The financial sector in India is changing at a rapid pace and with the new developments, the use of technical advancements, and changing policies, it is creating a dynamic space for every participant in this sector. But it is also necessary to keep up with this rapid pace and make suitable regulations to ensure the protection of the interest of every participant while at the same time promoting the healthy growth of the economy as a whole. This is where financial regulators come into the picture and hold the reigns of the economy. But who are these major players and what is their role exactly? Check out this blog to know about the prime financial regulators in India and their broad roles in shaping the country. Read More: Key players in Indian stock markets

The financial sector in India is changing at a rapid pace and with the new developments, the use of technical advancements, and changing policies, it is creating a dynamic space for every participant in this sector. But it is also necessary to keep up with this rapid pace and make suitable regulations to ensure the protection of the interest of every participant while at the same time promoting the healthy growth of the economy as a whole. This is where financial regulators come into the picture and hold the reigns of the economy. But who are these major players and what is their role exactly? Check out this blog to know about the prime financial regulators in India and their broad roles in shaping the country. Read More: Key players in Indian stock markets

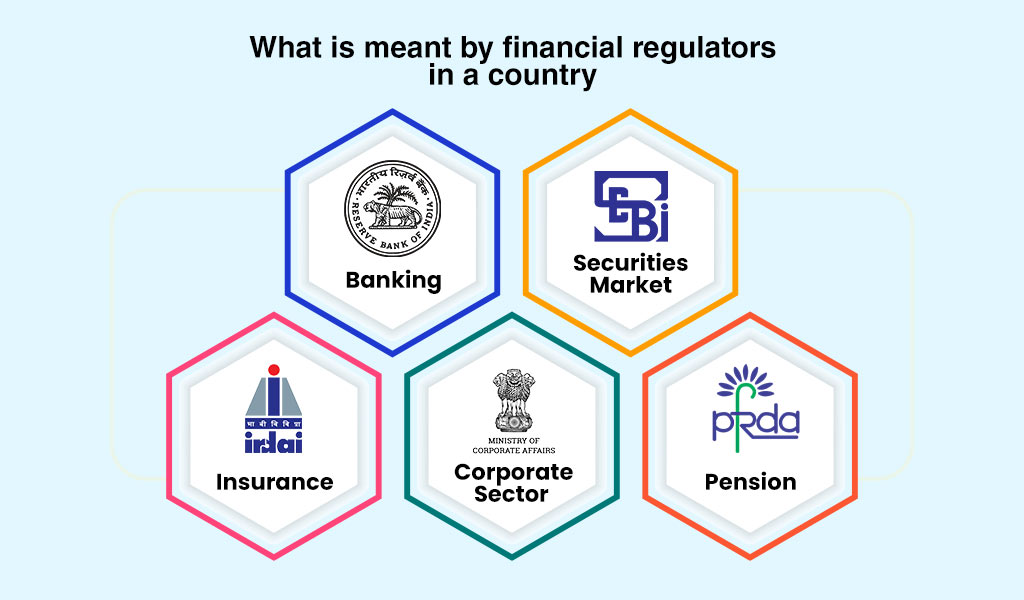

Financial regulators in a country are like referees to a game. They're organisations set up by the government to keep an eye on everything happening in the financial playground. These regulators make sure that various financial participants and institutions like banks, stock markets, insurance companies, and other financial players follow the rules and treat customers and investors right. These regulators help maintain stability, prevent fraud, and create an environment where everyone can trust and participate in the financial game. In short, financial regulators are the referees who keep things in check and make sure it's a fair and safe game for everyone involved

Financial regulators in a country are like referees to a game. They're organisations set up by the government to keep an eye on everything happening in the financial playground. These regulators make sure that various financial participants and institutions like banks, stock markets, insurance companies, and other financial players follow the rules and treat customers and investors right. These regulators help maintain stability, prevent fraud, and create an environment where everyone can trust and participate in the financial game. In short, financial regulators are the referees who keep things in check and make sure it's a fair and safe game for everyone involved

The pillars of the financial sector in India include banks, stock markets, insurance industry, and more. The regulatory authorities for each of these pillars and their details are mentioned below.

