Fundamental analysis and technical analysis of securities are the basis used for trading in various securities like stocks, commodities, currencies, and more. It involves analysing the price and volume of the security to understand the market trends and take suitable market positions with the aim of earning profits. Traders can use various trading strategies that can help them make strategic decisions and understand the behaviour of the security to any micro or macroeconomic changes. Open high open low is one of the many trading strategies that can be used by traders to understand stock markets and create an optimum investment portfolio.

The open high open low strategy is an intraday trading strategy that can be used for analysing stocks and understanding their price movements to evaluate optimum buy and sell signals. This strategy is fairly simple and can be easily interpreted by even novice traders as against other complex strategies. This strategy is used prominently in intraday trading as it requires analysis of the stocks rapidly and taking buy and sell positions instantly according to price movement.

The "open high open low" strategy is a technical analysis method used to identify the potential direction of price movements in financial markets, such as stock markets or commodity markets. The strategy is based on the idea that the direction of the market can be determined by looking at the relationship between the key price points like the open price, high price, low price, and close prices of an asset.

OHLC can be visualized by using charts called candlestick charts which are commonly used for technical analysis of the financial market, in which an "up" candle represents an open price that is higher than the close price and a "down" candle represents an open price that is lower than the close price.

Some key highlights of the OHOL strategy include:

This strategy is based on analyzing price movements on a day-to-day basis

It can also be referred to as a contrarian strategy, which means that it goes against the current trend in the market.

Traders can apply this strategy to a wide range of assets, including stocks, commodities, and currencies.

The strategy relies on the premise that the opening price is a key indicator or the basis of the security's future price movements.

In general, the strategy is considered to be profitable in a trending market but may lead to significant losses in a non-trending or choppy market.

Here are the basic steps to executing an OHOL strategy:

The first step is to login into the trading account

Traders have to identify a target stock/security that is to be traded using this strategy.

Check the previous day's high and low prices for that stock/security.

At the opening of the market, check the open price of the stock/security.

If the current price is higher than the opening price of the day, sell the stock/security.

If the current price is lower than the opening price of the day, buy the stock/security.

Finally, exit the trade as soon as your predetermined target is reached or when the stop loss is hit.

The security's price should be volatile enough to provide ample opportunity for buying at a new high and selling at a new low. A security that has more or less static prices may not provide good opportunities to apply this strategy.

The stock should be sufficiently liquid to allow for easy buying and selling without a major price impact. This implies that traders should preferably use this strategy in high-volume stocks to successfully execute it.

The security's price should be trending in a particular direction, either up or down. This is crucial to provide a clear indication of buying and selling signals.

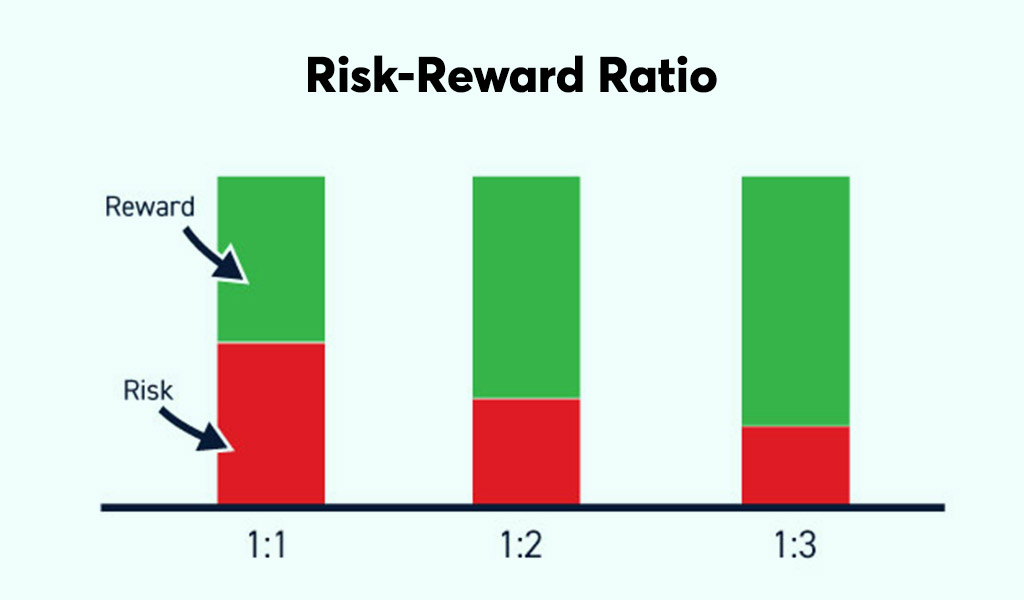

This is a crucial point of consideration while using any trading strategy as the potential profit from the trade should outweigh the potential risk. This strategy must be used within the overall risk management of the trader.

It is important to note that traders should use additional technical indicators to provide further acknowledgement that the strategy is working and to confirm the entry and exit points.

Also, this strategy might not always be effective and can be high risk, so it is recommended that you conduct thorough research, consider multiple factors, and apply it with caution.

This strategy is one of the easiest strategies to apply and hence is quite popular among traders. The key to successfully applying this strategy like any strategy is a thorough understanding of the market and the price trends. Without this basic understanding, there is a high possibility of losses even in these types of simple trading strategies.

Hope this article was helpful in providing a basic understanding of this strategy and how it functions. Keep watching this space for more information on such trading strategies and understand them in a more simplified manner.

Till then happy reading!

Read More: What is an iron condor strategy?

When we talk about trading, which security is the most common one that comes to ...

There are very few things that investors agree on, and one of them is that earn...

Options trading is a very popular trading segment in theIndian stock markets yet...