Before getting into any technicalities or know-how, we need to know what we mean by backtesting in Amibroker. Backtesting is an easy process used by Traders to evaluate Trading Ideas and provides information regarding how good is a trading system based on historical datasets. Precisely, it talks about the behavior of the trading system, risks involved in a particular trading system, and more regarding the performance of the trading system. There is one such program AmiBroker which performs all these functions and does much more for the traders.

To keep it simple, AmiBroker is a full-fledged professional Technical Analysis and charting tool that can be used by traders to Analyse the Market, prepare charts, and backtest trading strategies. You need to know about AmiBroker before using it to backtest. Better make an informed decision rather than just going with a feature that you might regret later (which you won’t!)

Here is a list of features which are offered by the trading platform apart from backtesting-

Here is a list of features which are offered by the trading platform apart from backtesting-

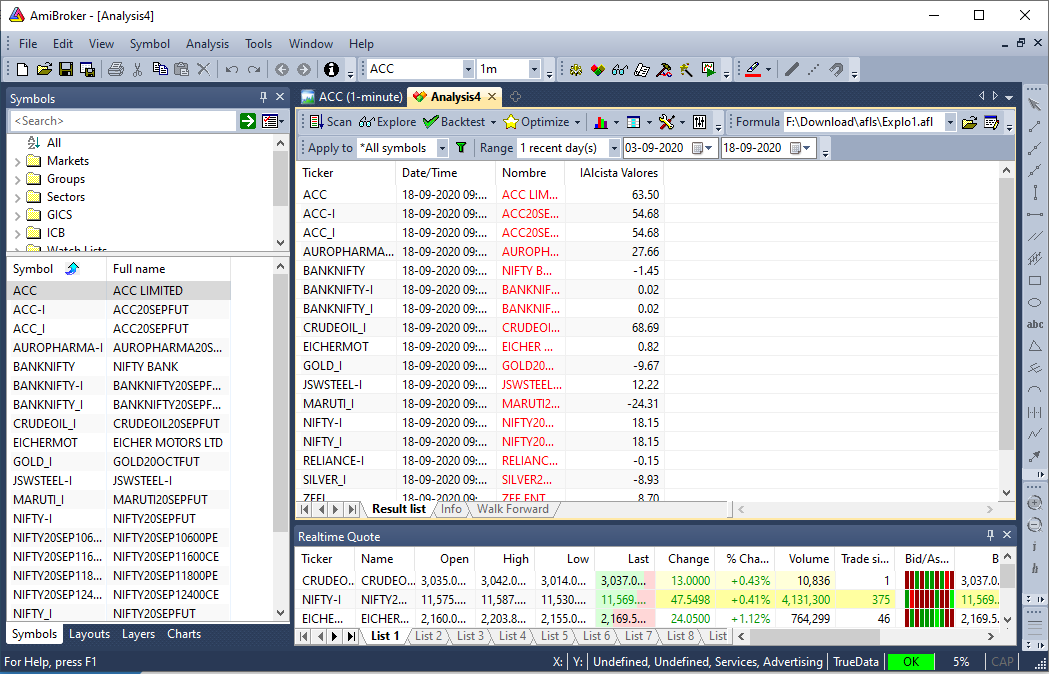

On the analysis window, you will be able to see almost everything, i.e. portfolio, walk-forward tests, optimization, backtests, explorations, Monte Carlo Simulation, and so on.

On the analysis window, you will be able to see almost everything, i.e. portfolio, walk-forward tests, optimization, backtests, explorations, Monte Carlo Simulation, and so on.

AmiBroker is a multi-purpose tool for data screening/mining that supplies programmable output with infinite rows and columns.

AmiBroker is a multi-purpose tool for data screening/mining that supplies programmable output with infinite rows and columns.

This feature of Charting in AmiBroker comes with several built-in indicators, multiple time frames (which can be used at your convenience), drag-and-drop indicators, customizable parameters, object-creating capabilities, etc. Sliders are good options for modifying parameters in real time and can also be customized in various styles and gradients.

It is ideal for confirming the robustness of the trading sample before and after optimization.

AmiBroker assigns different threads for each graphics renderer and each formula chart.