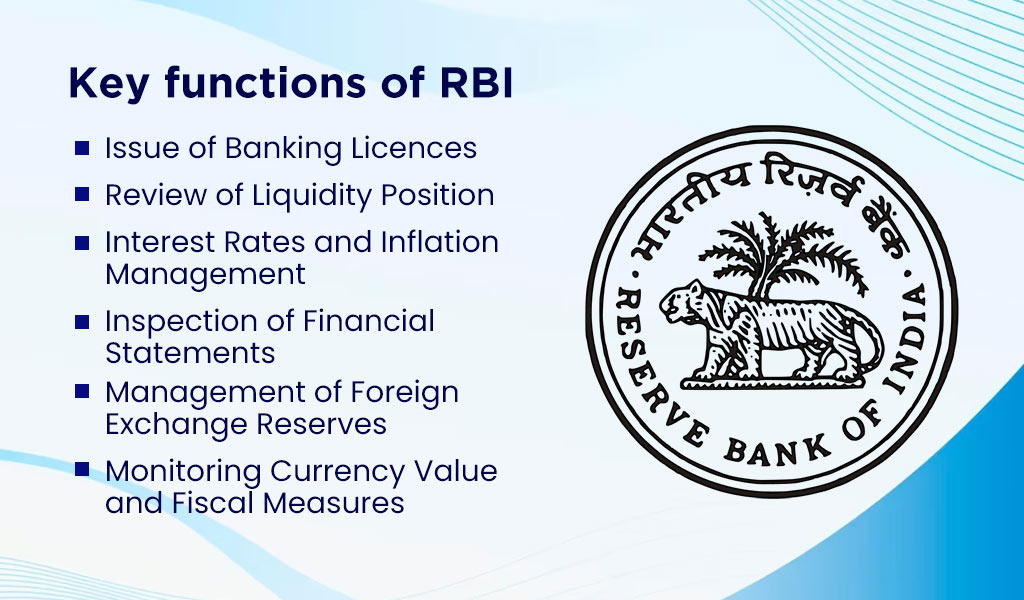

RBI or the Reserve Bank of India is the country’s apex bank or the central bank. It was established under the Reserve Bank of India Act 1935 with the primary aim to regulate the banking sector and the monetary policies of the country. The core functions of the RBI include the oversight of commercial banks, cooperative banks, NBFCs, and similar entities. It also involves safeguarding the economy's stability and tracking the movement of funds within the country.  The key functions of RBI can be highlighted hereunder.

The key functions of RBI can be highlighted hereunder.

The RBI plays a vital role in granting licences to eligible entities that want to establish and operate banks in the country, ensuring that new banks meet the necessary criteria for financial stability and credibility.

The RBI regularly assesses the liquidity status of the nation's financial system and implements measures to maintain it at an optimal level, ensuring a healthy flow of funds in the economy while preventing excesses.

The RBI plays a pivotal role in determining interest rates, which impacts borrowing costs and influences economic activities. It also works towards maintaining stable inflation rates in the country.

The RBI inspects the financial statements of banks to ensure their accuracy and stability. It also monitors the reserves maintained by banks to ensure they are sufficient to handle unexpected events. The RBI inspects the financial statements of banks to identify any signs of stress or vulnerability within the financial sector, taking proactive measures to address potential issues.

The RBI manages the country's foreign exchange reserves, ensuring they are optimally utilised to support international trade and economic stability.

The RBI keeps a close watch on the value of the Indian rupee and implements corrective measures in its monetary policies to protect it from significant fluctuations. It also contributes to managing and eventually reducing the fiscal deficit, safeguarding the country's overall financial interests.

After banks, the other important pillar of the financial sector is the stock market. Stock market in India are regulated by SEBI (Securities Exchange Board of India). The emergence of SEBI became imperative following the upheaval of the Indian financial system triggered by significant frauds, including the Harshad Mehta scam and various others. These incidents exposed a critical gap in safeguarding investors' interests within the capital markets, leading to a substantial erosion of their confidence. In direct response, the SEBI Act of 1992 was enacted, establishing the Securities and Exchange Board of India (SEBI) with an expansive mandate. SEBI's multifaceted responsibilities encompass the implementation of protective, regulatory, and developmental measures. These measures collectively construct a comprehensive framework designed to establish a secure and dependable environment for all participants engaged in the securities markets. By doing so, SEBI aims to uphold the interests of these participants, ensuring their financial well-being and fostering a sense of trust and reliability in the market's operations.  The primary functions or objectives of SEBI include,

The primary functions or objectives of SEBI include,

SEBI provides the framework for companies to list their securities on stock exchanges, ensuring that the process is transparent and fair. Similarly, it regulates the delisting of securities, safeguarding the interests of investors and maintaining market integrity.

