There has been a significant increase in the number of traders in the Indian stock markets. This includes the options traders which focuses on derivative markets. This requires The novice traders to have a deep understanding of such trading and its related concepts. One of the key concepts of options trading is understanding options greeks. Given here is the meaning of this concept and related details of the same. Read More: Multibagger Penny Stocks - All you need to know

There has been a significant increase in the number of traders in the Indian stock markets. This includes the options traders which focuses on derivative markets. This requires The novice traders to have a deep understanding of such trading and its related concepts. One of the key concepts of options trading is understanding options greeks. Given here is the meaning of this concept and related details of the same. Read More: Multibagger Penny Stocks - All you need to know

Options Greeks are a set of parameters that traders use to assess the risks associated with trading options. These parameters help traders understand how an option price is likely to change based on changes in the underlying asset price, time to expiration, implied volatility, and interest rates. The five main Greeks that traders use are Delta, Gamma, Theta, Vega, and Rho. By understanding the Greeks, traders can better understand the risks associated with trading options and make more informed trading decisions. They can use this information to manage their risk exposure and develop more effective trading strategies.

There are five main types of option Greeks: Delta, Gamma, Theta, Vega, and Rho. Let's take a look at each of these Greeks in more detail.

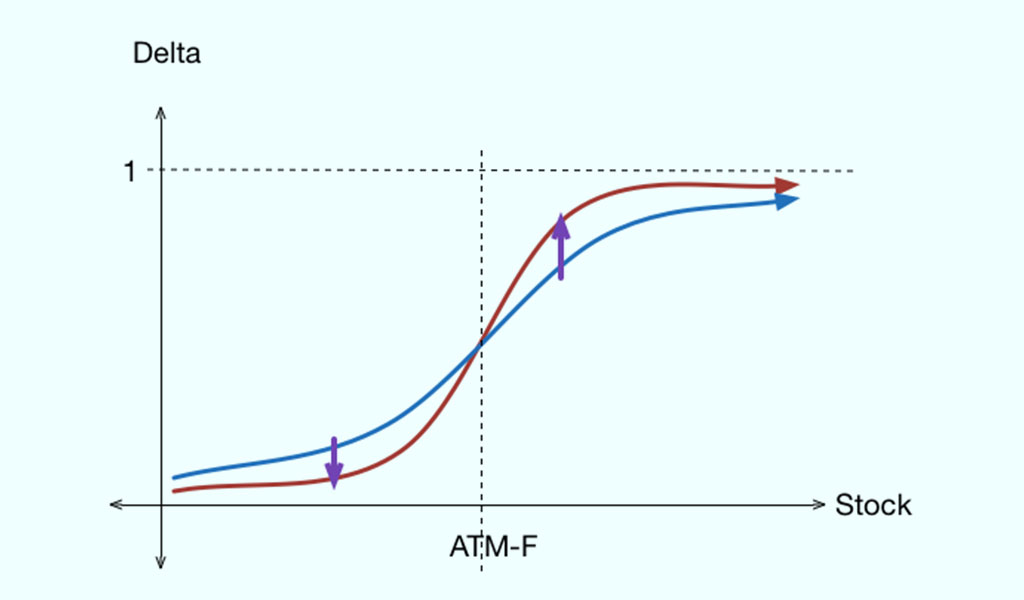

Delta measures the sensitivity of an option's price to changes in the underlying asset price. Delta ranges from 0 to 1 for a call option and from -1 to 0 for a put option. The Delta of an option can be calculated using the following formula: Delta = (? Options Price / ? Underlying Asset Price) For example, if a call option has a Delta of 0.5, it means that for every Rs.1 increase in the underlying asset price, the option's price will increase by Rs.0.50. If a put option has a Delta of -0.5, it means that for every Rs.1 increase in the underlying asset price, the option's price will decrease by Rs.0.50.

