The recent Union Budget 2023 had a special focus on renewable energy and the government’s efforts towards making India energy efficient. There were significant allocations in capital expenditure in line with its target of carbon neutrality by 2070 and reducing the carbon intensity by 45% by the end of 2030. The renewable energy sector in the country is seen among the sunrise sectors and the companies belonging to the same are receiving huge government incentives and FDI. The details of this sector and the top stocks in terms of market capitalisation are highlighted hereunder

The recent Union Budget 2023 had a special focus on renewable energy and the government’s efforts towards making India energy efficient. There were significant allocations in capital expenditure in line with its target of carbon neutrality by 2070 and reducing the carbon intensity by 45% by the end of 2030. The renewable energy sector in the country is seen among the sunrise sectors and the companies belonging to the same are receiving huge government incentives and FDI. The details of this sector and the top stocks in terms of market capitalisation are highlighted hereunder

The renewable energy sector in India is ranked globally third for total renewable power capacity additions, 4th largest in terms of installed capacity of wind power, and 3rd largest market in the world for new solar photovoltaics capacity. India has a renewable energy potential of more than 1000GW of which the country has about 174.53GW of installed renewable energy capacity as of February 2023. There has been a huge push to the renewable energy sector post 2014 and the country has seen an increase of about 128% in the installed renewable energy capacity since. The sector is growing at a remarkable pace and is expected to become one of the dominant sectors of the economy backed by the consistent efforts of the PPP (Public Private Participation) Model. The key renewable energy sector in India is divided into solar energy, wind energy, hydropower, bioenergy, and ocean energy. The primary hubs for renewable energy in India are in the states of Rajasthan, Gujarat, Andhra Pradesh, Karnataka, Telangana, and Tamilnadu.

There have been several government initiatives over the years that signify the government’s commitment towards making India net zero carbon negative. Some of these key initiatives are highlighted below.

There have been several government initiatives over the years that signify the government’s commitment towards making India net zero carbon negative. Some of these key initiatives are highlighted below.

The government has allowed 100% FDI in the renewable energy sector through the automatic route which has given a significant boost to the sector and increased private participation as well. During the period between April 200 to June 2022, the FDI in the non-conventional energy sector was approximately US$ 12.57 billion. Furthermore, investment in India’s renewable sector stood at more than US$ 70 billion since 2014. Private investments in the sector are also seeing a tremendous increase. This includes the acquisition of SB Energy India by Adani Green Energy Ltd. (AGEL) for US$ 3.5 billion to strengthen its position in the renewable energy sector in India. Recently, Delhi’s Indira Gandhi International Airport (IGIA) has become the first Indian airport that is run entirely on hydro and solar power. Approximately 6% of the airport’s electricity requirement is met from the onsite solar power plants. The government has also announced 500 new ‘waste to wealth’ plants will be established under the new GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme with a total investment of Rs 10,000 crore.

The government has allowed 100% FDI in the renewable energy sector through the automatic route which has given a significant boost to the sector and increased private participation as well. During the period between April 200 to June 2022, the FDI in the non-conventional energy sector was approximately US$ 12.57 billion. Furthermore, investment in India’s renewable sector stood at more than US$ 70 billion since 2014. Private investments in the sector are also seeing a tremendous increase. This includes the acquisition of SB Energy India by Adani Green Energy Ltd. (AGEL) for US$ 3.5 billion to strengthen its position in the renewable energy sector in India. Recently, Delhi’s Indira Gandhi International Airport (IGIA) has become the first Indian airport that is run entirely on hydro and solar power. Approximately 6% of the airport’s electricity requirement is met from the onsite solar power plants. The government has also announced 500 new ‘waste to wealth’ plants will be established under the new GOBARdhan (Galvanizing Organic Bio-Agro Resources Dhan) scheme with a total investment of Rs 10,000 crore.

The Indian economy is expected to grow at a pace of approximately 7% in the coming years despite the growing concerns about recession in other parts of the world. The commitment of the government to the renewable energy sector will play a key role in shaping the Indian economy in the coming years. The steps taken to reduce the dependency on fossil fuels will not only reduce the overall pollution even in the remotest parts of the country but will also be beneficial in the long run as they form the largest chunk of our imports leading to a trade deficit. There are many experts that have estimated that by 2040, approximately 49% of the energy needs of the country will be met through the renewable energy sector. This is a huge commitment for any country especially a developing country like India. Furthermore, as per the Central Electricity Authority (CEA), it is estimated that the share of thermal energy is expected to reduce from 78% to 52%. The CEA also estimates India’s power requirement to grow to reach 817 GW by 2030.

