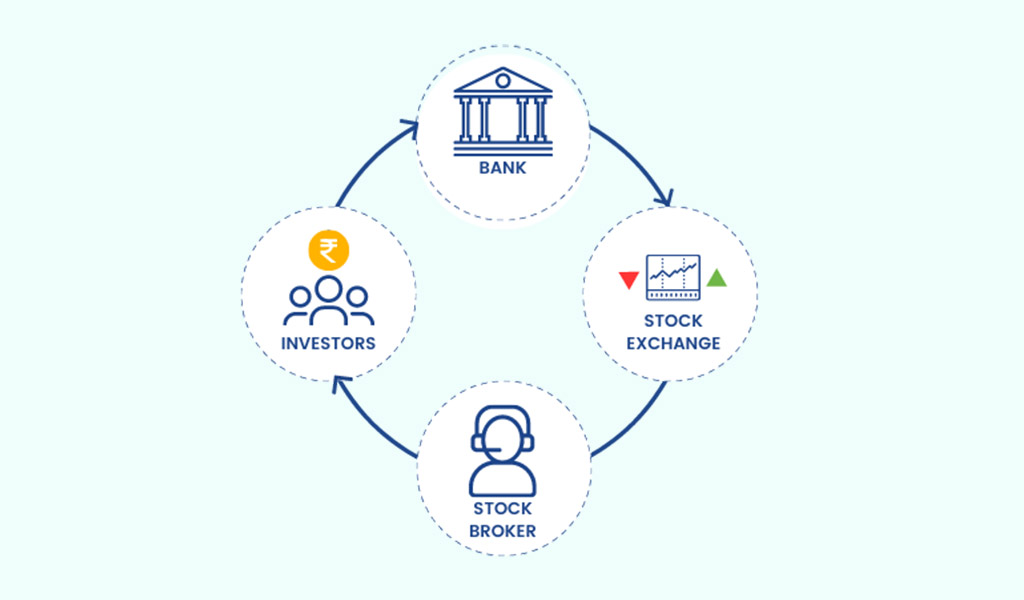

What are the steps to invest in stocks? Many new investors face this question. Well, the short answer for an average investor is that they open their trading app, select the stock they want to invest in, pay the amount for the investment and get their desired stocks in their Demat account. But do you know that behind this simple process, there are many participants that have a significant role at every stage of executing a buy or sell order of the securities? These are the key players or the participants of the stock markets that make up its whole ecosystem.

Given below are the details of all the key participants of the Indian stock markets and their roles and responsibilities.

Stock market participants are the entities that form the link between the ultimate investor and SEBI including them. The details of these participants are highlighted below.

The pensions of every citizen in the country are regulated by the PFRDA (Pension Fund Regulatory and Development Authority), similarly, the stock market in India is regulated by SEBI (Securities Exchange Board of India). SEBI was established in 1988 with the intention of protecting the interests of the investors. The need for SEBI became paramount after the Harshad Mehta Scam in 1992. After the scam, SEBI tightened its rules and regulations to prevent any similar future events. The core functions of SEBI and its key responsibilities are mentioned hereunder.

Protection of investor’s interests

SEBI is in charge of laying down the rules and regulations relating to all the securities available in the stock markets. All the participants have to follow these regulations failing which they are liable to face penal actions.

SEBI is also responsible for setting all roles and responsibilities pertaining to the market participants.

It is the duty of SEBI to ensure transparency in all the transactions in the stock market to avoid any cases of fraud or manipulation and ensure the smooth functioning of the market.

SEBI is also charged with due diligence while issuing licences to various participants in stock markets.

We have all heard the names NSE and BSE and know them to be the stock exchanges in India. But did you know these are not just the only stock exchanges in the country? India currently has 7 operational stock exchanges. These stock exchanges are essentially a platform for buyers and sellers to trade in securities like shares, derivatives, commodities, etc. SEBI is responsible to regulate these stock exchanges and ensure that all the participants follow the rules set by the regulatory authority.

When we own some jewellery we keep them safe in the bank locker, similarly, our shares and other securities from the stock market are kept safe in our Demat account. The Demat account is in the nature of a digital locker where all the securities held by an investor are held in the digitized format or the dematerialized format. These Demat accounts are maintained by the depositories in the name of individual investor names. India has two depositories that are responsible for maintaining all the Demat accounts. These depositories are NSDL (National Securities Depository Limited) and CDSL (Central Securities Depository Limited).

A Demat account is like a bank account for the securities from the stock exchange. However, investors cannot directly put their shares and other securities in their individual Demat accounts. This is where depository participants come into the picture. Depository participants are the link between the depositories and the investors. These are the authorized agents that open the Demat accounts on behalf of the investors.

Stockbrokers are SEBI registered agents who act on behalf of the investors and execute their buy and sell orders. Stockbrokers have to be registered with the SEBI to get the due licence for their role. With the age of online trading, stockbrokers provide an online trading platform through mobile apps as well as through their websites. Investors can contact stockbrokers with their trade requirements or execute the same on these platforms by logging in using valid credentials.

Stock exchanges are a hub for transactions worth millions on a daily basis. However, the chances of default in any of these transactions cannot be avoided. Clearing houses are charged with the duty of ensuring that all the traders are executed correctly and settled in due time.

The final link of any trade in stock markets is the ultimate investors. There are three main categories of investors that invest in various securities. These broad categories are Qualified Institutional Buyers or Investors (QIB or QII), Non-Institutional Investors (NII), and Retail Institutional Investors (RII). QIBs have the highest share of investment in any IPO (Initial Public Offering) followed by RII and NII. The retail category of investors is the small investors that have been increasing their participation in stock markets, especially after the pandemic.

The various participants of stock markets are responsible for ensuring that all the transactions are carried out seamlessly. The roles and responsibilities of all the participants are clearly defined by SEBI which ensures that the risk of fraud and misrepresentation is greatly reduced. Post the scams in the early 90s, SEBI has tightened its norms and the stringent regulations that are to be followed by all the participants of stock markets. The focus or the crux of defining the roles of all the participants is ensuring the protection of investors’ interests. When any participant fails to carry out their responsibilities in a due manner, they are liable for stringent penal actions that can also include jail time along with hefty fines.

Did you know that the entire process of selecting stocks or other securities and finally getting them in your portfolio involves so many participants? The most common of these participants is SEBI and their authority in the country is far and wide. Do you want to know more about SEBI? Do let us know in your comments.

Happy reading!

The second half of the year is always buzzing with excitement of festivals, fami...

Taxation is one of the key points to consider while making any career or investm...

The world is rapidly embracing digitisation, and India is proudly leading the ch...