Like starting any new venture, the first step in stock investments is knowing the basics. Understanding the basics includes knowing the type of stocks and their relationship with the market fluctuations. This helps in creating a successful investment portfolio that is aligned with individual risk-return perceptions. Check out this blog to understand the basic types of stocks based on market capitalisation and their level of volatility to market movements.

Like starting any new venture, the first step in stock investments is knowing the basics. Understanding the basics includes knowing the type of stocks and their relationship with the market fluctuations. This helps in creating a successful investment portfolio that is aligned with individual risk-return perceptions. Check out this blog to understand the basic types of stocks based on market capitalisation and their level of volatility to market movements.

Large-cap stocks, short for "large capitalization stocks," refer to shares of well-established and financially stable companies with a significant market capitalization. As per SEBI classifications, the top 100 companies as per market capitalization (Rs. 20,000 crores and more) on stock exchanges are termed as large-cap stocks. Large-cap stocks or blue-chip stocks are typically associated with companies that have a substantial presence in their respective industries and have a proven track record of generating consistent revenue and profits over the years. These companies are considered less risky and provide more or less stable returns as compared to smaller or newer companies and are often part of benchmark stock market indices like the Nifty 50 or the Sensex.

Large-cap stocks, short for "large capitalization stocks," refer to shares of well-established and financially stable companies with a significant market capitalization. As per SEBI classifications, the top 100 companies as per market capitalization (Rs. 20,000 crores and more) on stock exchanges are termed as large-cap stocks. Large-cap stocks or blue-chip stocks are typically associated with companies that have a substantial presence in their respective industries and have a proven track record of generating consistent revenue and profits over the years. These companies are considered less risky and provide more or less stable returns as compared to smaller or newer companies and are often part of benchmark stock market indices like the Nifty 50 or the Sensex.

As per SEBI classification, mid-cap stocks are companies with a market capitalization between Rs. 5,000 crores and Rs. 20,000 crores and ranking 101-250 on the stock exchanges. These stocks are moderately volatile as compared to large-cap stocks but are less volatile as compared to small-cap stocks. Mid-cap stocks are generally considered to be growth stocks with a strong trajectory to be industry pioneers in the coming years and are often backed by innovation and emerging technology. These stocks are considered to be a good bet for investors with mid to long-term investment horizons and relatively higher risk appetites.

As per SEBI classification, mid-cap stocks are companies with a market capitalization between Rs. 5,000 crores and Rs. 20,000 crores and ranking 101-250 on the stock exchanges. These stocks are moderately volatile as compared to large-cap stocks but are less volatile as compared to small-cap stocks. Mid-cap stocks are generally considered to be growth stocks with a strong trajectory to be industry pioneers in the coming years and are often backed by innovation and emerging technology. These stocks are considered to be a good bet for investors with mid to long-term investment horizons and relatively higher risk appetites.

Small-cap stocks are the final category of stocks classified in terms of market capitalisation. As per SEBI classification, these stocks are ranked 251 and above on the stock exchanges and have a market capitalisation of up to Rs 5,000 crores. These stocks are highly volatile and therefore, may not appeal to investors with low-risk appetites. Small-cap stocks have the potential to provide higher-than-market returns in an upward trend but can also potentially erode your capital investment in case of market downturns.

Small-cap stocks are the final category of stocks classified in terms of market capitalisation. As per SEBI classification, these stocks are ranked 251 and above on the stock exchanges and have a market capitalisation of up to Rs 5,000 crores. These stocks are highly volatile and therefore, may not appeal to investors with low-risk appetites. Small-cap stocks have the potential to provide higher-than-market returns in an upward trend but can also potentially erode your capital investment in case of market downturns.

