We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric vehicles in the coming years. There is a complete EV corridor being set up to facilitate this vision and be a global leader in the EV segment. The recent discovery of lithium along with cobalt and nickel is going to provide a huge boost to the Indian EV sector. Given here are the details of the electric vehicle sector in India and top stocks in terms of market capitalisation.

We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric vehicles in the coming years. There is a complete EV corridor being set up to facilitate this vision and be a global leader in the EV segment. The recent discovery of lithium along with cobalt and nickel is going to provide a huge boost to the Indian EV sector. Given here are the details of the electric vehicle sector in India and top stocks in terms of market capitalisation.

The EV sector in India has been growing at a rapid pace with a CAGR of 23.76%. According to recent projections, the EV industry is expected to grow from US% 3.21 billion in 2022 to US$ 113.99 billion in 2029. This growth is expected at a further rapid pace of 66.52% CAGR. Currently, the automobile sector of India is ranked 5th globally and is expected to be the 3rd largest by 2030. This increase will also be backed by a significant increase in the demand for Electric Vehicles in the coming years supported by key industry players and a push for the EV corridor by the government. The driving factors for the increased demand are primarily the growing fuel costs and constant reduction in the EV battery costs year on year. The EV sector in the country is dominated by two-wheelers followed by three-wheelers and four-wheelers. There is also a huge demand for heavy motors like e-busses with many states adopting the same as part of their state transport.

The EV sector in India has been growing at a rapid pace with a CAGR of 23.76%. According to recent projections, the EV industry is expected to grow from US% 3.21 billion in 2022 to US$ 113.99 billion in 2029. This growth is expected at a further rapid pace of 66.52% CAGR. Currently, the automobile sector of India is ranked 5th globally and is expected to be the 3rd largest by 2030. This increase will also be backed by a significant increase in the demand for Electric Vehicles in the coming years supported by key industry players and a push for the EV corridor by the government. The driving factors for the increased demand are primarily the growing fuel costs and constant reduction in the EV battery costs year on year. The EV sector in the country is dominated by two-wheelers followed by three-wheelers and four-wheelers. There is also a huge demand for heavy motors like e-busses with many states adopting the same as part of their state transport.

The focus of the government for many budgets is to gradually move from ICE (Internal combustion Engines) to EVs. Some of the key initiatives taken by the government for the promotion of the EV sector in the country include the following.

This scheme was launched in 2015 and it aims to promote the use of electric and hybrid vehicles in the country. This scheme is used as a medium to offer subsidies for the purchase of EVs and supports the development of EV charging infrastructure.

This programme was launched in 2013 in order to facilitate the easy promotion and adoption of EVs in the country. The aim of this programme is to make India a global hub for manufacturing EVs. The plan focuses on creating an entire ecosystem for EVs which will include the charging infrastructure, battery manufacturing, and skill development enabling ample employment opportunities in the country as well.

The government has also taken steps like reducing the GST on electric vehicles from 12% to 5%. Similarly, the GST on chargers and charging stations were reduced from 18% to 5%. Along with the GST reduction, the government also provides subsidies and tax incentives in the form of deductions on loans taken for the purchase of EVs under section 80EEB up to Rs. 1,50,000. These moves were introduced with the aim to provide incentives to the public for purchasing the EV as well as redhttps://www.investindia.gov.in/sector/automobile/electric-mobilityucing the ultimate cost burden on them. The recent budget announced the exemption of customs duty on the manufacture of lithium-ion batteries and introduced more sops to boost vehicle scrappage. Furthermore, customs duty exemption is also extended for the import of capital goods and machinery that is necessary for manufacturing lithium-ion cells or batteries used in electric vehicles.

FAME-II was launched in 2019 with a budget of INR 10,000 crore. The scheme renewed the government’s commitment to the EV sector and focuses on supporting the development of charging infrastructure, promoting the use of electric buses and two-wheelers, and providing incentives for EV manufacturers.