The code editor pairs up with parameter call tips, auto indenting, code folding, etc. Whenever you encounter an error, a meaningful message alerts you promptly.

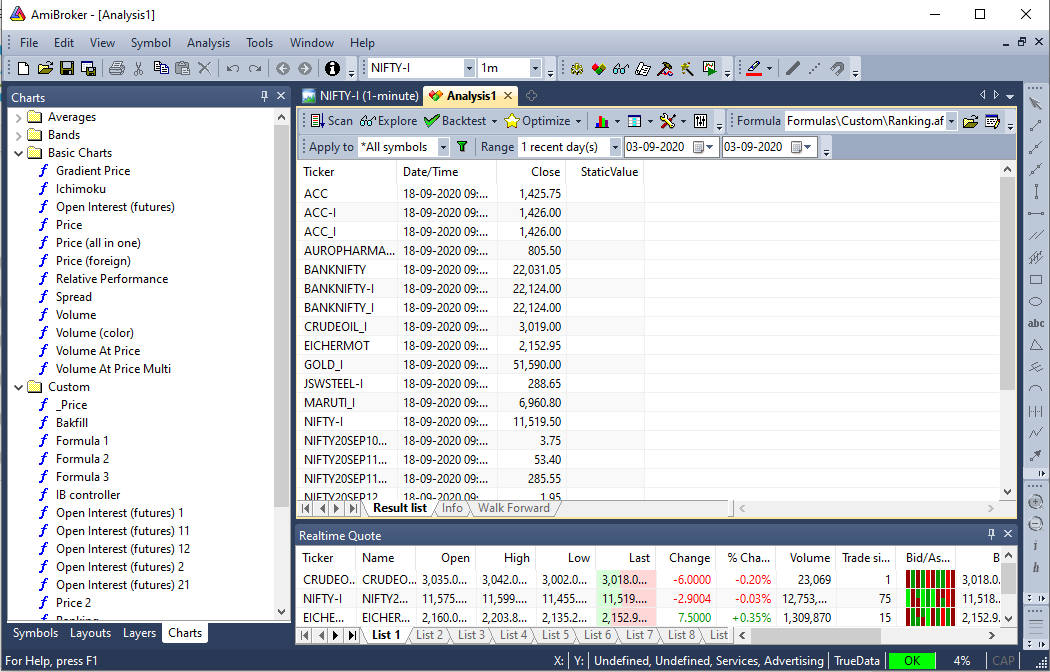

It is used to perform bar-by-bar ranking depending on the user score to find a suitable trade.

It is used to perform bar-by-bar ranking depending on the user score to find a suitable trade.

The most productive thing that can be done in the analysis window is to backtest the trading strategy on historical data. It helps you to gain insight into the strengths and weaknesses of the system before you begin to invest real money. Thus, AmiBroker is a feature that can help you to save lots of money.

The first thing that needs to be done is that you must have objective or mechanical rules to enter and exit the market. This step is necessary to create a base of your strategy and whether or not the system matches with risk tolerance, portfolio size, money management techniques, and several other factors. Once you have established rules for trading, you must write to them as buy and sell rules in AmiBroker Formula Language.

The first thing that needs to be done is that you must have objective or mechanical rules to enter and exit the market. This step is necessary to create a base of your strategy and whether or not the system matches with risk tolerance, portfolio size, money management techniques, and several other factors. Once you have established rules for trading, you must write to them as buy and sell rules in AmiBroker Formula Language.