Delta measures the sensitivity of an option's price to changes in the underlying asset price. Delta ranges from 0 to 1 for a call option and from -1 to 0 for a put option. The Delta of an option can be calculated using the following formula: Delta = (? Options Price / ? Underlying Asset Price) For example, if a call option has a Delta of 0.5, it means that for every Rs.1 increase in the underlying asset price, the option's price will increase by Rs.0.50. If a put option has a Delta of -0.5, it means that for every Rs.1 increase in the underlying asset price, the option's price will decrease by Rs.0.50.

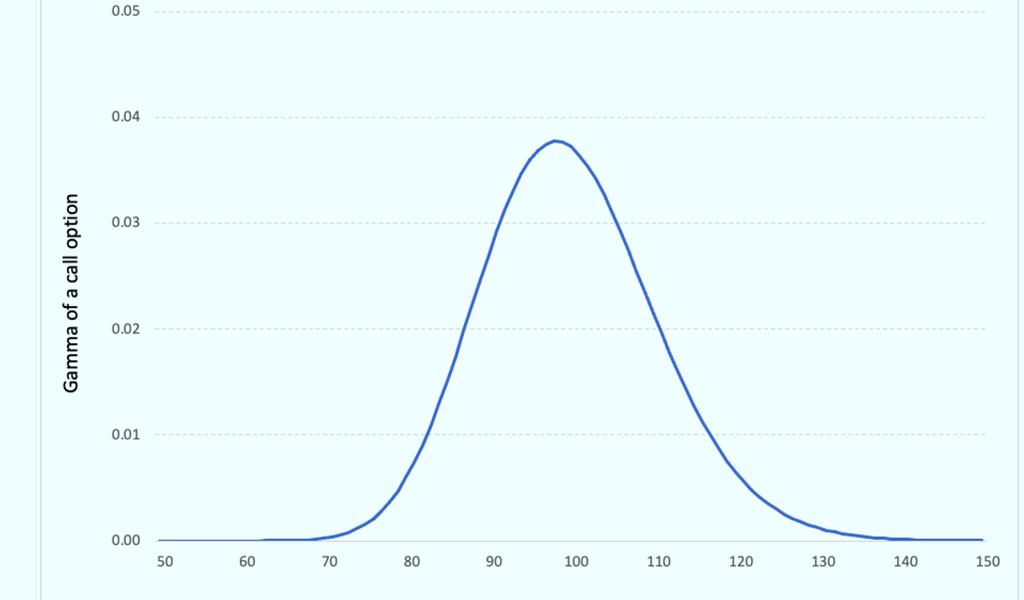

Gamma measures how much an option's Delta will change for every Rs.1 move in the underlying asset price. Gamma ranges from 0 to infinity for both calls and put options. The Gamma of an option can be calculated using the following formula: Gamma = (?² Option Price / ? Underlying Asset Price²) For example, if an option has a Gamma of 0.5, it means that if the underlying asset price moves by Rs.1, the Delta of the option will increase by 0.5.

Gamma measures how much an option's Delta will change for every Rs.1 move in the underlying asset price. Gamma ranges from 0 to infinity for both calls and put options. The Gamma of an option can be calculated using the following formula: Gamma = (?² Option Price / ? Underlying Asset Price²) For example, if an option has a Gamma of 0.5, it means that if the underlying asset price moves by Rs.1, the Delta of the option will increase by 0.5.

