Stock markets have traditionally been considered to be not for the average investor. There have been many notions that to invest in stock markets you either have to be super rich or you need to have profound expertise in finances. However, this is a myth. For investment in stock markets, all you need is a basic understanding of stocks and other securities and their price movements to various micro or macroeconomic events. This brings us to the most significant question for any beginner or novice investors, where and how to start..how to buy the first stock, and gradually build your portfolio.

Given below are the answers to the same and details to understand while buying the first stock.

The concerns of buying the first stock include arranging the finances for the same, selecting where to invest and how much, selecting the timeframe for investment, etc. The way to navigate these questions and other details that have to be focused on while buying the first stock are discussed hereunder.

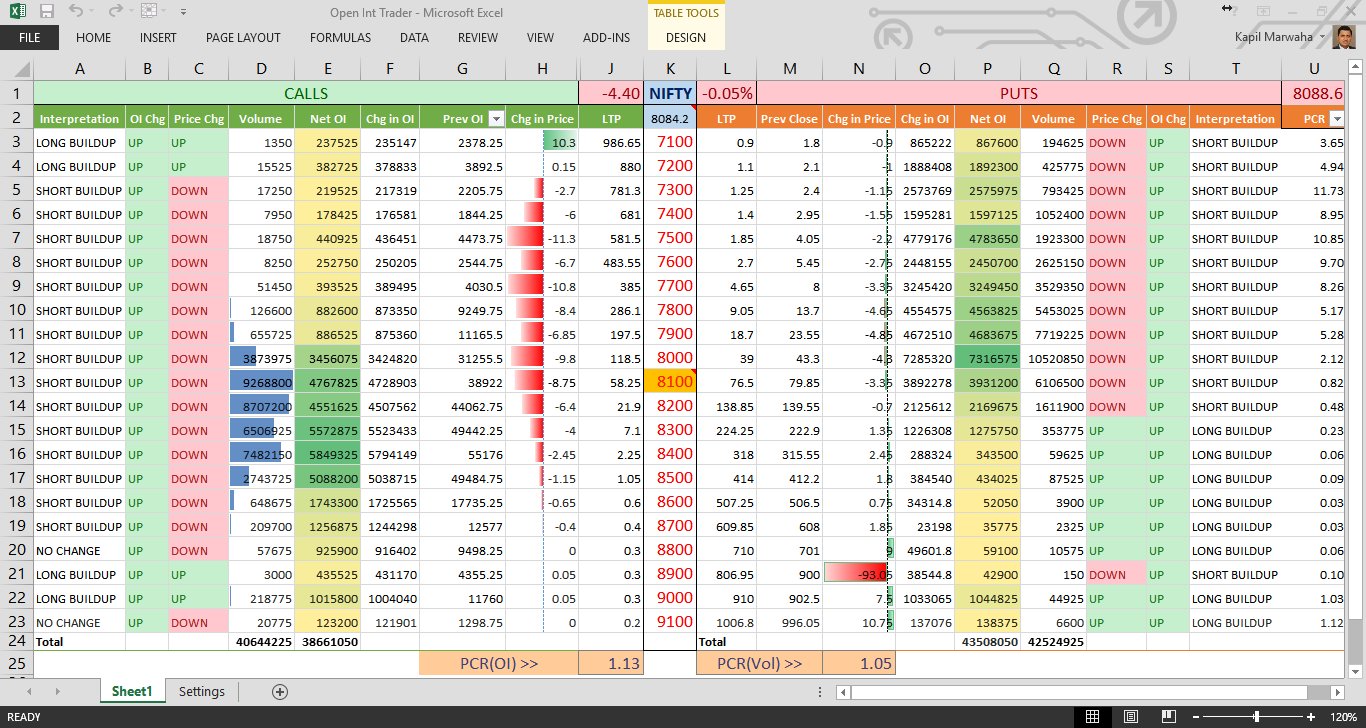

The first and foremost step is to understand the stock markets and the way it functions. This includes getting basic knowledge of the number of stock exchanges in India, the market timings, the process of buying and selling the stock, the settlement process, market participants, etc. Understanding these factors of the stock markets will help the investors in better portfolio management as well as having a timely response to any price volatility for any stocks or other securities.

The next step is to understand the available options for investments. Most investors think that investment in stock markets is only about shares. However, there are so many more available options like Exchange Traded Funds (ETFs), mutual funds, index funds, commodities, futures and options, forward contracts, etc. Each of these options has its own set of risks, return expectations, and guidelines for investing. Therefore, to start investing in stock markets it is primarily important to first understand the security to invest in and whether they meet the risk-return perception of the investor.

While we are analysing the type of security to invest in, it is also equally important to understand that a step towards the same is by understanding the type of investor you are. This implies analysing the expectations from investing in stock markets whether the investor is a value investor, growth investor, targeting dividend stocks, blue chip stocks, etc. This basic understanding helps in selecting the securities that suit the most in meeting the investors' goals.