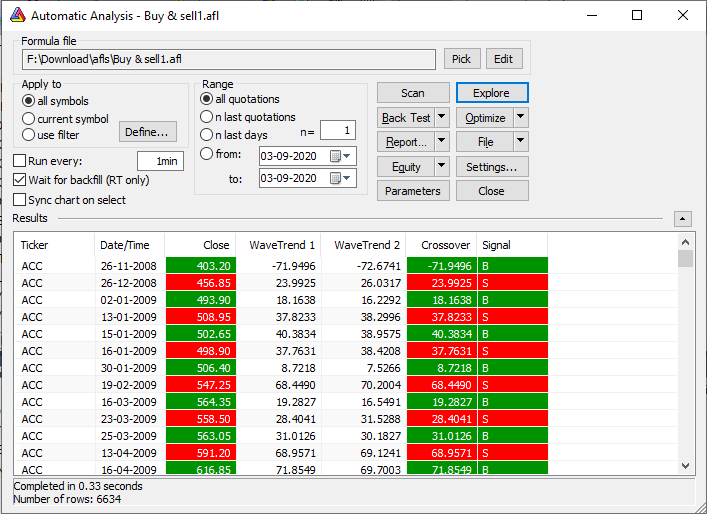

To Backtesting in AmiBroker, you need to click on the Backtest button in the Automatic analysis window. Ensure that you have typed the formulas which contain buy and sell trading rules. Once the correct formula is entered, AmiBroker starts to analyze symbols according to trading rules and generates a list of simulated trades. This process is rapid in terms that you can easily backtest thousands of symbols in a few minutes. There is a progress window that will show the estimated completion time. If you wish to stop the process at any given point in time, click on the Cancel option in the progress window.

To Backtesting in AmiBroker, you need to click on the Backtest button in the Automatic analysis window. Ensure that you have typed the formulas which contain buy and sell trading rules. Once the correct formula is entered, AmiBroker starts to analyze symbols according to trading rules and generates a list of simulated trades. This process is rapid in terms that you can easily backtest thousands of symbols in a few minutes. There is a progress window that will show the estimated completion time. If you wish to stop the process at any given point in time, click on the Cancel option in the progress window.

When the process is completed, you will be presented with a list of simulated trades in the bottom part of the Automatic analysis window aka the Results pane. Here, you can examine when the buy and sell signals occur only by double-clicking on the trade in the Results pane. Post this, you are presented with raw or unfiltered signals for each bar where buy and sell conditions are met. If you wish to see only a single trade arrow (opening and closing currently selected trade) you are required to double-click a line while holding the SHIFT key pressed down. The other option that you can choose is the kind of display by choosing the appropriate item from the context menu which appears once you click on the results pane with a right-click. In addition to the results, you will also be provided with detailed statistics on the performance of your system by choosing the Report option.

When the process is completed, you will be presented with a list of simulated trades in the bottom part of the Automatic analysis window aka the Results pane. Here, you can examine when the buy and sell signals occur only by double-clicking on the trade in the Results pane. Post this, you are presented with raw or unfiltered signals for each bar where buy and sell conditions are met. If you wish to see only a single trade arrow (opening and closing currently selected trade) you are required to double-click a line while holding the SHIFT key pressed down. The other option that you can choose is the kind of display by choosing the appropriate item from the context menu which appears once you click on the results pane with a right-click. In addition to the results, you will also be provided with detailed statistics on the performance of your system by choosing the Report option.