The NPEM launched in 2013 and 2018 aims to create a conducive environment for the adoption and manufacturing of EVs in India. The programme includes measures such as research and development support, technology transfer, human resource development financial incentives for EV manufacturers, support for charging infrastructure development, and the promotion of electric buses.

The PLI (Production Linked Incentive) scheme is one of the many flagship programs initiated by the government for boosting the manufacturing industry in the country including the EV infrastructure. The scheme is expected to play a key role in boosting the battery infrastructure in the country. The sector also saw a proposed investment of about Rs 74,850 crore under the PLI scheme in the recent budget, giving a push to local manufacturing.

There have been multiple investments in the EV sector from the government as well as the private sector. The permissible FDI in the EV sector in India is 100% from the automatic route. The total FDI investment in this sector was to the tune of US$ 32 billion between April 2000 to March 2022. The private sector as well as foreign players realising the growth potential of the Indian EFV market have invested heavily in different aspects of the sector like the charging infrastructure, battery manufacturing unit, providing affordable vehicles to the Indian public, etc. Tata Power along with other key players like HPCL, Hero Motocorp, Ather Energy, Ola Electric, etc. have entered into several agreements for setting up charging infrastructure across the country. Many international companies like Tesla, BYD, Suzuki, Hyundai, and Kia are set to enter the EV market in the country with huge outlays and significant contributions to the EV infrastructure.

There have been multiple investments in the EV sector from the government as well as the private sector. The permissible FDI in the EV sector in India is 100% from the automatic route. The total FDI investment in this sector was to the tune of US$ 32 billion between April 2000 to March 2022. The private sector as well as foreign players realising the growth potential of the Indian EFV market have invested heavily in different aspects of the sector like the charging infrastructure, battery manufacturing unit, providing affordable vehicles to the Indian public, etc. Tata Power along with other key players like HPCL, Hero Motocorp, Ather Energy, Ola Electric, etc. have entered into several agreements for setting up charging infrastructure across the country. Many international companies like Tesla, BYD, Suzuki, Hyundai, and Kia are set to enter the EV market in the country with huge outlays and significant contributions to the EV infrastructure.

The shift to EVs is inevitable as the rising cost of fuel and its impact on the environment is not feasible to sustain. The sector is considered to be among the sunrise sectors in the country with significant incentives and policies made with the aim to make India an EV-dominant country in the coming years. The recent discoveries of the white gold, lithium, in the country is also a crucial breakthrough that will further help in reducing the overall cost of manufacturing and purchasing an EV which will ultimately benefit the end consumer. The targets set by the government once seen to be too aggressive seem feasible with the growing awareness and demand for EVs in the country.

The shift to EVs is inevitable as the rising cost of fuel and its impact on the environment is not feasible to sustain. The sector is considered to be among the sunrise sectors in the country with significant incentives and policies made with the aim to make India an EV-dominant country in the coming years. The recent discoveries of the white gold, lithium, in the country is also a crucial breakthrough that will further help in reducing the overall cost of manufacturing and purchasing an EV which will ultimately benefit the end consumer. The targets set by the government once seen to be too aggressive seem feasible with the growing awareness and demand for EVs in the country.

Some of the top stocks in the EV sector in terms of market capitalization and their details are mentioned below.

