Options Greeks are an important concept in options trading and understanding the same is crucial for having a successful options trading portfolio. We have covered the initial two Options Greeks namely, the Delta Greeks and Gamma Greeks in our previous blogs. The third stage of learning Options Greeks is the understanding of Theta Greeks. Theta Greeks relate to the time decay in options trading and provide a better understanding of this concept. Check out this blog to learn about Theta Greeks and the related details of the same.

Read More: How to select stocks for intraday trading?

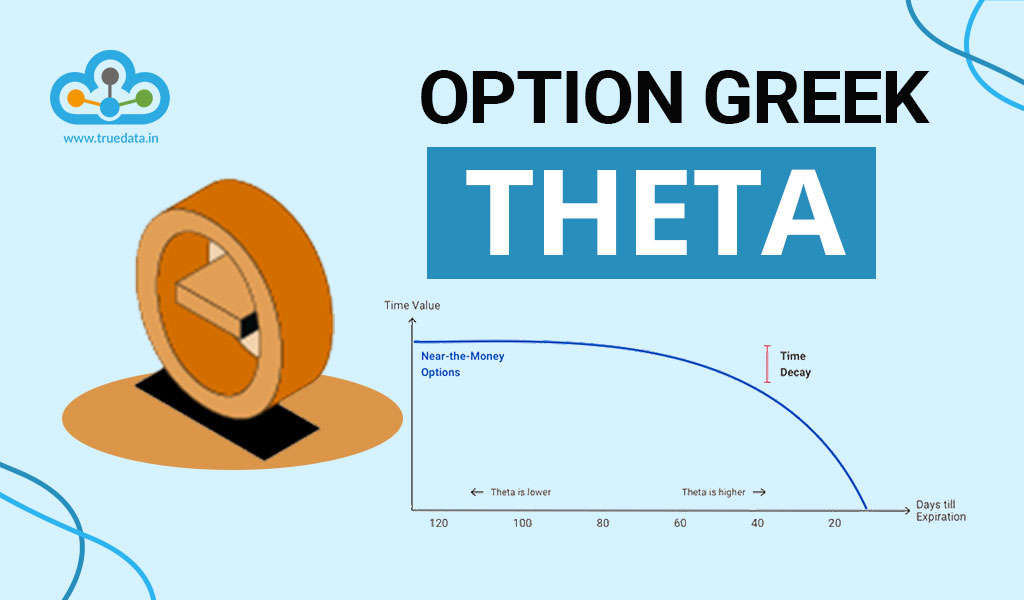

Theta, also known as time decay, is one of the essential "Greeks" in options trading, providing a measure of how an option's value diminishes as time passes, while all other factors remain constant. In India, where options trading is gaining popularity, understanding Theta is vital for traders and investors. In practical terms, it signifies that the value of an options contract can decrease each day as it approaches its expiration date. For option sellers, Theta can work to their advantage, allowing them to collect premiums and benefit from the erosion of the option's value over time. However, for option buyers, it's a factor to be mindful of, as it means their options may lose value as time passes, even if the underlying stock price remains stable. Effectively managing Theta is crucial for making informed trading decisions and designing strategies that leverage time decay while minimising potential losses.

In the dynamic Indian stock market context, Theta becomes a valuable tool for those engaging in options trading. Traders often use it to determine when to enter or exit options positions, helping them navigate the complexities of the market and seize opportunities while considering the time factor. Whether you're a seller aiming to capitalise on Theta's erosion effect or a buyer looking to make prudent choices, understanding and accounting for Theta is essential for a successful options trading journey in India or any other market.