Fundamental analysis of a company is another essential feature that needs great focus while purchasing any stock especially if it's your first. Even seasoned investors and traders understand that without the backing of fundamental analysis of a stock or any other security, any investment decision is nothing but a hunch or a gamble. Therefore, investors have to undertake a thorough analysis of the company and its key ratios along with other important aspects of the company like its products, the life cycle and the demand for the product, their competition, the latest advancements or challenges for the company, and the products, etc. These factors help in getting a clear idea of the growth trajectory of the company or its products and services and by extension the viability of investment in such a company.

As mentioned earlier, most potential investors think that for investment in stock markets, one needs to be very rich. This is highly untrue as there are many investment options like mutual funds, ETFs, etc. where investors can invest small amounts periodically and gradually build their investment portfolio.

One of the key parameters to assess while investing in stock markets is to ascertain one's risk appetite. This will help in buying the right stock that matches the expectations and helps in building a healthy portfolio. Stocks of blue-chip companies are less volatile and are ideal for risk-averse or beginners in the stock market while stocks of small-cap or mid-cap companies are relatively riskier. Therefore, it is important to understand the individual risk appetite to choose the right investment option that can help in meeting investment goals in the best possible manner.

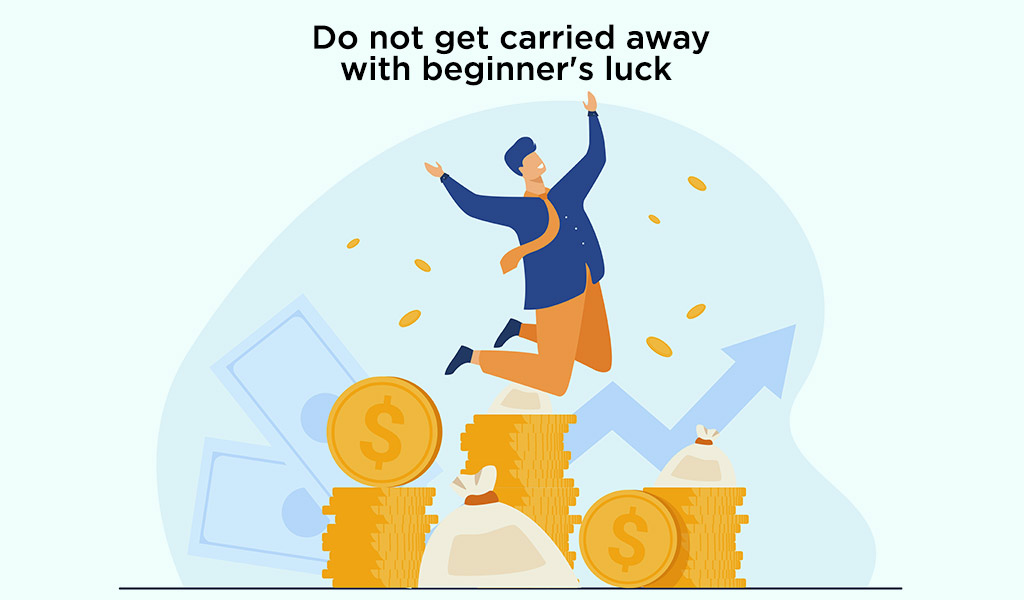

Stock markets are a game and many times, beginners also have a small amount of luck on their side. It may happen that a person may be able to make huge profits on their first investment. But this can simply be attributed to beginner’s luck. It should not be interpreted as a clear strategy for making money or that every investment option is going to be as profitable. Therefore, seeing one profitable trade in the beginning, one should remember not to put in all the eggs and risk losing everything in return.

Another important factor to remember is to invest consistently despite losses. Most investors stop investing in stock markets after their first investment does not yield profits or due to market volatility, after purchasing the same, the share prices start going down. At this juncture, one should remember that losses are part of stock markets and therefore one should not stop investing. Investors should usually focus on long-term returns from investing in stocks and therefore, short-term volatility should be ignored.

To invest in stock markets, having a Demat account is mandatory. One has to select a good stock broker who can provide a seamless investment process along with real-time access to data and features like a hassle-free registration process to open the Demat account, ensure the safety of data and transactions, multiple portals for prompt access, etc. The cost of investing through a broker in the form of brokerage to be paid should also be considered while selecting a broker.

Most people often have that final moment of hesitation right before buying the first stock. This feeling is quite natural but that should not stop you from taking the final plunge into the stock markets. The return potential from stock markets is the highest among any other class of investments. A risk-adjusted investment portfolio that is built carefully will help in meeting all the short-term and long-term financial objectives effectively.

Buying your first stock is a huge milestone as it is the first step in wealth creation and hence it should be enjoyed. Let us know if you need any more details to buy your first stock or further knowledge relating to various investment products.

Till then Happy Reading!

Read More: 5 Tips for Financial Planning for Women

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Introduction For the longest time, investment in stock markets was thought to b...

Stock market volatility can feel like a rollercoaster, with prices constantly mo...