SEBI is dedicated to preventing insider trading and safeguarding the interests of all participants in the securities market. This involves ensuring fair practices, transparency, and equal opportunities for everyone, maintaining the integrity of the market.

SEBI mandates the formal registration of intermediaries operating in the securities market. Additionally, it takes regulatory actions such as conducting periodic audits to ensure that these intermediaries adhere to the prescribed norms and maintain transparency.

SEBI's role extends to creating and enforcing a formal code of conduct that must be followed by all market participants. This code ensures ethical behaviour, fairness, and adherence to established rules and guidelines.

SEBI sets out penalties and consequences for violations of the code of conduct and other provisions outlined in the regulatory framework. It enforces these penalties to maintain market discipline and deter any non-compliant behaviour.

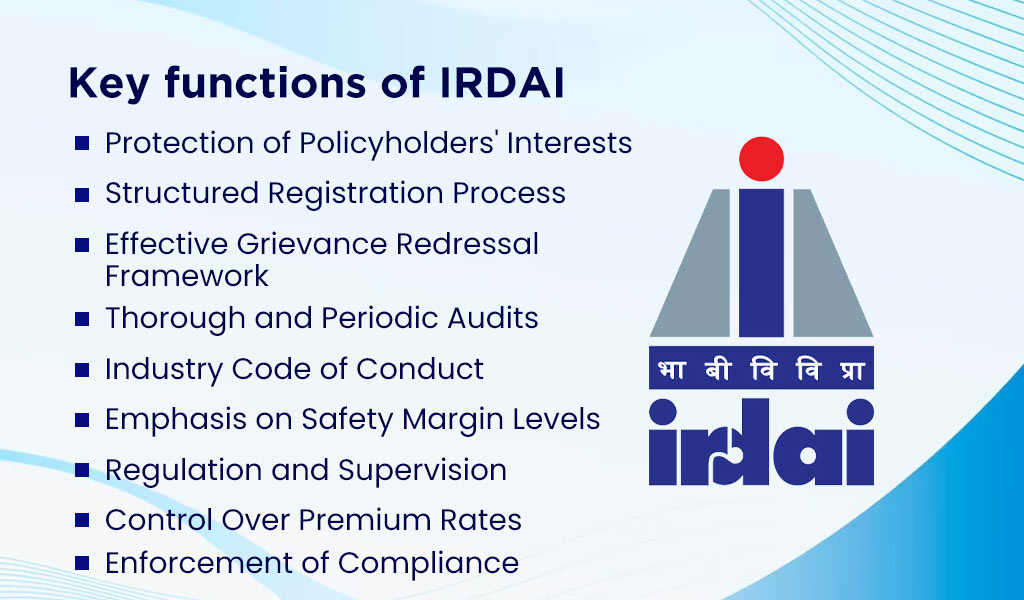

Formed in 1999, the IRDA assumes the crucial role of overseeing the insurance realm and safeguarding the interests of policyholders. Given the ever-evolving nature of the insurance sector, the guidance provided by IRDA advisories holds immense significance for insurance companies, aiding them in navigating regulatory changes effectively. With a firm grip on insurance rates, the IRDA sets definitive boundaries that insurers must not breach. Moreover, the IRDA outlines the prerequisites and training criteria for insurance agents and intermediaries, a mandate that insurers must adhere to. Empowered by the IRDA Act, this regulatory body possesses the authority to levy and adjust fees. It exercises comprehensive control over premium rates and permissible terms offered by insurers, with any insurer-provided benefits requiring the IRDA's endorsement. Notably, the IRDA plays a pivotal role in addressing grievances in an industry often characterised by protracted claims disputes.  The key roles and functions of IRDAI are explained hereunder.

The key roles and functions of IRDAI are explained hereunder.

The foremost duty of the IRDAI is to ensure the safeguarding of policyholders' interests within the insurance sector.

The IRDAI is responsible for establishing a well-structured and clear-cut procedure for the registration of insurance companies, along with defining the grounds for potential cancellations and modifications of these registrations.

Creating an efficient framework that comprises designated channels for addressing grievances and ensuring prompt and suitable remedies is one of the significant functions of the IRDAI.