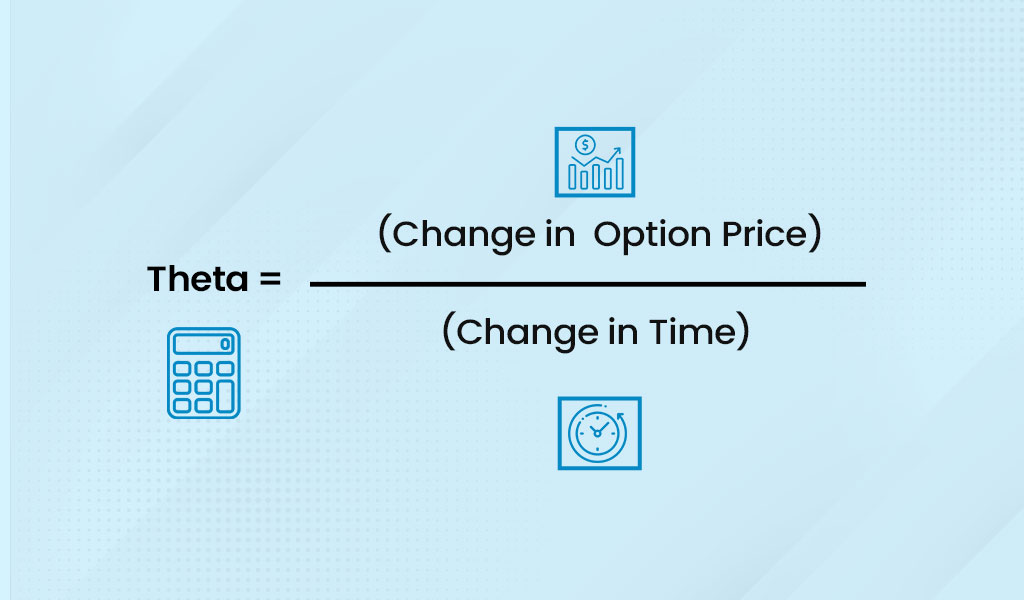

Calculating Theta, or time decay, for an options position involves a relatively straightforward process, and it's essential for traders to understand how to do this. Here's how you can calculate Theta using the following formula.

Theta (Θ) = (Change in Option Price) / (Change in Time)

To calculate it precisely, you can use the Black-Scholes model or other advanced pricing models. However, a simplified way to estimate Theta is to use the following formula:

Theta (Θ) ≈ (Option Price at Time t1 - Option Price at Time t0) / (t1 - t0)

Where,

Option Price at Time t1 0= Current option price.

Option Price at Time t0 = Option price at a previous time, typically one day earlier.

(t1 - t0) = the time difference in days.

Let's consider an example to illustrate this.

Suppose you are a trader and you hold a call option on a stock with the following details -

Current option price (t1) - Rs. 100

Option price one day ago (t0) - Rs. 105

Time difference (t1 - t0) - 1 day

Using the simplified Theta formula -

Theta (Θ) ≈ (100 - 105) / 1 = - Rs. 5 per day

In this example, your call option's Theta is approximately - Rs. 5 per day. This means that all else being equal, the option's value is expected to decrease by Rs. 5 per day as time passes. As a trader, you should be aware of this time decay and factor it into your trading strategies.

