With the growing digitisation, investing in stocks and mutual funds has become quite easy. All you need is a registered stockbroker and a demat account to begin. But what happens if your stockbroker shuts shop? Do your investments from your hard-earned money go bust? Not at all. So what happens to these investments, and what should the investors do? Get answers to all these questions and more in this blog and safeguard your portfolio.

Let us begin with the basics, i.e., the meaning of a stockbroker. A stockbroker is a person or company that helps investors buy and sell shares, mutual funds, and other financial products on the stock market. Stockbrokers act as intermediaries between investors and stock exchanges such as the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Since individuals cannot trade directly on these exchanges, they need a SEBI-registered stockbroker to carry out transactions on their behalf. Stockbrokers provide access to trading platforms or mobile apps, allowing investors to place buy or sell orders easily. They also assist in opening a demat account, where the investor’s shares are stored securely in digital form. In exchange for these services, stockbrokers usually charge a brokerage fee.

A stockbroker may shut down its business for various reasons. Some of these reasons are explained below.

One of the most common reasons a stockbroker shuts down is financial loss. If the stockbroker’s business is not making enough profit, or if they are spending more than they are earning, they may not be able to continue operations. Like any other business, stockbroking also involves costs like technology, staff salaries, office maintenance, and compliance fees. If these costs are not covered by income from brokerage and other services, the broker may choose to shut down.

All stockbrokers must be registered with SEBI (Securities and Exchange Board of India) and follow strict rules to protect investors. If a broker violates SEBI regulations, gets involved in fraud, misuses client funds, or fails to meet compliance standards, SEBI can take strict action. This may include suspending or cancelling their license, which can force the broker to shut down. In such cases, the shutdown may be sudden and beyond the broker’s control.

SEBI and stock exchanges have set minimum financial requirements (like net worth and security deposits) that every broker must maintain to operate safely. If a broker fails to meet these requirements due to losses or mismanagement, the exchange or SEBI can suspend their license. This can lead to a shutdown if the broker is unable to raise more funds in time.

Running a digital stockbroking platform requires strong technology and customer support. If a broker faces frequent technical issues, poor app performance, or weak service quality, they may lose clients over time. If these problems are not fixed, the business may become unsustainable, and the broker may shut down.

In some cases, a stockbroker may not shut down due to failure but instead merge with a larger broker or get acquired by another company. This process, known as business consolidation, often leads to the old broker’s platform being closed and clients being shifted to a new one, usually to improve services, reduce operational costs, or expand market presence. Furthermore, the rise of low-cost discount brokers like Zerodha, Groww, and Upstox has created tough competition in the Indian market. Traditional brokers with higher fees and outdated technology struggle to keep up, and if they fail to adapt, they may lose customers and eventually shut down.

A broker shutting down can be stressful, however, SEBI ensures that the investor's interests are protected. The consequences of a stockbroker shutting down are mentioned below.

When a stockbroker shuts down, the investor’s stocks, mutual funds, and other holdings do not get lost. These investments are not actually held by the broker but are stored safely in the investor’s demat account, which is managed by SEBI-registered depositories like CDSL (Central Depository Services Limited) or NSDL (National Securities Depository Limited). These depositories are independent and secure systems where all investments are stored in electronic form under the investor’s name. So, even if the broker shuts down, the investor’s ownership of shares and funds remains completely safe.

If a broker shuts down suddenly, investors may temporarily lose access to the broker’s app, website, or customer support. This might make it difficult to view or manage investments for a short period. However, the investor’s demat account remains active and secure. Once the investor opens an account with a new broker, they can reconnect their existing demat account and regain full control over their portfolio.

After a shutdown, the investor can easily shift their investments to another SEBI-registered stockbroker. This can be done by opening a new trading account and linking it with the existing demat account. If the investor wishes to transfer holdings from one demat account to another, they can do so using a Delivery Instruction Slip (DIS) or through an online transfer system like e-DIS provided by CDSL or NSDL. This process is safe and ensures that the investor continues to have access to all their shares and mutual fund units.

If the investor had unused money lying in their trading account with the broker, for example, from selling shares, that amount still belongs to the investor. In most cases, the money is refunded automatically to the investor’s registered bank account. If the broker shuts down suddenly and the funds are not returned on time, the investor can file a complaint with,

The broker (if still operational),

The concerned stock exchange (NSE or BSE), or

SEBI using the SCORES (SEBI Complaint Redress System) platform.

These authorities will help the investor recover their funds after proper verification.