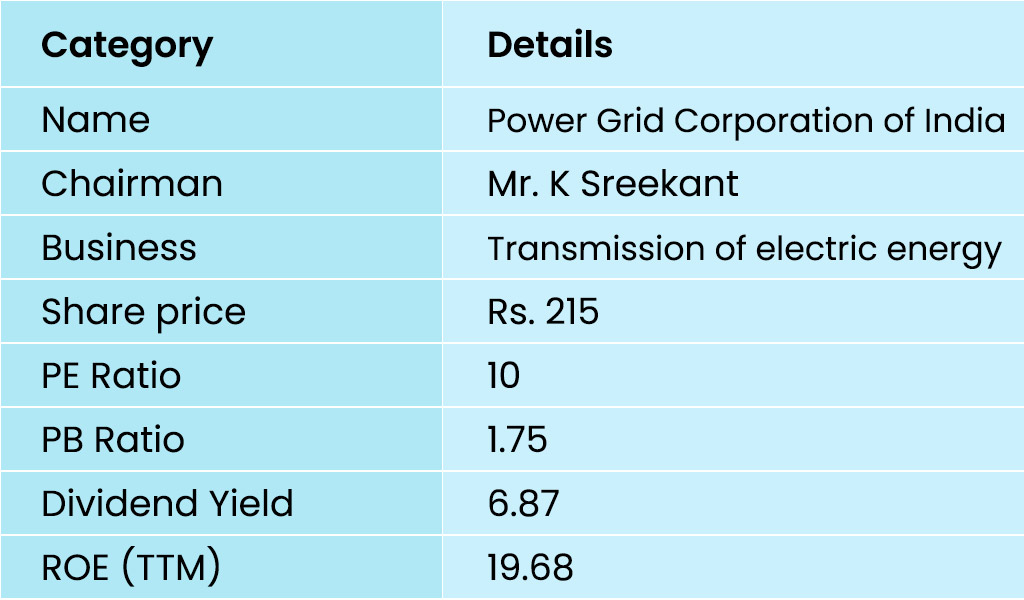

This is a PSU and the largest electric power transmission company in the country. This company is a pioneer in setting up EV charging stations across multiple cities. The key details of this company are tabled below.

This is a PSU and the largest electric power transmission company in the country. This company is a pioneer in setting up EV charging stations across multiple cities. The key details of this company are tabled below.

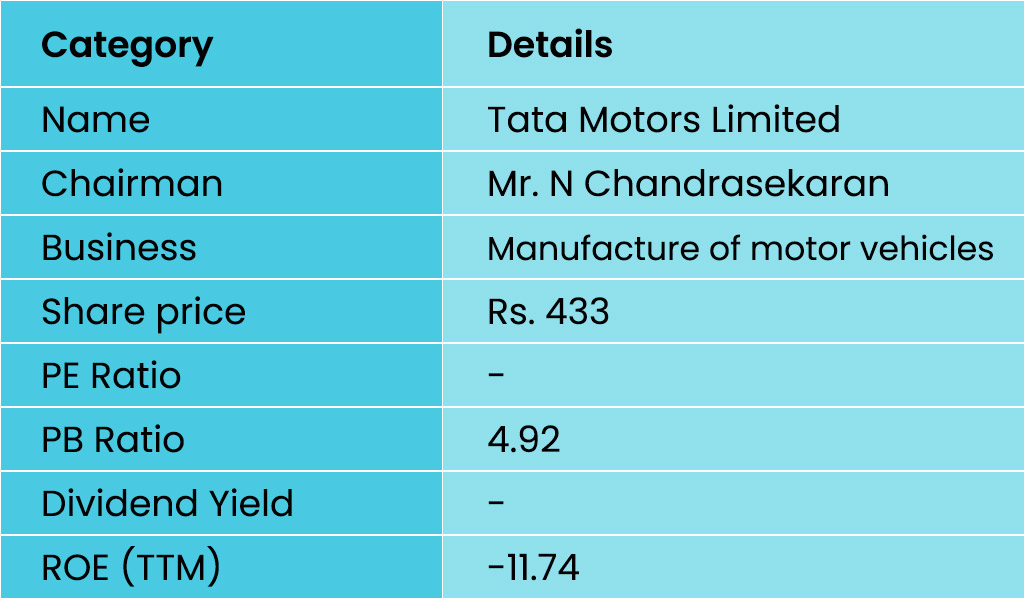

Tata Motors is one of the biggest names in the Indian automobile industry. The recent EVs launched under this brand have proved to be market disrupters. The key details of this company are tabled below.

