For the longest time, investment in stock markets was thought to be only for the rich and the elite and a very risky proposition that can simply erode one’s hard-earned money. Stock market investments are often equated with gambling and we have all heard our elders say at some point in time to stay away from stocks. The multiple frauds and scams in the stock markets have also contributed to this general notion but today the scenario is no longer the same. Investors today have multiple investment options to choose from depending on their investment goals and create a tailored portfolio that can suit their pockets as well as return expectations. Mutual funds are a classic example of the same and the buzz around them has increased quite a lot in recent decades, especially after the pandemic. Therefore, one of the many questions that investors, especially new investors face is what should they invest in, pure stocks or mutual funds.

Given below is a brief discussion relating to the same that can help investors understand stocks and mutual funds better and make suitable investment decisions.

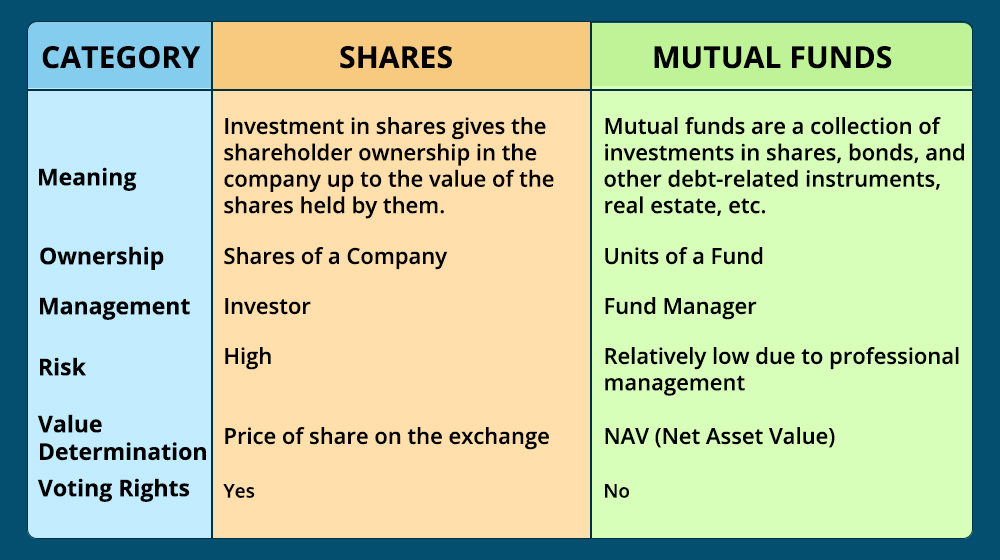

We have all heard the words shares and stocks but what is the exact meaning of these terms? Shares are the individual unit of the equity capital in the company. By investing in shares, investors get to be part of the ownership of the company along with voting rights and the right to returns in the form of dividends and net profits at the time of liquidation. The investor’s collective holdings of shares in one or more companies represent their total stocks or aggregate holding in a company which is usually represented as a percentage.

On the other hand, mutual funds are investments in a diverse pool of assets (equities, debt instruments, money market instruments, gold, etc.) in a single fund. Investors can invest in units of mutual funds through lumpsum investment or through SIPs at their convenience. The fund is managed by the fund managers who are in charge of the investment decisions and strategies to navigate the fund through the various market trends. Investors can invest in various types or categories of mutual funds depending on their risk-return profile and investment horizon.

Now that we know the basic meaning of shares and mutual funds, let us understand the difference between the two.

Now that we have seen the meaning and the key features of each of these products, how to determine which one is better? The answer to this question may not be a “one shoe fits all” kind of answer. Investors who may have a good understanding of the market and can navigate through the market fluctuations in the most optimum manner as well as a high-risk appetite can invest in stocks and create their own portfolio. On the other hand, risk-averse investors, or investors with little to no understanding and experience of stock markets or time to manage their own portfolios can opt for mutual funds. The investment decisions will also depend on the investment capital available to the investors. A financially sound investor who can afford to invest a substantial amount in stock markets along with other factors mentioned above may also prefer to invest in stocks directly rather than going through mutual funds. Similarly, investors with limited funds who are looking to gradually build their portfolio through small investment capital over a long-term investment horizon will prefer investing in mutual funds.

The critical differences between stocks and mutual funds help the investors understand these products in a better manner as well as help them have reasonable expectations in terms of risks and returns. However, recent years have shown a growing preference for mutual funds and an influx of especially small and retail investors in the market looking for essentially inflation-beating returns.

So what do you prefer for investment; stocks or mutual funds? Do let us know what you think is better according to you and can help you secure your future; because that's the ultimate goal right?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Every investor knows that the stepping stones to a good investment in thestock m...

Mutual fund investments are subject to market risks.’ There is a generatio...