The year 2023 began with a bummer for the Indian stock markets which saw a significant decline on the backdrop of the Adani Hindenburg report. The world was also trying to cope with the impending recession and the disruption in the global supply chains due to the Russian-Ukraine war and the world economy looked bleak. Even in this scenario, global monetary experts like the IMF and the Word Bank mentioned India as the bright spot in the global darkness. Cut to 6 months in 2023 and the Indian stock markets are proving this notion by hitting all-time highs of crossing 19000 in Nifty and 65000 in Sensex. So what does this mean for us average investors? Does this mean it is the right time to book our profits and take a bow or to stay invested for the long haul? Read on to clear your doubts and have more insights into the markets. Read More: What is Life Stage Investing?

The year 2023 began with a bummer for the Indian stock markets which saw a significant decline on the backdrop of the Adani Hindenburg report. The world was also trying to cope with the impending recession and the disruption in the global supply chains due to the Russian-Ukraine war and the world economy looked bleak. Even in this scenario, global monetary experts like the IMF and the Word Bank mentioned India as the bright spot in the global darkness. Cut to 6 months in 2023 and the Indian stock markets are proving this notion by hitting all-time highs of crossing 19000 in Nifty and 65000 in Sensex. So what does this mean for us average investors? Does this mean it is the right time to book our profits and take a bow or to stay invested for the long haul? Read on to clear your doubts and have more insights into the markets. Read More: What is Life Stage Investing?

Let us begin with the basic question, why are the markets on a high, it is not the first time this has happened but then why is this time special? The answer is the perfect mix of ingredients that are pushing for the bullish view of the Indian economy and the factors contributing to it. While the primary pillar for the global momentum is seen to be the better-than-expected Q1 GDP figures of the US and the fall in the jobless claims across the country, there are many domestic factors too that have supported the stock markets and helped the bulls to push it further. These factors include the robust buying of Indian equities by foreign portfolio investors (FPIs), strong earnings outlook, demand from the banking sector, and private capex expectations coupled with the increased push to the long-term capital-intensive projects of the government announced in the Budget of 2023. Trivia - The journey of Sensex from 100 points to 65000 points

Let us begin with the basic question, why are the markets on a high, it is not the first time this has happened but then why is this time special? The answer is the perfect mix of ingredients that are pushing for the bullish view of the Indian economy and the factors contributing to it. While the primary pillar for the global momentum is seen to be the better-than-expected Q1 GDP figures of the US and the fall in the jobless claims across the country, there are many domestic factors too that have supported the stock markets and helped the bulls to push it further. These factors include the robust buying of Indian equities by foreign portfolio investors (FPIs), strong earnings outlook, demand from the banking sector, and private capex expectations coupled with the increased push to the long-term capital-intensive projects of the government announced in the Budget of 2023. Trivia - The journey of Sensex from 100 points to 65000 points

The Indian equity markets currently are on a high PE multiple making them the fourth most expensive market in the world and the most expensive in the emerging market segment. The current bull run therefore can be sustained only if it is backed by the economic growth at the macro and the micro level that is promised and foreseen by the investors within the country and abroad. This also includes the strong earnings report by the domestic businesses especially in the small-cap and the mid-cap segment which are also among the top gainers in this market rush. So coming back to our main question, what should the investors do? Let us break this question and understand it from the perspective of the equity mutual funds and the top sectors that are set to gain the most as well as other securities to add to the portfolio.

