between buying volumes and selling volumes at each price level within a given period. By analysing this data, traders can identify the areas of significant buying or selling interest.

Volume delta is typically represented as a histogram or bar chart that shows the volume imbalances at different price levels. For instance, if there's a higher volume of buy orders at a certain price level compared to sell orders, the volume delta for that level would be positive, indicating bullish sentiment. Conversely, a negative volume delta suggests more selling pressure.

The formula for Volume Delta is,

Volume Delta (VD) = Bid Volume − Ask Volume

Let us understand the calculation of VD using an example.

Consider analysis of the trading activity for a stock over a one-minute interval. During this minute,

Bid Volume (Buying Volume)- 500 shares

Ask Volume (Selling Volume)- 300 shares

Using the formula for Volume Delta -

Volume Delta (VD) = 500 − 300

Volume Delta (VD) = 200

In this example, the Volume Delta (VD) is positive (+200). This means that during that one-minute interval, there were 200 more shares bought (bid volume) than sold (ask volume). Positive Volume Delta typically indicates bullish sentiment or buying pressure.

Conversely, if the numbers were reversed,

Bid Volume - 300 shares

Ask Volume - 500 shares

Volume Delta (VD) = 300−500

Volume Delta (VD) = −200

In this scenario, the Volume Delta (VD) is negative (-200), indicating that during that one-minute interval, there were 200 more shares sold (ask volume) than bought (bid volume). Negative Volume Delta often suggests bearish sentiment or selling pressure.

Traders use volume delta to confirm price trends and identify potential reversal points. For example, during an uptrend, increasing positive volume delta can indicate strong buying support, reinforcing the bullish trend. Conversely, a divergence between price movement and volume delta may signal a weakening trend or an upcoming reversal. Volume delta is also useful in intraday trading to identify short-term opportunities. Traders may look for price levels with significant positive or negative volume deltas to pinpoint potential entry or exit points. Furthermore, volume delta analysis alongside other technical indicators such as moving averages or support/resistance levels can help in enhancing trading strategies.

.webp)

Cumulative Volume Delta (CVD) is an advanced technical analysis tool that builds upon the concept of volume delta to provide a comprehensive view of buying and selling pressure in the financial markets. It is the cumulative measure that tracks the net difference between buying volume and selling volume over multiple price bars or a specified time period. CVD overcomes the limitation of volume delta (VD) where the volume imbalances at each price level are looked at in isolation. CVD aggregates these imbalances to show the cumulative flow of buying and selling activity.

The calculation of CVD involves adding up the volume delta values for each price bar or time period. Positive volume delta values (indicating more buying volume) are cumulatively added to the CVD, while negative values (more selling volume) are subtracted. This process results in a continuous line or histogram that represents the cumulative buying/selling pressure over the specified period.

The formula for calculating CVD is,

CVD = CVD (previous) + Volume Delta (current)

Where,

CVD = Cumulative Volume Delta for the current period

CVD (previous) = Cumulative Volume Delta for the previous period (initially set to 0 or a starting value

Volume Delta (current) = Volume Delta for the current period (the net difference between buying and selling volume)

Let us understand the calculation of CVD using an example.

Consider a hypothetical scenario of trading activity for a particular stock over five consecutive days, along with the corresponding volume delta values.

Day 1- Price closes at 100, Volume Delta = +500 (more buying volume)

Day 2- Price closes at 105, Volume Delta = -300 (more selling volume)

Day 3- Price closes at 110, Volume Delta = +700 (more buying volume)

Day 4- Price closes at 108, Volume Delta = -200 (more selling volume)

Day 5- Price closes at 112, Volume Delta = +400 (more buying volume)

Calculating the Cumulative Volume Delta (CVD) using the above formula.

Day 1 (Initial Calculation) -

CVD (Day 1) = CVD (previous) + Volume Delta (Day 1)

CVD (Day 1) = 0+500 = 500

Day 2 (Cumulative Calculation) -

CVD (Day 2) = CVD (previous) + Volume Delta (Day 2)

CVD (Day 2) = 500-300 = 200

Day 3 (Cumulative Calculation) -

CVD (Day 3) = CVD (previous) + Volume Delta (Day 3)

CVD (Day 3) = 200+700 = 900

Day 4 (Cumulative Calculation) -

CVD (Day 4) = CVD (previous) + Volume Delta (Day 4)

CVD (Day 4) = 900-200 = 700

Day 5 (Cumulative Calculation) -

CVD (Day 5) = CVD (previous) + Volume Delta (Day 5)

CVD (Day 5) = 700+400 = 1100

Traders use CVD to analyse the strength and sustainability of price trends. A rising CVD suggests increasing buying pressure and confirms an uptrend, while a falling CVD indicates rising selling pressure and supports a downtrend. By monitoring CVD alongside price movements, traders can spot divergences that may signal potential trend reversals or continuation patterns.