The IRDAI conducts comprehensive audits of insurance companies at regular intervals, aiming to maintain transparency and accountability within the industry. Additionally, it initiates investigations related to grievances raised by any participants in the industry.

Laying down a code of conduct for all participants within the insurance industry, the IRDAI ensures ethical and professional behaviour. It also enforces proper training and education programs for industry participants to enhance their capabilities.

The IRDAI plays a vital role in emphasising the importance of maintaining appropriate safety margin levels within insurance operations and ensuring their consistent upkeep.

The IRDAI's regulatory powers extend to supervising the functioning of the Tariff Advisory Committee, specifying the permissible percentage of an insurer's premium income, and determining the percentage of business that can be undertaken in both life insurance and general insurance categories within the rural sector.

With the objective of maintaining fairness and stability, the IRDAI regulates insurance premium rates, contributing to a balanced insurance market.

The IRDAI enforces penalties for any violations of the rules and regulations stipulated by the Act, ensuring adherence to the established norms within the industry.

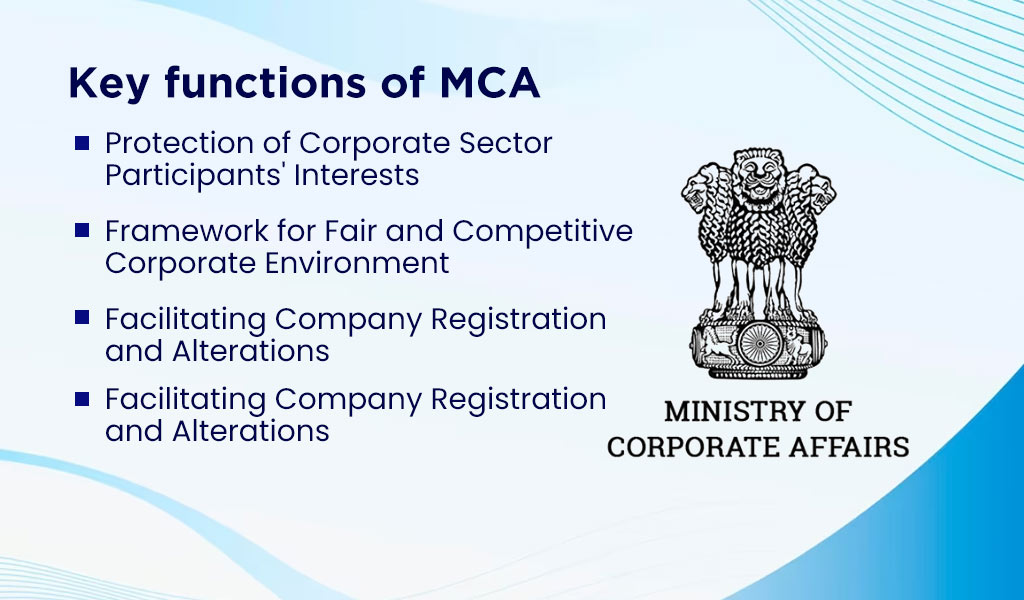

The Ministry of Corporate Affairs (MCA) operates as a government ministry in India, overseeing the corporate sector's regulation with a primary focus on administering the Companies Act of 2013, and related legislations. It establishes regulations and guidelines to ensure lawful operations within the corporate domain. The MCA's key goals include safeguarding stakeholder interests, fostering a competitive and equitable business environment, and supporting corporate growth. The Registrar of Companies, a constituent body, holds the authority to register companies and oversee their adherence to legal provisions. Additionally, the issuance of securities by companies falls within the scope of the Companies Act.  The role of MCA in India is explained hereunder.

The role of MCA in India is explained hereunder.

The Ministry of Corporate Affairs (MCA) plays a crucial role in safeguarding the interests of all participants within the corporate sector, ensuring their rights are protected and upheld.

MCA's responsibilities extend to establishing and maintaining a framework that fosters fairness and competitiveness within the corporate landscape. This framework facilitates the growth of companies and contributes to the overall development of the economy.

MCA provides the essential groundwork for the registration, modification, alteration, and even cancellation of companies, as well as the underlying laws that govern them. This ensures that companies operate within a legal and regulated framework.

MCA governs the issuance and redemption of various securities such as shares and debentures. It ensures strict adherence to all the relevant provisions of the Act, thereby maintaining transparency, fairness, and compliance in the issuance and redemption processes.

