It is often said that technical analysis in stock is the bread and butter of any trader. It largely depends on the study of the price trends backed by the volume profile that is traded on any day. This helps the traders to understand if the stock is in demand or is about to be on a downtrend. However, the market as we know is quite volatile and its reaction to any external news can be moderate to extreme depending on its sensitivity to the news. Therefore, traders are always at risk of losing their money even if they have interpreted the trends correctly. At such a time, stop loss is one of the handiest tools that can safeguard the interest of traders and save them from heavy losses.

So what is this stop loss and why do all traders whether new or even seasoned ones swear by it? Below are the answers to these questions and other details of stop loss that can help traders understand and implement it in a better manner.

Stock market trading was not as popular as it is today. Some credit for it also goes to COVID. With a majority of people working from home or many laid off due to any reason, they have turned to stock market trading as a means of an alternate or primary source of income. However, it may not be possible for every trader to track the markets every minute and exit their positions on time to avoid huge losses. Therefore, placing a stop loss allows them the relief to limit their losses. Stop loss order is essentially an instruction set by the trader at the trading portal or within the broker that allows them to exit their positions when a predetermined price level is reached. Stop loss is also commonly known as a stop order or stop market order. This is a definite instruction by the trader and therefore, once placed, the order is executed when the price level is breached.

The concept of a stop loss can be explained in the following example. Consider trader A has 100 shares of Company B which is currently trading at Rs. 500. The trader now sees a potential downtrend for the stock and is of the opinion that the stock may slide to a certain extent. Therefore, to safeguard from extreme losses, he puts a stop loss at Rs. 450. Now when the stock price of Company B shares will reach Rs. 450, the trading portal will automatically execute the sell order of these shares at Rs. 450, and the net loss for Trader A will be restricted to Rs. 5,000 (100 shares * Rs. 50 loss). In an adverse case, if there was no stop loss and the shares were not sold in time till the stock price fell to say Rs. 300, the trader will have to book a loss of Rs. 20,000 (100 shares * Rs. 200 loss).

There are two types of stop loss that can be used by traders to limit their losses. The details of the same are mentioned below.

This is the common type of stop loss that is usually used by most traders. The traders set a fixed price for the trade to be executed. Fixed stop loss can also be time bound where the trader sets a time interval of say 10 mins to allow the stock to gain profits and exit the trade no matter the price range. It is advisable to use time-based stop loss only when the trader does not foresee any major swing in the share prices.

The simplest explanation for trailing stop loss is a continuous stop loss. This is executed usually in an upswing where the trader gives himself a maximum chance of earning capital gains while at the same time having a caution for any potential losses. The stop loss, in this case, is set as a percentage of the stock price and adjusts with the increasing price band, and is executed when the stop loss level is breached.

Consider shares of company A trading at a price of Rs. 100 and the trader sets a trailing stop loss of say 10%. This means that if the price does not change, the stop loss will be executed if the stock price falls below Rs. 90. Consequently, if the stock price is traded at Rs. 150, the stop loss, in this case, will be at Rs. 135. Therefore, now if the stock reaches this point, a stop loss will be executed and the shares will be sold at the price of Rs. 135 per share. The trader in this case has managed to avoid the chance of potential loss if the stock price would have dropped rapidly and has a capital gain of Rs. 35 per share (Rs.135 - Rs. 100).

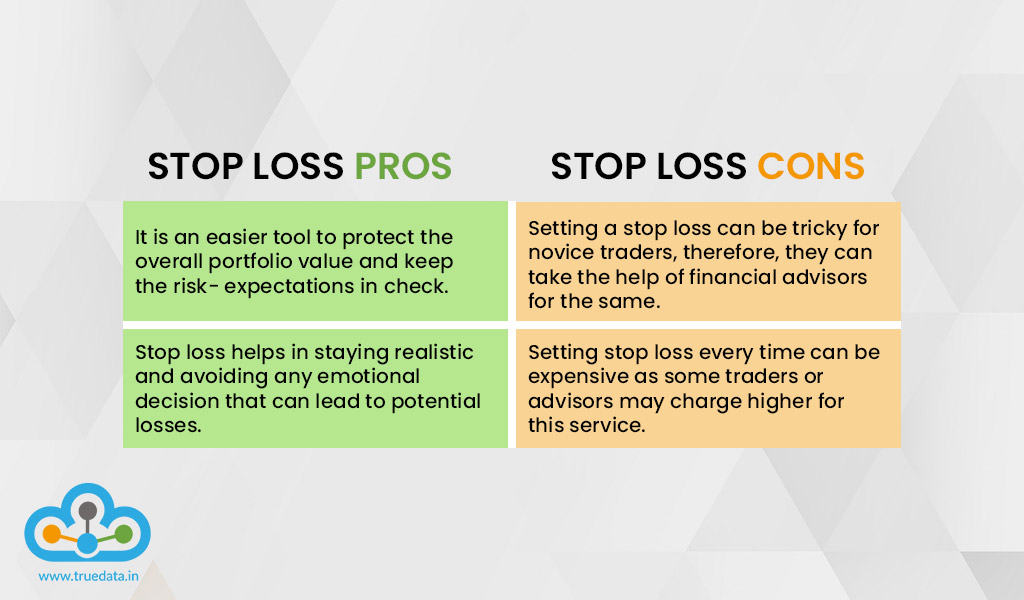

The pros and cons of stop loss are stated below.