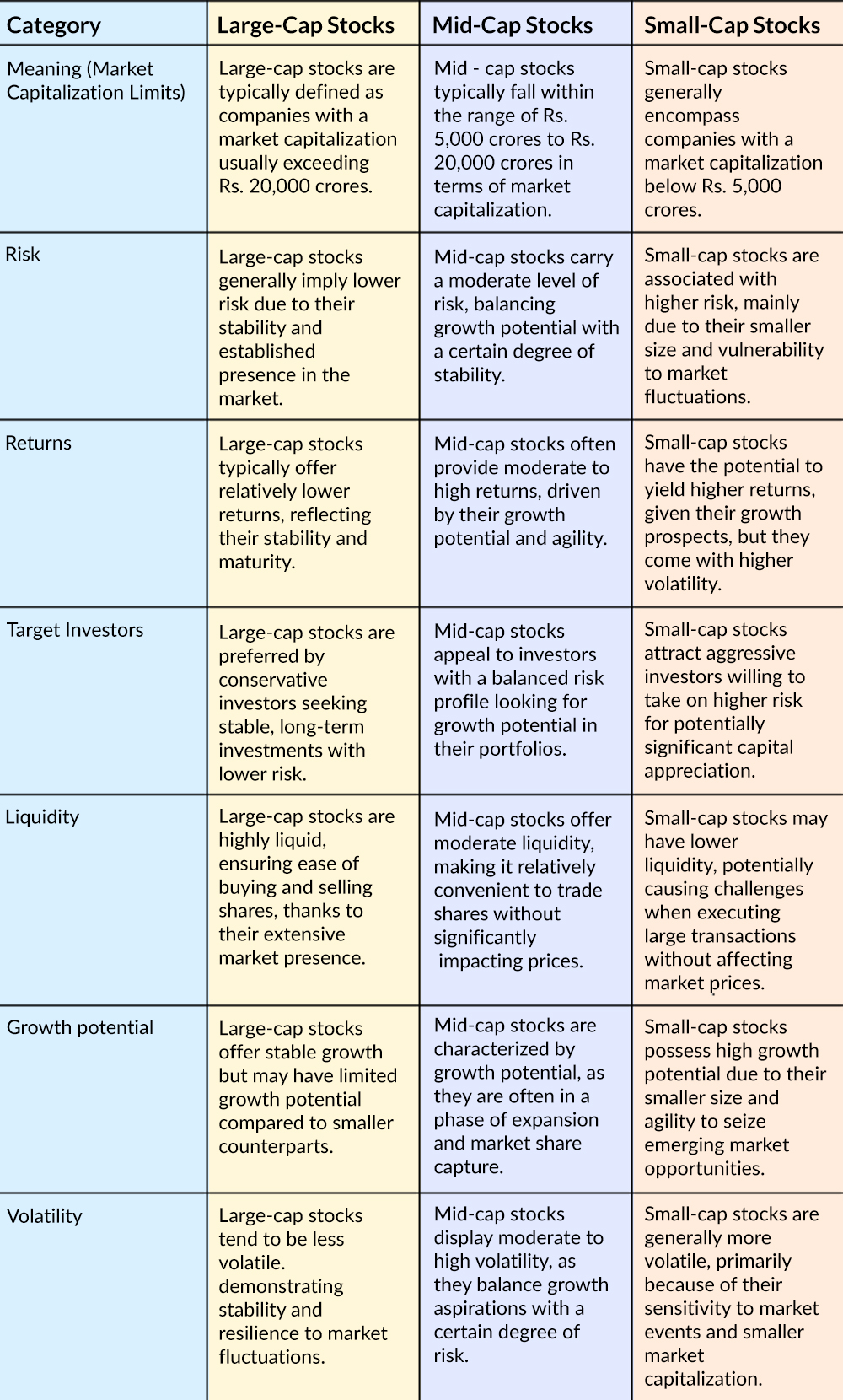

The core differences between large-cap, mid-cap and small-cap stocks are tabled below.  Conclusion Understanding the classification of stocks based on market capitalisation is one of the primary requirements for creating a successful investment portfolio. Therefore, beginners in stock markets should first focus on the basic characteristics of each category of stocks to ensure that their investments are in line with their financial goals and they can meet them in a timely manner. Discussed here are some of the core concepts of stock markets enabling investors, especially new investors and traders in stock markets, to make the right pick. Let us know if you have any queries or need more information on this topic and we will be happy to help you. Till then Happy Reading!

Conclusion Understanding the classification of stocks based on market capitalisation is one of the primary requirements for creating a successful investment portfolio. Therefore, beginners in stock markets should first focus on the basic characteristics of each category of stocks to ensure that their investments are in line with their financial goals and they can meet them in a timely manner. Discussed here are some of the core concepts of stock markets enabling investors, especially new investors and traders in stock markets, to make the right pick. Let us know if you have any queries or need more information on this topic and we will be happy to help you. Till then Happy Reading!

Finance is the grease that is needed to keep the wheels of the business running....

Despite the multiple market swings and changes intaxation, mutual funds continue...

We have established in our previous blogs the importance of finance for the surv...