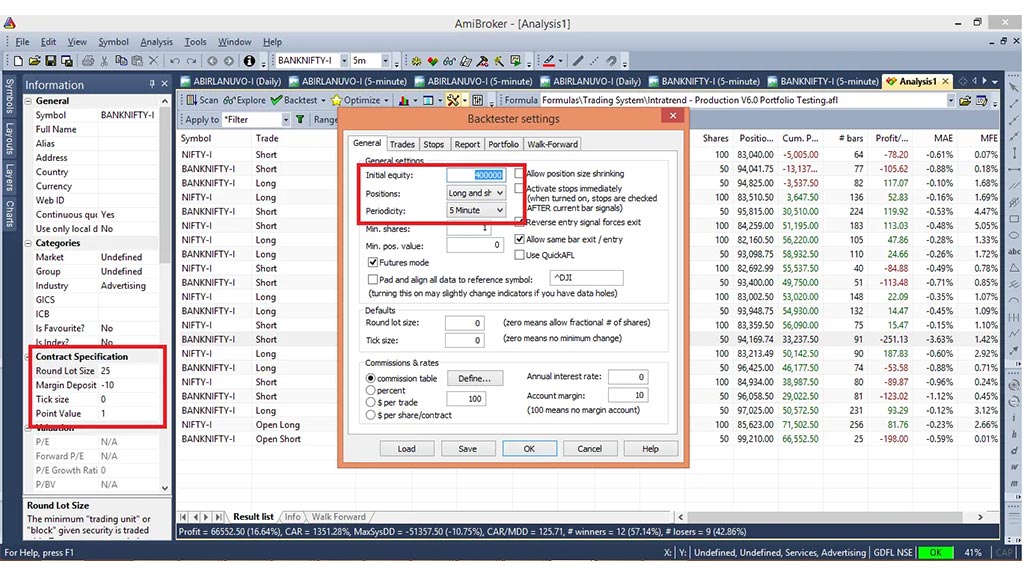

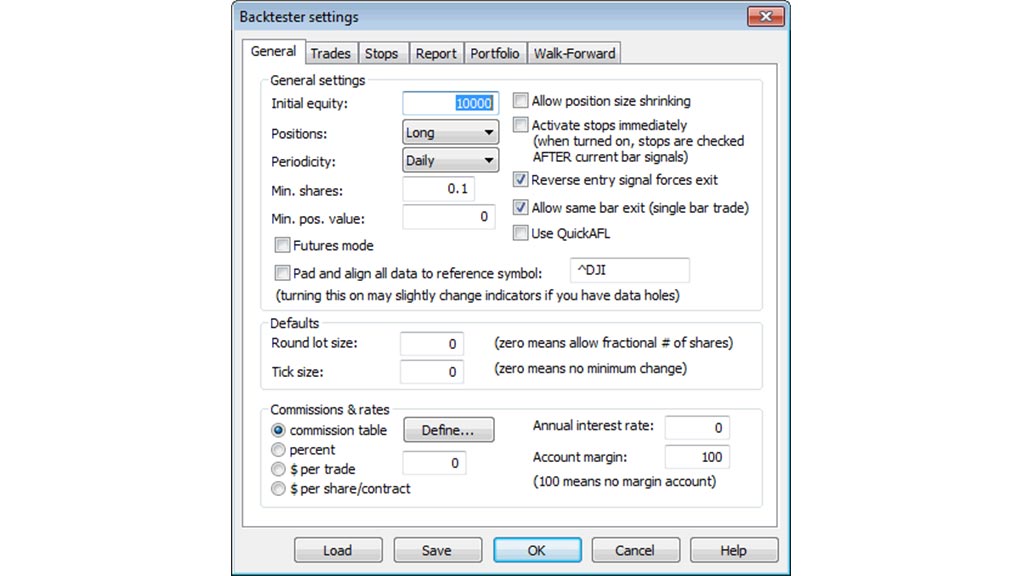

Backtesting in AmiBroker makes use of predefined values for performing its task including portfolio size, and periodicity, i.e. daily/weekly/monthly, amount of commission, type of trades, price fields, interest rates, and so on. These settings can be altered by the user settings window. Post changing the settings, you must remember to run your backtesting if you wish the results to be in sync with the settings.

Backtesting in AmiBroker makes use of predefined values for performing its task including portfolio size, and periodicity, i.e. daily/weekly/monthly, amount of commission, type of trades, price fields, interest rates, and so on. These settings can be altered by the user settings window. Post changing the settings, you must remember to run your backtesting if you wish the results to be in sync with the settings.

Until now, we have discussed fair simple use of backtesting. However, AmiBroker comes with a lot more sophisticated concepts and methods. We will be listing the newly introduced features of the back tester. There you go -

Ans. 1. Here is the list of following skills you may require to build an effective Algo Trading Solution using AmiBroker -

Ans. 2. Yes, you do need additional requirements to build an effective automated trading system infrastructure. Here are these additional requirements -

Ans. 3. You should have the following availabilities after taking your system live -

Ans. 4. Well, not technically disadvantages but yes, there are a few issues with AmiBroker that one must know -

AmiBroker is one of the best when it comes to coding, programming, and developing, however, it does not satisfy those who are from a non-technical background. One requires extensive training before using the analysis and charting tool. Even though AmiBroker has quite several features and tools, that make the trading process safe and satisfying. We are hoping that shortly AmiBroker will become popular among non-technical users as well. Till then, keep trading!

Introduction Lately, several traders have started using Range Bars for their tr...

Introduction Lately, several traders have started using Range Bars for their tr...

Do you still get daunted by the feeling of facing losses while trading in stock...