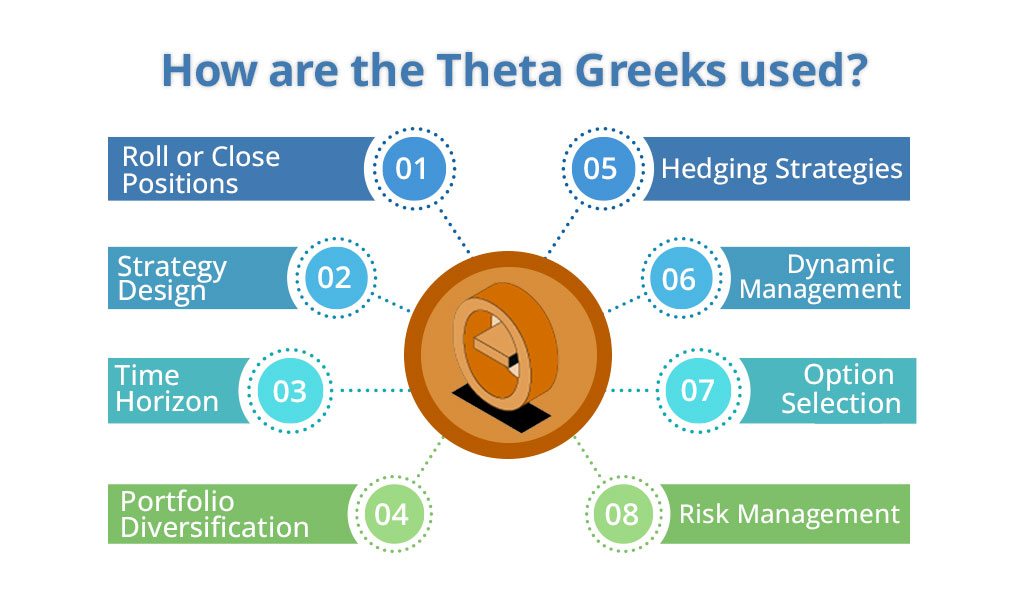

Understanding Theta Greeks is important to execute options trading successfully. The use of Theta Greeks in options trading can be explained hereunder.

Understanding Theta Greeks is important to execute options trading successfully. The use of Theta Greeks in options trading can be explained hereunder.

When choosing options for trading, traders must factor in Theta, which signifies the rate of time decay in an option. Various options have distinct Theta values, and traders should consider these when making their selections. If a trader intends to profit from time decay as an option seller, they should opt for options with higher Theta, as these will lose value at a quicker rate. Conversely, if they are an option buyer with a longer holding period in mind, it's advisable to choose options with lower Theta values to minimise the impact of time decay.

Traders should integrate Theta into their options trading strategies. For instance, selling options with higher Theta values can be a part of income-generating strategies, offering a consistent source of income as time decay works in their favour. Strategies like calendar spreads or iron condors can effectively harness Theta decay to capitalise on the erosion of time value.

It's imperative for traders to align their option choices with their specific investment horizon. For those seeking short-term gains or limited risk, options with shorter time to expiration and lower Theta should be favoured. Long-term investors may find options with lower time decay more suitable, allowing for extended holding periods without significant loss of option value.

As options approach their expiration date, traders should vigilantly assess the impact of Theta. If a position is adversely affected by time decay, it is prudent to consider rolling the position. Rolling entails closing the current option and initiating a new one with a later expiration date, extending the time frame and potentially mitigating the influence of Theta.

When implementing hedging strategies in the stock market, traders should account for Theta. For instance, if one holds a stock portfolio and wishes to shield it from short-term losses due to time decay, they can purchase protective put options with lower Theta. These options can serve as a protective buffer, limiting downside risk and safeguarding the portfolio.

Active management of options positions is paramount in India's rapidly evolving market. Traders should regularly evaluate how Theta affects their positions and make necessary adjustments. Should time decay become excessive, they should contemplate closing or adjusting positions to contain potential losses effectively.

Diversifying the options portfolio is a prudent risk management approach for traders. By holding a mix of options with varying Theta values, they can disperse the impact of time decay. This diversification helps reduce overall risk exposure, contributing to the refinement of their trading strategies.

Traders are advised to remain mindful of their risk tolerance at all times. Options with high Theta may offer promising returns, but they also entail higher risk due to accelerated time decay. Employing risk management tools such as position sizing and stop-loss orders is essential to safeguard capital and mitigate potential losses.

Theta Greeks is the third level of understanding options Greeks relating to an important concept of time decay affecting option pricing. This blog was a brief attempt to explain Theta Greeks and thereby aid in option trading strategies for traders. Let us know if you have any queries relating to this concept or need more details and we will address them. Till then Happy Reading!

India is increasingly becoming a dominant options trading market with the highes...

There has been a significant increase in the number of traders in the Indian st...

Options trading is one of the most significant trading segments and is gaining i...