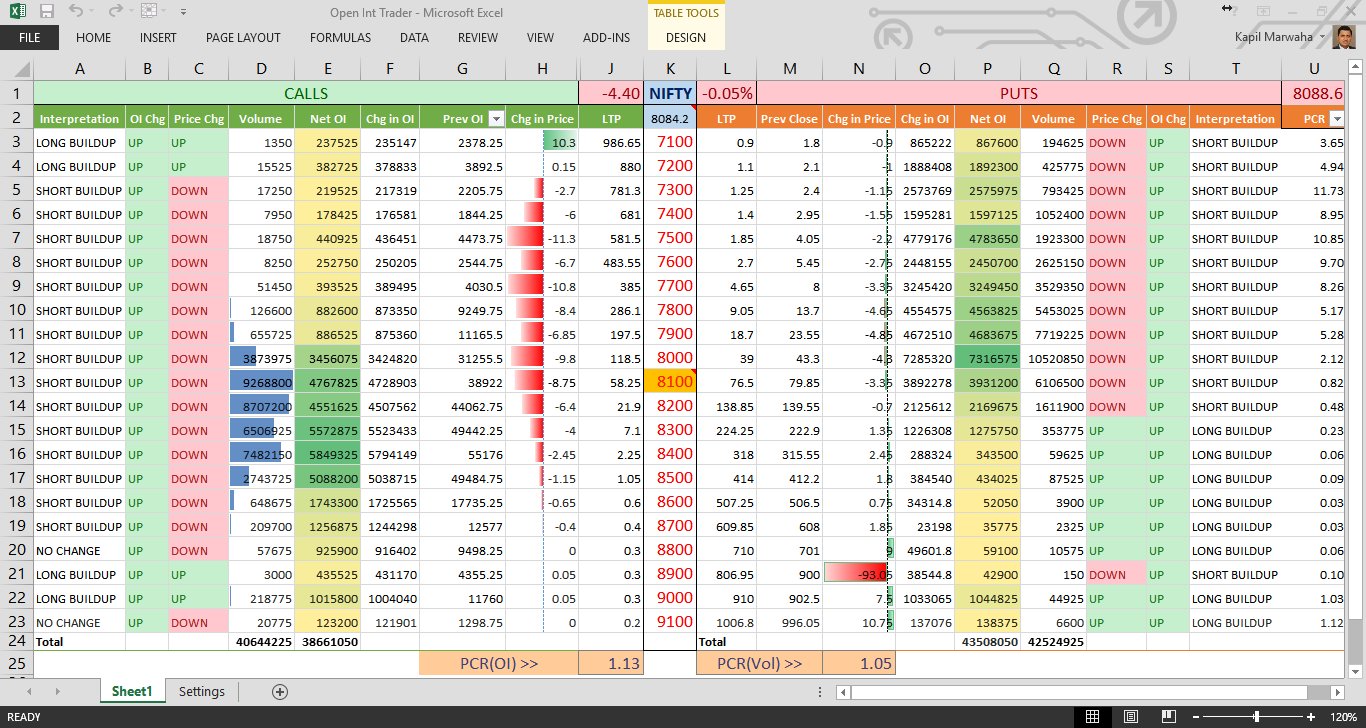

Stocks have rallied big time and as mentioned above, small-cap and mid-cap segment stocks and equity mutual funds especially in this segment have shown strong potential. Most investors think that since the market is at an all-time high, this is the most opportune time to stop their SIPs, exit the market booking maximum profits and invest again when the market is at a low. This can be both correct and wrong at the same time depending on many factors like individual investment horizons, investment goals, etc. If you have a short-term investment horizon or investment goals, you may want to book your profits and exit the market. However, most experts believe that the bull run is not yet done and any contraction in the market may be seen as a buying opportunity with the long-term investment perspective. So it is better to not aim to time the market to plan your perfect exit as it may never happen. However, what can be done is to keep adding quality stocks that are backed by strong fundamentals at every dipping opportunity and create a successful long-term investment portfolio. With the expectation of average 12-15% growth on the investments compounded annually, investors can be in a position to gain substantial returns due to compounding factors over the investment horizon of 10-20 years. Traders, on the other hand, with a relatively short-term view of the market can use many technical analysis tools and indicators like charts and candlestick patterns to understand the price and volume movements of their target securities. The aim should be to maximise their profits while ensuring they are protected against potential losses using stop-loss or trailing stop-loss.

Stocks have rallied big time and as mentioned above, small-cap and mid-cap segment stocks and equity mutual funds especially in this segment have shown strong potential. Most investors think that since the market is at an all-time high, this is the most opportune time to stop their SIPs, exit the market booking maximum profits and invest again when the market is at a low. This can be both correct and wrong at the same time depending on many factors like individual investment horizons, investment goals, etc. If you have a short-term investment horizon or investment goals, you may want to book your profits and exit the market. However, most experts believe that the bull run is not yet done and any contraction in the market may be seen as a buying opportunity with the long-term investment perspective. So it is better to not aim to time the market to plan your perfect exit as it may never happen. However, what can be done is to keep adding quality stocks that are backed by strong fundamentals at every dipping opportunity and create a successful long-term investment portfolio. With the expectation of average 12-15% growth on the investments compounded annually, investors can be in a position to gain substantial returns due to compounding factors over the investment horizon of 10-20 years. Traders, on the other hand, with a relatively short-term view of the market can use many technical analysis tools and indicators like charts and candlestick patterns to understand the price and volume movements of their target securities. The aim should be to maximise their profits while ensuring they are protected against potential losses using stop-loss or trailing stop-loss.