The Indian economy is expected to grow at a pace of approximately 7% in the coming years despite the growing concerns about recession in other parts of the world. The commitment of the government to the renewable energy sector will play a key role in shaping the Indian economy in the coming years. The steps taken to reduce the dependency on fossil fuels will not only reduce the overall pollution even in the remotest parts of the country but will also be beneficial in the long run as they form the largest chunk of our imports leading to a trade deficit. There are many experts that have estimated that by 2040, approximately 49% of the energy needs of the country will be met through the renewable energy sector. This is a huge commitment for any country especially a developing country like India. Furthermore, as per the Central Electricity Authority (CEA), it is estimated that the share of thermal energy is expected to reduce from 78% to 52%. The CEA also estimates India’s power requirement to grow to reach 817 GW by 2030.

The budget announcements by the Finance Minister on 1st February 2023 have shown a positive impact on green energy sector. Some of the top stocks in this sector in terms of market capitalisation and their related details are mentioned hereunder.

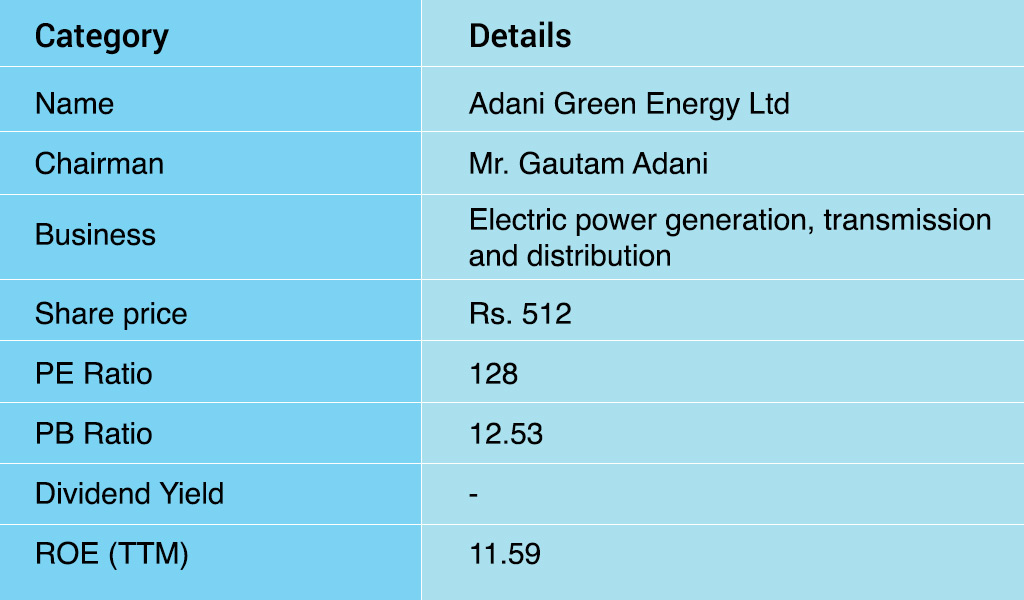

The name Adani has been making constant news in the stock market. Adani Green Energy Limited is the largest company in terms of market capitalisation in the renewable energy sector. The key details of this company are tabled below.

The name Adani has been making constant news in the stock market. Adani Green Energy Limited is the largest company in terms of market capitalisation in the renewable energy sector. The key details of this company are tabled below.