The importance of VD and CVD in different time frames is mentioned below.

Intraday Scalping - CVD and VD on 1-minute bars can provide valuable insights into rapid changes in buying and selling pressure for traders focusing on short-term price movements. Scalpers can use spikes or drops in VD to identify quick entry and exit points and execute their trading strategies accordingly.

Confirmation of Momentum - A 1-minute CVD can confirm the strength of short-term price momentum. A case of rising CVD coupled with price increases or a decreasing CVD during price declines can be used to validate the momentum. This helps traders make quick decisions to shape their trading portfolio.

Risk Management - Traders can also use 1-minute VD and CVD as confirmation tools for risk management. Any sudden shifts in VD or divergences between price and CVD can be used as signals for potential reversals. This analysis can prompt traders to adjust their positions accordingly.

Trend Identification - CVD and VD on 5-minute bars help traders identify and confirm medium-term trends. Traders can use rising CVD during an uptrend or falling CVD during a downtrend to support trend identification and aid in trade direction.

Entry and Exit Strategies - Traders can use VD and CVD on 5-minute bars to determine optimal entry and exit points for medium-term trades. Significant changes in VD at key support/resistance levels or trend line breaks can signal potential trade opportunities.

Confirmation with Other Indicators - Integrating 5-minute VD and CVD analysis with other technical indicators such as moving averages or Fibonacci levels enhances trend confirmation and improves overall trading strategies.

Trend Confirmation - CVD and VD on 15-minute bars provide confirmation of longer-term trends. Traders can rely on consistent trends indicated by CVD and VD to make informed decisions for swing or position trades.

Divergence Analysis - Monitoring divergences between price and 15-minute VD/CVD can be crucial for anticipating trend reversals or continuations. Divergences may signal shifts in market sentiment, prompting traders to adjust their strategies.

Risk Assessment - Traders can assess risk on 15-minute bars by considering the stability of CVD and VD trends. Consistent patterns in CVD and VD help traders trust price changes more, making it easier for them to handle risks well.

Holistic Analysis - Analysing CVD and VD across multiple time frames (1-minute, 5-minute, and 15-minute bars) offers traders a holistic view of market dynamics. It allows for better trend confirmation, entry/exit timing, and risk management.

Adaptability - Traders can adapt their strategies based on the time frame analysis of CVD and VD. Short-term traders can capitalise on 1-minute VD/CVD for quick trades, while medium to long-term traders can rely on 5-minute and 15-minute trends for strategic decision-making.

Confirmation with Price Movements - Integrating CVD and VD analysis with price action enhances the reliability of trading signals. Confirming price movements with corresponding changes in VD and CVD can strengthen the conviction behind trade decisions.

Volume Delta and Cumulative Volume Delta are among the prominent indicators used by traders to analyse different time frames and make suitable trading decisions. Integrating the use of CVD and VD in the trading plan helps traders in enhancing trend identification improving entry or exit timing and effective risk management strategies. The use of VD and CVD can contribute significantly to trading success for beginners as well as seasoned players in the trading arena.

This article is an attempt to explain two key trading indicators and how to use them for creating a trading plan. Let us know if there are any queries related to this topic or if you need any information related to other trading indicators and we will take it up in our coming blogs.

Till then Happy Reading!

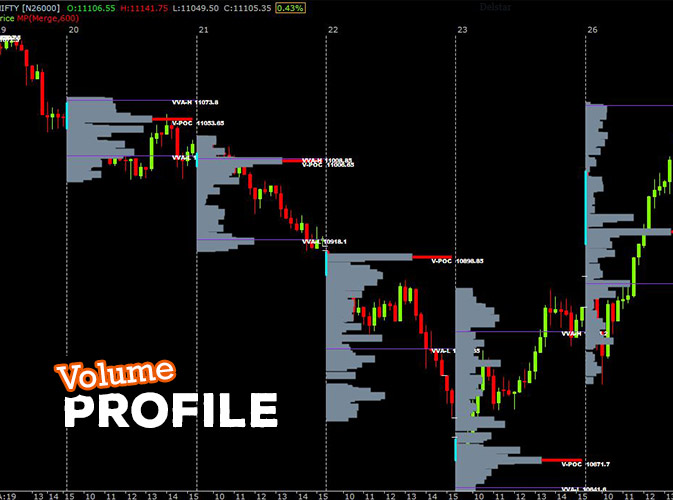

What is Volume Profile? Volume Profile is a visual representation of how muc...

It is a fact that technical analysis is the basis of analysing stocks. What does...

With the outcome of the Indian General Elections around the corner, theIndian st...