The other concern for investors can be an insight into the sectors to watch out for or invest in at this time to maximise returns in the long term. According to many industry experts, the strong sectors to bet on at such times include the private banking sector in the country, NBFCs, engineering and capital goods industry, Infrastructure, auto and auto ancillary industries, Railways, Defence, Cement, Pharma, and Renewable Energy. A majority of these sectors also saw a strong push in terms of commitment and the huge allocation of resources by the Government in their recent budget. This makes the investors (domestic and international) bullish on these sectors. Investors should look for companies backed by strong fundamentals in such sectors and consistent performance to include them in their portfolio with a long-term view. This will help them maximise their returns at the same time ignore the short-term volatility of the markets.

The other concern for investors can be an insight into the sectors to watch out for or invest in at this time to maximise returns in the long term. According to many industry experts, the strong sectors to bet on at such times include the private banking sector in the country, NBFCs, engineering and capital goods industry, Infrastructure, auto and auto ancillary industries, Railways, Defence, Cement, Pharma, and Renewable Energy. A majority of these sectors also saw a strong push in terms of commitment and the huge allocation of resources by the Government in their recent budget. This makes the investors (domestic and international) bullish on these sectors. Investors should look for companies backed by strong fundamentals in such sectors and consistent performance to include them in their portfolio with a long-term view. This will help them maximise their returns at the same time ignore the short-term volatility of the markets.

Investors with a short-term to medium-term investment horizon can also invest in hybrid mutual funds, debt funds, or debt instruments with a maturity of approximately 3 years or more. Hybrid funds provide the benefits of debt and equity to the investors which is beneficial for the investors, especially with the short-term investment horizon as it can protect them against the volatility of the equity markets at the same time provide more or less balanced returns through the debt component of the fund. Another good addition to the investment portfolio can be gold even though it may be considered unpredictable. It is historically seen that even though gold prices are subject to fluctuations, in the long term they tend to increase especially in volatile times like what the world saw during the Covid pandemic or the onset of the Russian-Ukraine war. Gold can therefore act as a hedge against inflation and the volatile equity markets thereby safeguarding the overall investment portfolio.

Investors with a short-term to medium-term investment horizon can also invest in hybrid mutual funds, debt funds, or debt instruments with a maturity of approximately 3 years or more. Hybrid funds provide the benefits of debt and equity to the investors which is beneficial for the investors, especially with the short-term investment horizon as it can protect them against the volatility of the equity markets at the same time provide more or less balanced returns through the debt component of the fund. Another good addition to the investment portfolio can be gold even though it may be considered unpredictable. It is historically seen that even though gold prices are subject to fluctuations, in the long term they tend to increase especially in volatile times like what the world saw during the Covid pandemic or the onset of the Russian-Ukraine war. Gold can therefore act as a hedge against inflation and the volatile equity markets thereby safeguarding the overall investment portfolio.

The current buzz around the equity markets is the result of the strong bullish rally and the optimistic outlook of the world toward the Indian economy. Most investors in such scenarios are of the opinion to tap the gains that are available in the present and therefore, miss out on the potentially high gains that they can make in the long term. Hence, it is primarily important to align the investment portfolio with the individual short-term and long-term goals thereby making the most optimum investments and having a realistic view of the returns that can be made through them. We hope this article was able to help you in analyzing the stock markets and planning an effective investment strategy that can help you in meeting your investment goals. Let us know if you need more insights into the market or a better understanding of any specific investment instrument and we will take it up in our coming blogs. Till then Happy Reading!

For the past few years, we have been constantly saying that Indian stock markets...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Indian Stock market has two leading stock exchanges - BSE (Bombay Stock Exchange...