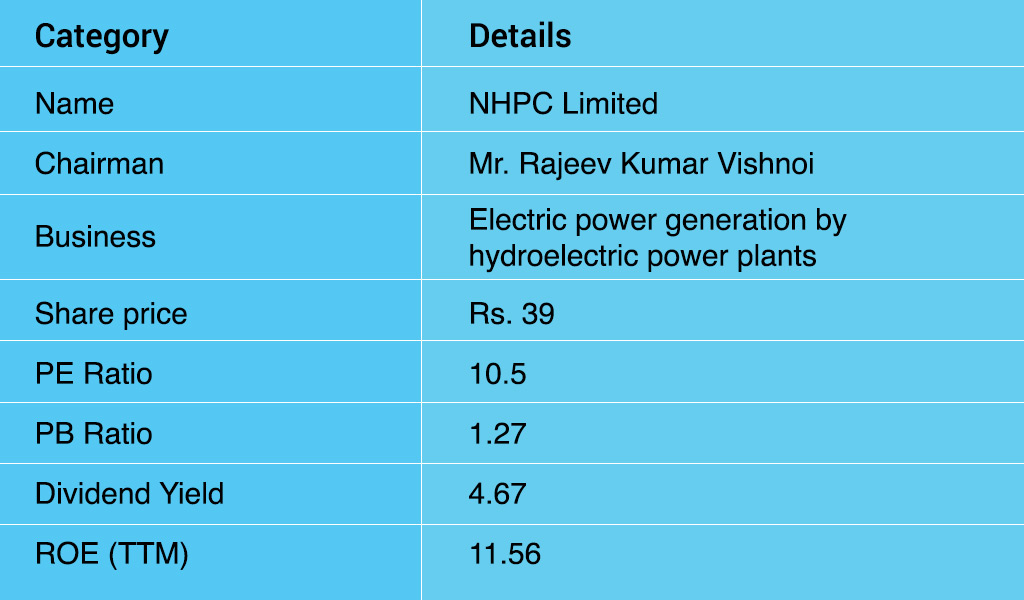

This is a PSU that is India’s flagship hydroelectric generation company. It is primarily involved in the generation and sale of bulk power to various Power Utilities and has also included other energy sources such as solar, geothermal, tidal, wind, and so on. The key details of this company are,

This is a PSU that is India’s flagship hydroelectric generation company. It is primarily involved in the generation and sale of bulk power to various Power Utilities and has also included other energy sources such as solar, geothermal, tidal, wind, and so on. The key details of this company are,

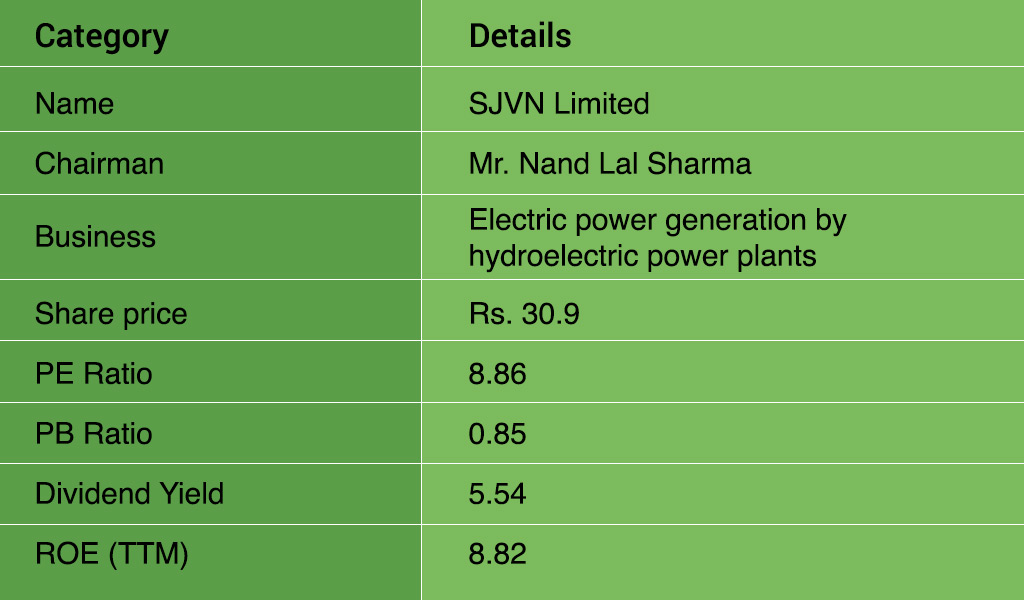

This company is engaged in the business of Electricity generation and also in the business of providing consultancy for hydropower projects. The key details of thai company are,

This company is engaged in the business of Electricity generation and also in the business of providing consultancy for hydropower projects. The key details of thai company are,