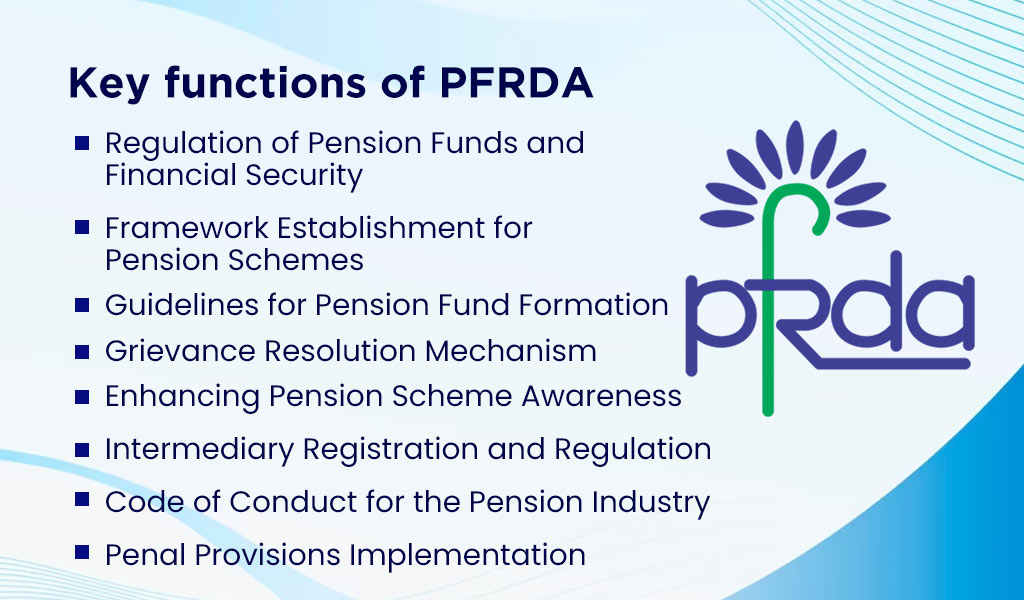

The Pension Fund Regulatory and Development Authority (PFRDA) assumes the role of governing pension schemes in India, exercising its oversight over the National Pension Scheme (NPS) and Atal Pension Yojana (APY). Established via the PFRDA Act of 2013, it extends its coverage to government, private, and unorganised sector employees. The primary mission of this regulatory entity is to ensure the financial stability of elderly citizens by overseeing and advancing pension funds, while simultaneously safeguarding the interests of pension schemes.  The role of PFRDA is briefly explained hereunder.

The role of PFRDA is briefly explained hereunder.

The PFRDA plays a pivotal role in regulating pension funds, ensuring the financial stability and security of pensioners.

Laying down comprehensive frameworks for pension schemes such as NPS and Atal Pension Yojana, the PFRDA safeguards the interests of subscribers to these schemes.

The PFRDA formulates guidelines that dictate the establishment and regulation of pension funds, ensuring a structured and accountable system.

By designing a robust process and an accessible portal, the PFRDA addresses grievances from concerned parties promptly, ensuring timely and effective remedies.

The PFRDA focuses on raising awareness regarding pension schemes and funds, facilitating informed decisions among potential beneficiaries.

Defining the procedure and conditions for registering and regulating intermediaries involved in pension funds and schemes, the PFRDA establishes accountability across the ecosystem.

The PFRDA establishes a comprehensive code of conduct for the entire pension industry, fostering ethical practices and fairness in pension fund disbursement.

The PFRDA enforces penal provisions to deter violations of the established code of conduct or any provisions outlined in the Act by any entity, ensuring compliance and accountability.

The financial regulators of India are like the backbone of the country ensuring that the steering wheels of the economy are steady and the pace is stable. Therefore, it is important to empower them with due authority and responsibility to carry out their functions in accordance with the law and ensure the smooth functioning of the economy for its rapid progress. This blog highlights the core financial regulators of India and their prime functions. Apart from these authorities, financial regulators also include the Association Of Mutual Funds In India (AMFI), Forward Markets Commission (FMC), National Housing Bank (NHB) and more. Let us know if you found this blog informative and also if you have any queries relating to any of these regulators. Till then Happy Reading!

Did you know that India’smutual fund industry now has over 26.63 crore inv...

SEBIs primary mission has always been to protect investors while creating a secu...

It was October 2022 when the stock markets started tightening the noose around s...