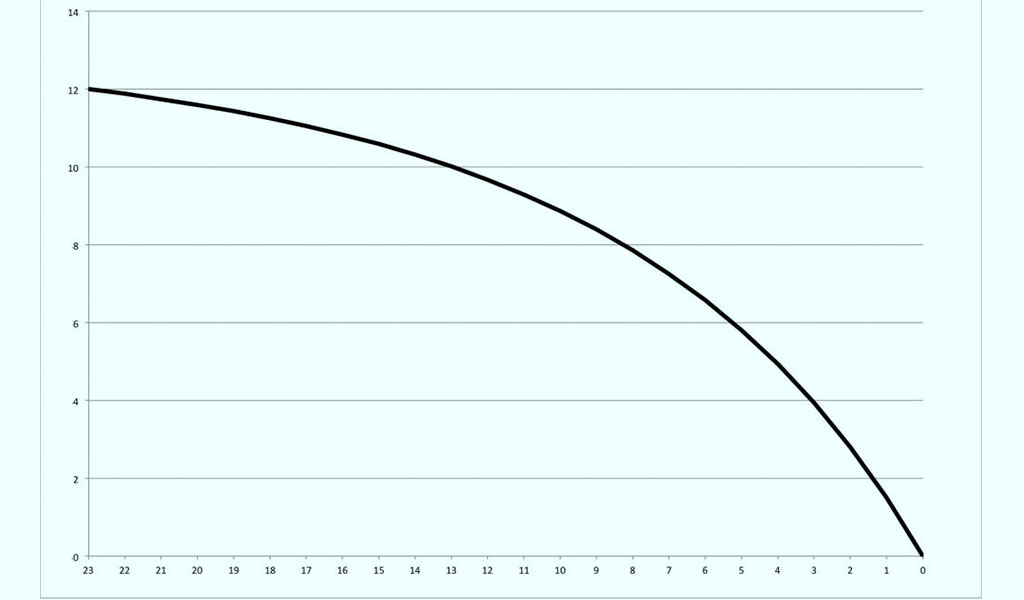

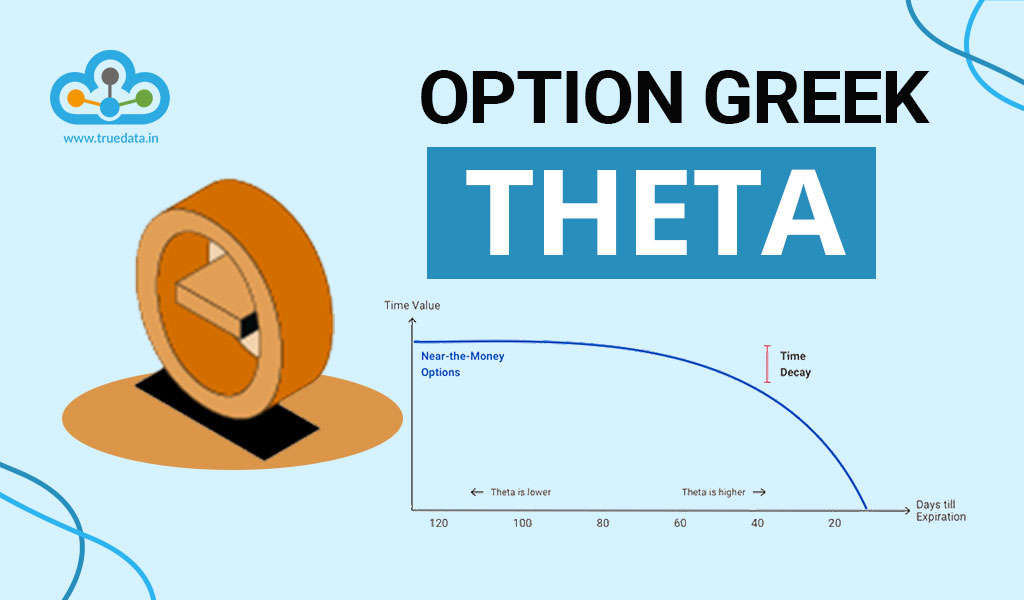

Theta measures the sensitivity of an option's price to the passage of time. Theta is always negative for both call and put options, indicating that the option's value decreases as time passes. The Theta of an option can be calculated using the following formula: Theta = (? Option Price / ? Time) For example, if an option has a Theta of -0.05, it means that for every day that passes, the option's price will decrease by Rs.0.05, all else being equal.