Tata Motors is one of the biggest names in the Indian automobile industry. The recent EVs launched under this brand have proved to be market disrupters. The key details of this company are tabled below.

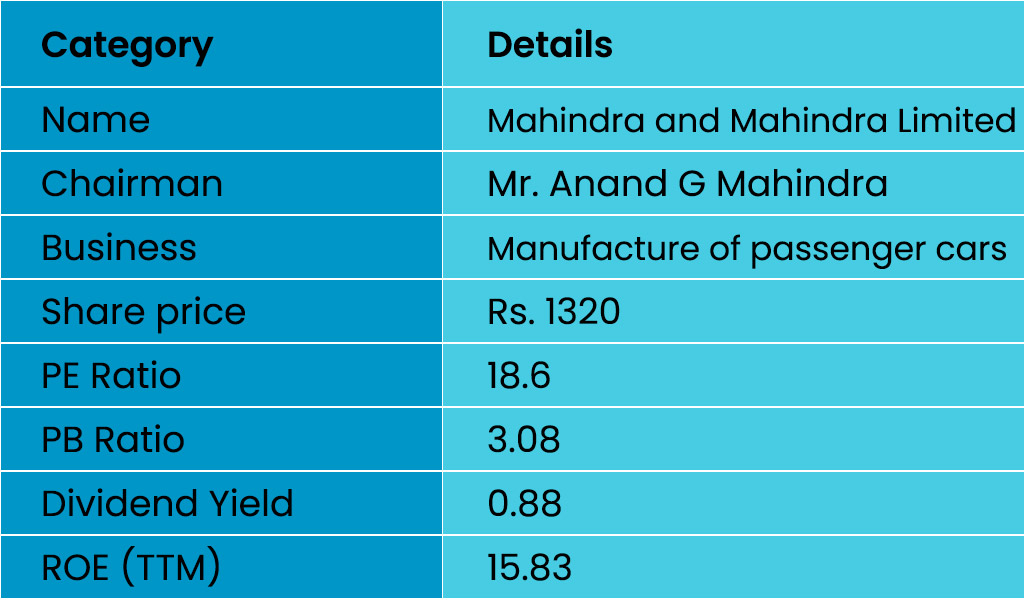

This company was incorporated in 1945 and is one of the leading EV manufacturers today. The key details of this company are tabled below.

This company was incorporated in 1945 and is one of the leading EV manufacturers today. The key details of this company are tabled below.