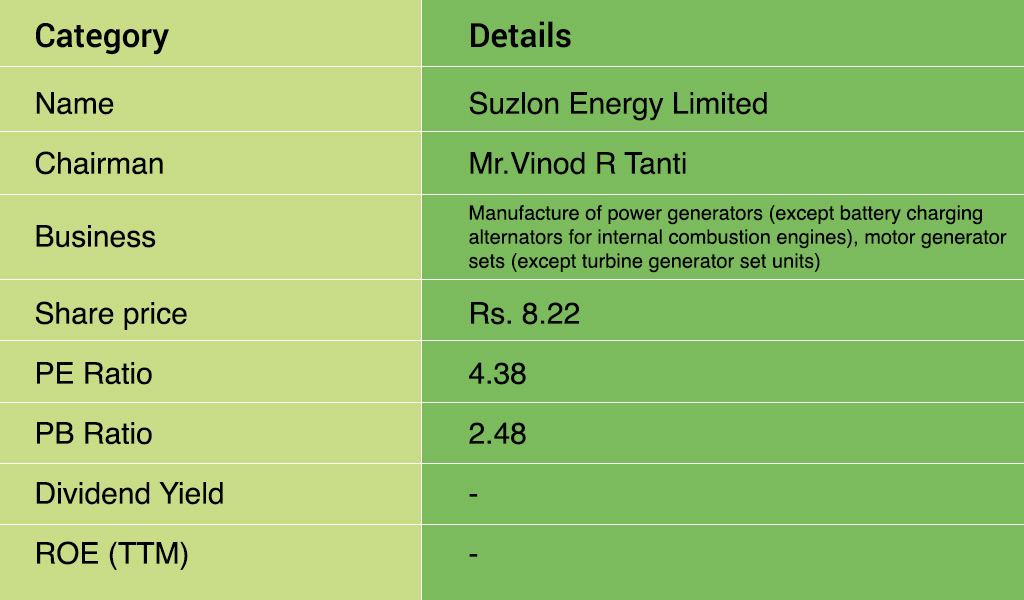

This company is primarily engaged in the business of manufacturing wind turbine generators (WTGs) and related components of various capacities. The key details of this company are,

This company is primarily engaged in the business of manufacturing wind turbine generators (WTGs) and related components of various capacities. The key details of this company are,

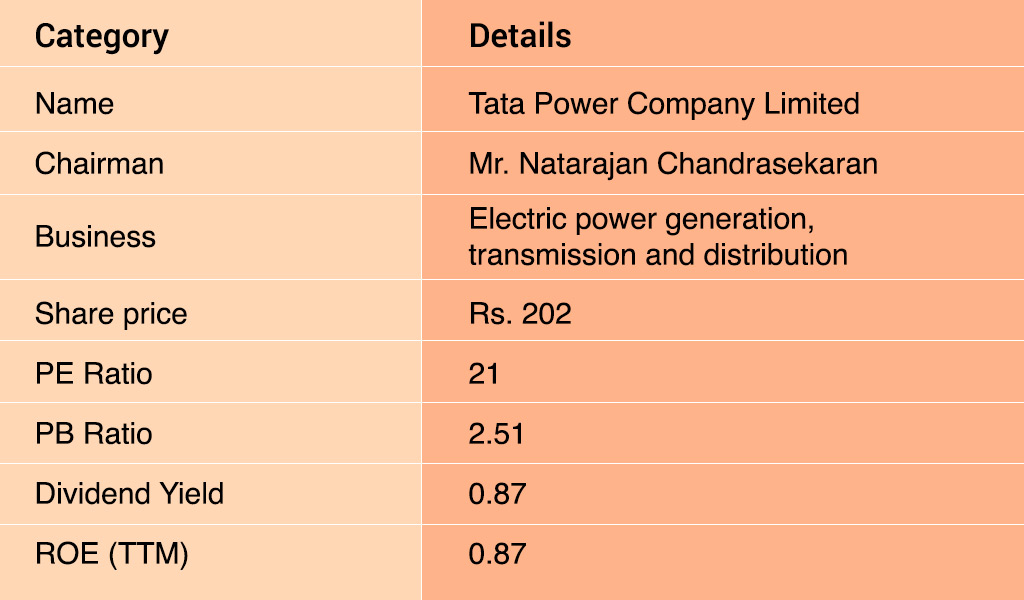

Tata Power is one of the biggest private players in the energy sector. Their commitment to renewable energy has been translated into huge infrastructure investments in this direction. The key details of the company are,

Tata Power is one of the biggest private players in the energy sector. Their commitment to renewable energy has been translated into huge infrastructure investments in this direction. The key details of the company are,

The renewable energy sector is set to become one of the strongest pillars of the Indian economy in the coming years. The collective effort of the government and the probate participants towards green energy is being largely seen at the seed stage currently. The fruits of these efforts will not only benefit the environment but also the Indian economy which is set to be the market leader in this sector through its strategic investments and infrastructure. We hope this article was able to provide valuable insights into the renewable energy sector in India and the steps taken to boost the same. Watch this space for more such sector analysis and related details. Also, let us know if you would like to know about any specific sector or industry and its key stocks. Till then Happy reading!

We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric v...

The IT sector has enjoyed huge growth over the past decades, however, the past ...

Unless you are living under a rock, you cannot miss the increasing use of AI in...