Theta measures the sensitivity of an option's price to the passage of time. Theta is always negative for both call and put options, indicating that the option's value decreases as time passes. The Theta of an option can be calculated using the following formula: Theta = (? Option Price / ? Time) For example, if an option has a Theta of -0.05, it means that for every day that passes, the option's price will decrease by Rs.0.05, all else being equal.

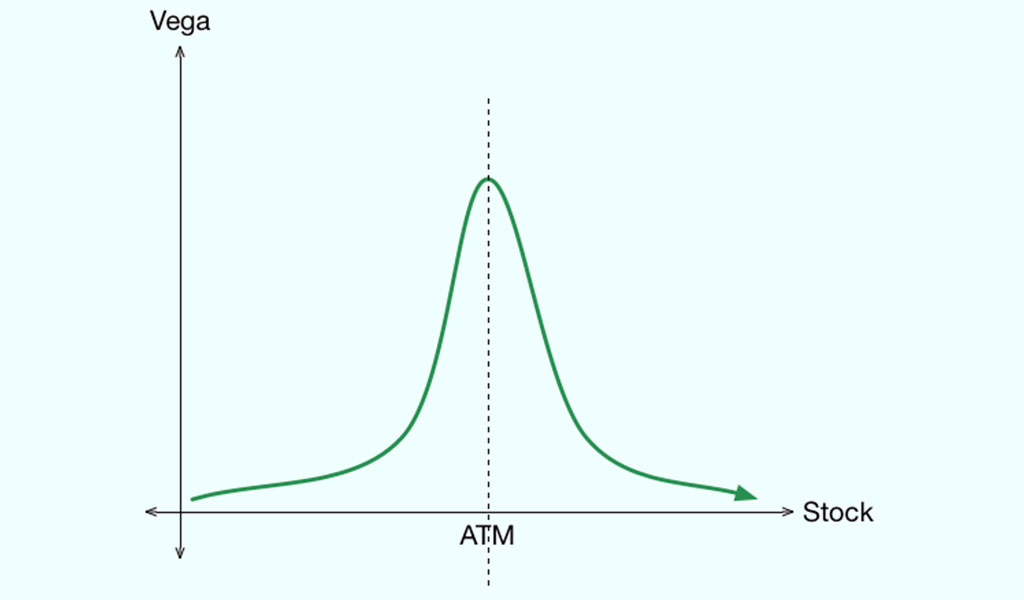

Vega measures the sensitivity of an option's price to changes in implied volatility. Vega is always positive for both call and put options, indicating that the option's value increases as implied volatility increases. The Vega of an option can be calculated using the following formula: Vega = (? Option Price / ? Implied Volatility) For example, if an option has a Vega of 0.1, it means that if the implied volatility of the option increases by 1%, the option's price will increase by Rs.0.10.

Vega measures the sensitivity of an option's price to changes in implied volatility. Vega is always positive for both call and put options, indicating that the option's value increases as implied volatility increases. The Vega of an option can be calculated using the following formula: Vega = (? Option Price / ? Implied Volatility) For example, if an option has a Vega of 0.1, it means that if the implied volatility of the option increases by 1%, the option's price will increase by Rs.0.10.