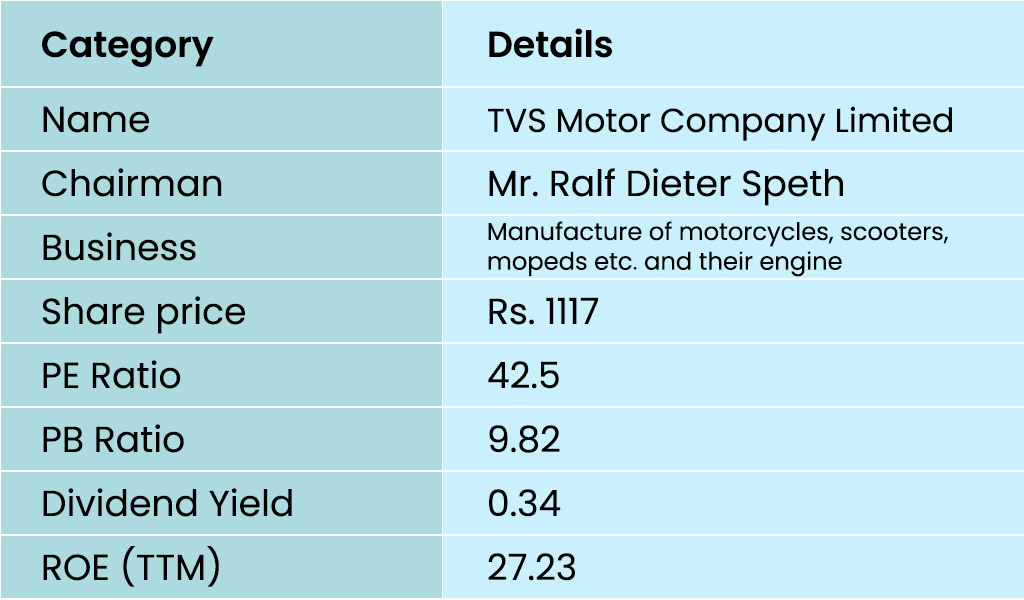

TVS is one of the largest manufacturers of two-wheelers and three-wheelers in the country. The key details of the company are tabled below.

TVS is one of the largest manufacturers of two-wheelers and three-wheelers in the country. The key details of the company are tabled below.

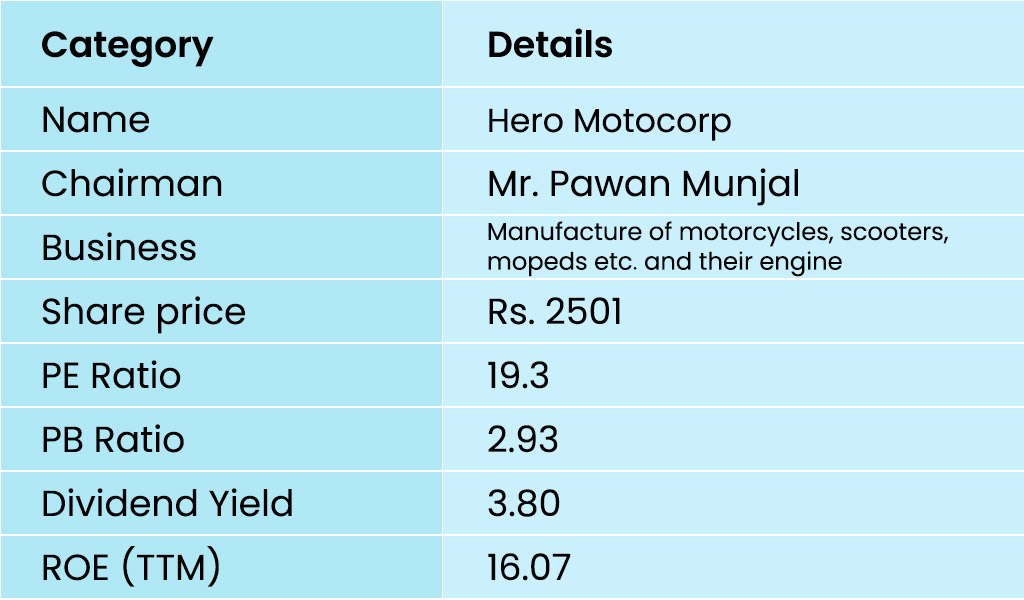

Established in 1984, Hero Motocorp today has the biggest market share in the two-wheeler EV segment. The key details of this company are tabled below.

Established in 1984, Hero Motocorp today has the biggest market share in the two-wheeler EV segment. The key details of this company are tabled below.

EV sector is not limited to just electric vehicles but also includes the EV infrastructure which is the manufacture of EV batteries, ancillary parts, chargers, etc. This sector is seen as a major employment generator in the years to come with the growing demand for EVs as well as the government taking significant steps towards 100% EV adoption by 2030. Although the target is quite steep, India is known to make significant leaps in the renewable energy sector. We hope this article was able to provide crucial information related to the EV sector in the country and its growing reach. Let us know if you want any further information relating to this sector and its latest developments or the EV stocks that are making significant buzz. Till then, Happy Reading!

Unless you are living under a rock, you cannot miss the increasing use of AI in...

The IT sector has enjoyed huge growth over the past decades, however, the past ...

The recent Union Budget 2023 had a special focus on renewable energy and the go...