SEBI (Securities and Exchange Board of India) and the stock exchanges have strong investor protection mechanisms. If a broker closes due to violations or financial trouble, SEBI may cancel their license and start an investigation. In such situations, stock exchanges like NSE or BSE work closely with depositories to help investors transfer their investments and claim any remaining funds. Investors can also check their holdings independently by logging in to the CDSL or NSDL portal or viewing their Consolidated Account Statement (CAS).

When a stockbroker shuts down, these are the steps that can be taken by the investor.

Stay calm as the shares and mutual funds are safe in your demat account, not with the broker.

Open a new account and choose a trusted, SEBI-registered stockbroker and open a new trading account.

Link the old demat account

Transfer shares (if needed) by using a DIS slip or online transfer (e-DIS) to move the holdings to another demat account if required.

Withdraw unused money from the trading account

If the broker is not responding, file a complaint with NSE/BSE or on SEBI’s SCORES portal.

Log in to your CDSL/NSDL account or check CAS (Consolidated Account Statement) to view the investments.

Avoid panic selling.

If a stockbroker shuts down, investors do not need to panic. Their shares and mutual fund investments remain safe in their own demat accounts, which are handled by CDSL or NSDL and not by the broker. The safeguards put in place by SEBI and stock exchanges ensure that there is no loss for the investors in such cases, and they can thus continue investing confidently.

This blog talks about the remedies available to investors in case their stockbrokers shut down their business. Let us know your thoughts on the topic or if you need further information on the same, and we will address it.

Till then, Happy Reading!

Read More: Common Mistakes to Avoid While Investing in Mutual Funds

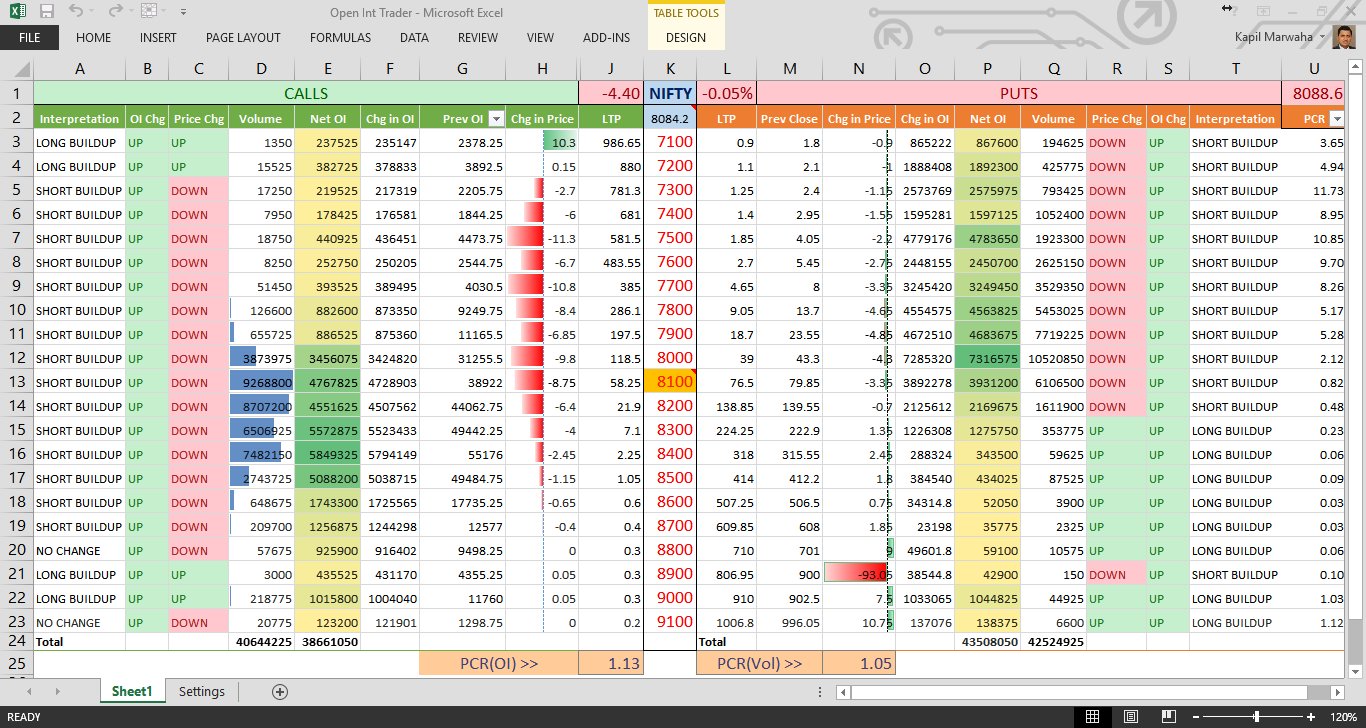

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...