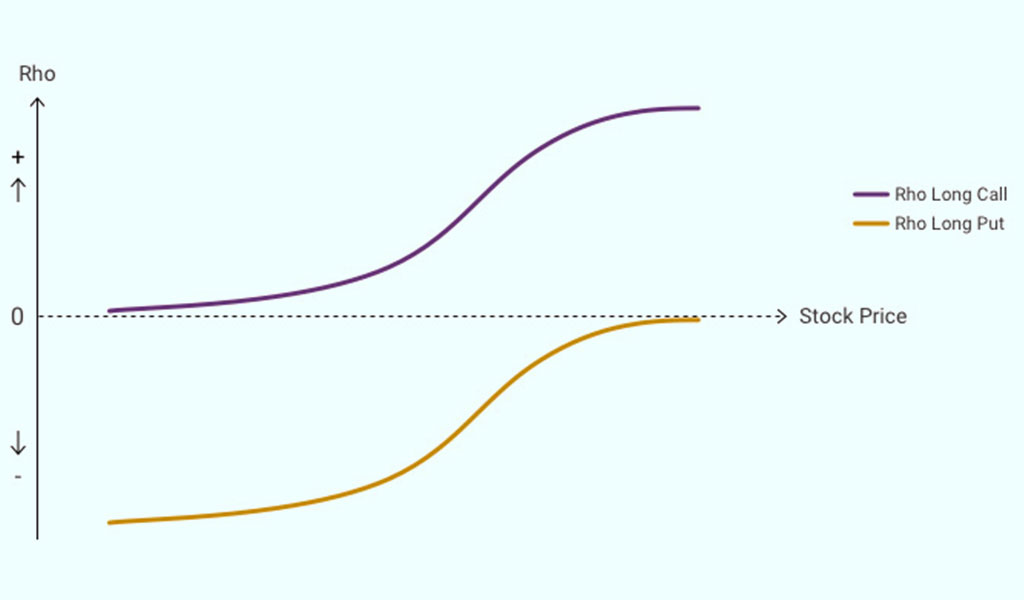

Rho measures the sensitivity of an option's price to changes in interest rates. Rho is always positive for call options and negative for put options. The Rho of an option can be calculated using the following formula: Rho = (? Option Price / ? Interest Rate) For example, if an option has a Rho of 0.05, it means that if interest rates increase by 1%, the option's price will increase by Rs.0.05 for a call option and decrease by Rs.0.05 for a put option.

Rho measures the sensitivity of an option's price to changes in interest rates. Rho is always positive for call options and negative for put options. The Rho of an option can be calculated using the following formula: Rho = (? Option Price / ? Interest Rate) For example, if an option has a Rho of 0.05, it means that if interest rates increase by 1%, the option's price will increase by Rs.0.05 for a call option and decrease by Rs.0.05 for a put option.

The various ways in which traders can use options greeks for trading and portfolio analysis are highlighted below.

The various ways in which traders can use options greeks for trading and portfolio analysis are highlighted below.

The options greeks allow traders to assess the different types of risk associated with an option, such as market risk, time decay risk, and volatility risk. This information can help traders make informed decisions on whether to buy, sell, or hold a particular option. For example, a trader might use delta to determine the likelihood that an option will be in-the-money at expiration, and use that information to decide whether to buy or sell the option.

The options greeks can also be used to analyze a portfolio of options and assess its overall risk exposure. Traders can use measures such as gamma and vega to understand how changes in market conditions might affect the value of their options portfolio. This information can help traders adjust their positions as needed to maintain a balanced and profitable portfolio.

Options greeks can be used to hedge against adverse market movements by determining the hedge ratio, or the number of futures contracts needed to offset the risk of an options position. For example, if a trader has a long call option position, they might use delta to calculate the number of futures contracts needed to short the underlying asset and create a neutral or hedged position.

Finally, options greeks can be used to optimize trading strategies by choosing the optimal strike price, expiration date, and volatility level based on a trader's risk-reward profile and market outlook. For example, a trader might use theta to select an expiration date that minimizes time decay or use vega to choose a volatility level that maximizes option value. Traders can improve their chances of success in the options market by using options greeks to fine-tune their trading strategies.

Options greeks may be a new concept for beginners of option trading but understanding it can provide a deeper insight into options trading and increase the chances of having a successful portfolio. The various levels of risk and volatility analysis using options greeks can help the traders navigate the market fluctuations more effectively. Traders can use the option decoder available on the website of TrueData for options trading and creating their trading portfolios. We hope this blog was effective in providing a better understanding of option greeks and demystifying them for you. Let us know if you have any queries related to options greeks or want to understand them better. Till then Happy Reading!

India is increasingly becoming a dominant options trading market with the highes...

Options trading is one of the most significant trading segments and is gaining i...

Options Greeks are an important concept in options trading and understanding the...