Some of the advantages of using stop loss are,

Protects the trader from potentially heavy losses and extreme market volatility

Provides a safety net for the trader as they do not have to constantly monitor the market every minute to account for price fluctuations

It is an easier tool to protect the overall portfolio value and keep the risk- expectations in check

Stop loss helps in staying realistic and avoiding any emotional decision that can lead to potential losses.

Some of the key disadvantages of using stop loss are,

When a stop loss is set, the losses are limited as the trading position is exited, but the trader also loses any opportunity of gaining any profits if the stock starts rallying subsequently.

Setting a stop loss can be tricky for novice traders, therefore, they can take the help of financial advisors for the same.

Setting stop loss every time can be expensive as some traders or advisors may charge higher for this service.

Stop loss is the most efficient way to limit one's losses in trading and keep the hard-earned money from being wiped out. While stop loss is quite an essential tool for beginners, it is equally important for seasoned traders to keep their losses in check.

So now that you know about stop loss, let us know if it reduces your fear of losses in stock trading and has made them more lucrative or relatively easier at the very least!

What are the topmost factors to be considered while making any investment decisi...

Do you know how stock trading was carried out on our stock exchanges in the earl...

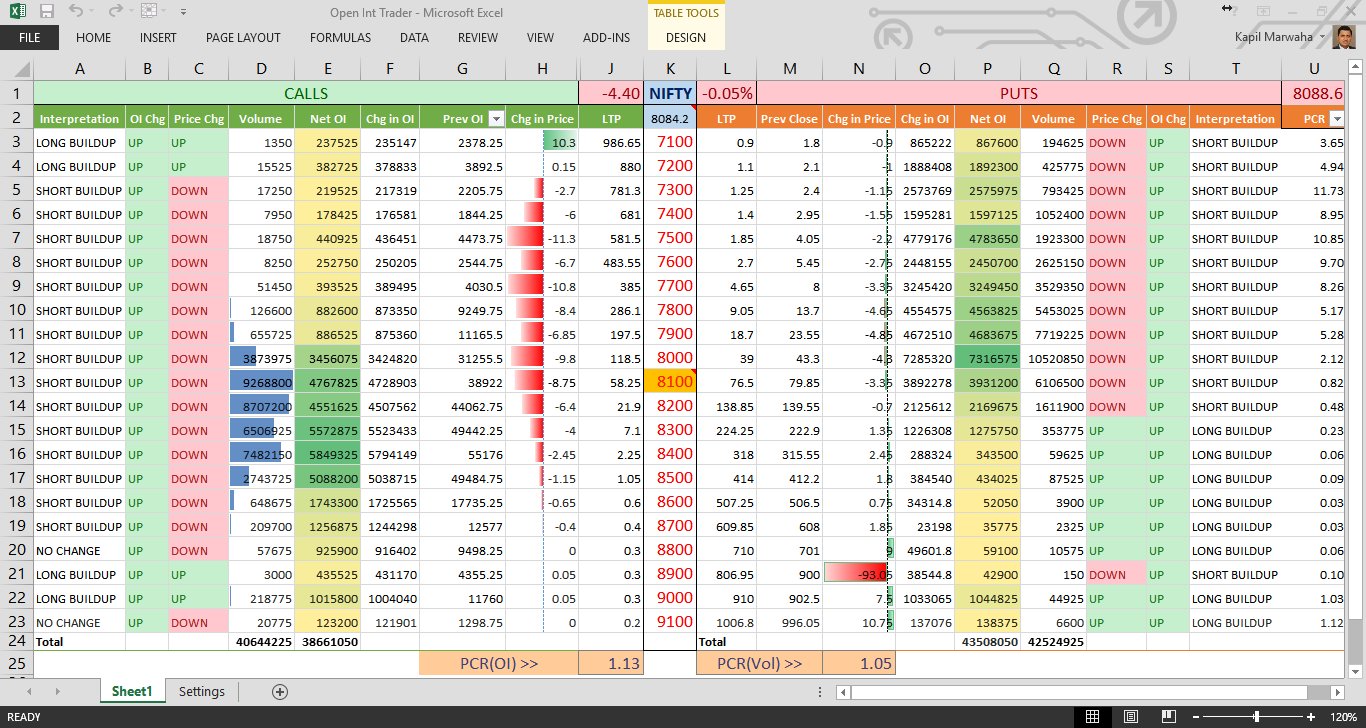

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...