Do you still get daunted by the feeling of facing losses while trading in stock markets? Are you still confused about the technical terms during trading, like financial pages? Well, it's not just you. Starting out as a beginner in such a complex market is a really big deal. Or however much of a pro-trader you are, in the stock market there is always a vacant room to learn! To gain an edge over all other traders in the market, it's essential to have knowledge about back-testing, charting, and future analysis. However, learning all this from the beginning is not just a walk in the part. Hence, to help traders with the same there are lots of programs available in the market that make trading easier. One such tool is Amibroker, popularly known as the best trading decision-making software in the market. Read more about Amibroker software to explore whether it's the right tool for you to invest in. Moreover, we have explained all the advanced features of the tool in detail, don't miss that out!

Do you still get daunted by the feeling of facing losses while trading in stock markets? Are you still confused about the technical terms during trading, like financial pages? Well, it's not just you. Starting out as a beginner in such a complex market is a really big deal. Or however much of a pro-trader you are, in the stock market there is always a vacant room to learn! To gain an edge over all other traders in the market, it's essential to have knowledge about back-testing, charting, and future analysis. However, learning all this from the beginning is not just a walk in the part. Hence, to help traders with the same there are lots of programs available in the market that make trading easier. One such tool is Amibroker, popularly known as the best trading decision-making software in the market. Read more about Amibroker software to explore whether it's the right tool for you to invest in. Moreover, we have explained all the advanced features of the tool in detail, don't miss that out!

Amibroker is a professional, full-fledged, stock analysis charting software that helps traders to decide and analyze stocks before purchasing. The tool, also known as AB, performs technical analysis by its advanced features to help traders stay ahead of the pack. Some of the advanced features include back-testing, real-time charting, scanning, etc. We believe that all these features are best for traders who aspire to become pro-traders!

Amibroker is a professional, full-fledged, stock analysis charting software that helps traders to decide and analyze stocks before purchasing. The tool, also known as AB, performs technical analysis by its advanced features to help traders stay ahead of the pack. Some of the advanced features include back-testing, real-time charting, scanning, etc. We believe that all these features are best for traders who aspire to become pro-traders!

This best feature section is nothing but the breakdown of the main components of Amibroker!

One of the advanced features of Amibroker is its technical charts that are highly customizable. Users can set these charts according to the styles they wish to. One can even use sliders to modify all the parameters in real-time. All the charts have built-in indicators, drag and drop indicators, an object-oriented drawing tool, and different time frames. Through these charts, users can switch between different timescales during real-time trading.

One of the advanced features of Amibroker is its technical charts that are highly customizable. Users can set these charts according to the styles they wish to. One can even use sliders to modify all the parameters in real-time. All the charts have built-in indicators, drag and drop indicators, an object-oriented drawing tool, and different time frames. Through these charts, users can switch between different timescales during real-time trading.

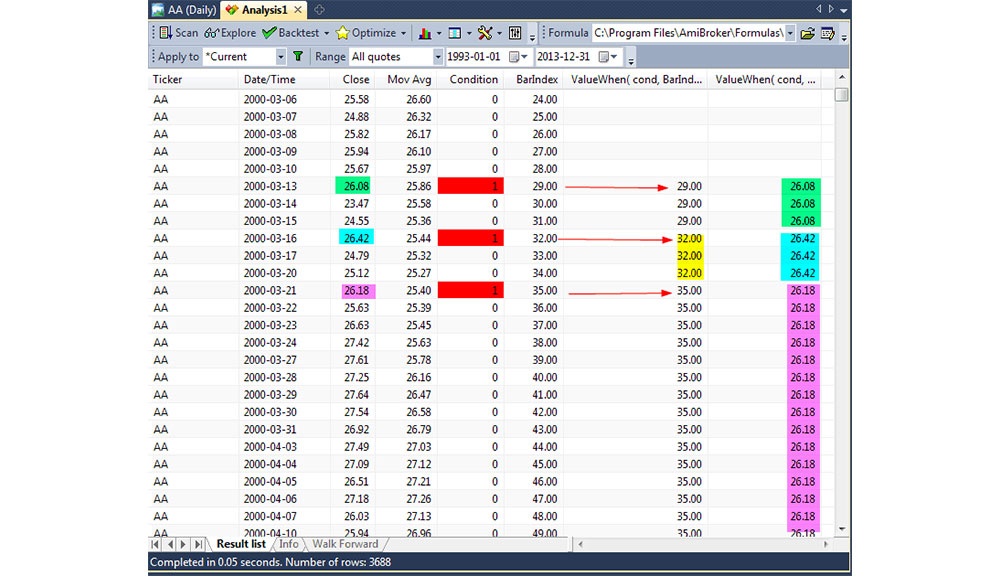

The analytical window of Amibroker allows users to scan and explore each aspect of the stock market. Users can easily screen stocks from these sections based on Buy, Sell, Short-term, and Cover conditions. The tool even offers generic filter conditions to explore high-return stocks.

The analytical window of Amibroker allows users to scan and explore each aspect of the stock market. Users can easily screen stocks from these sections based on Buy, Sell, Short-term, and Cover conditions. The tool even offers generic filter conditions to explore high-return stocks.

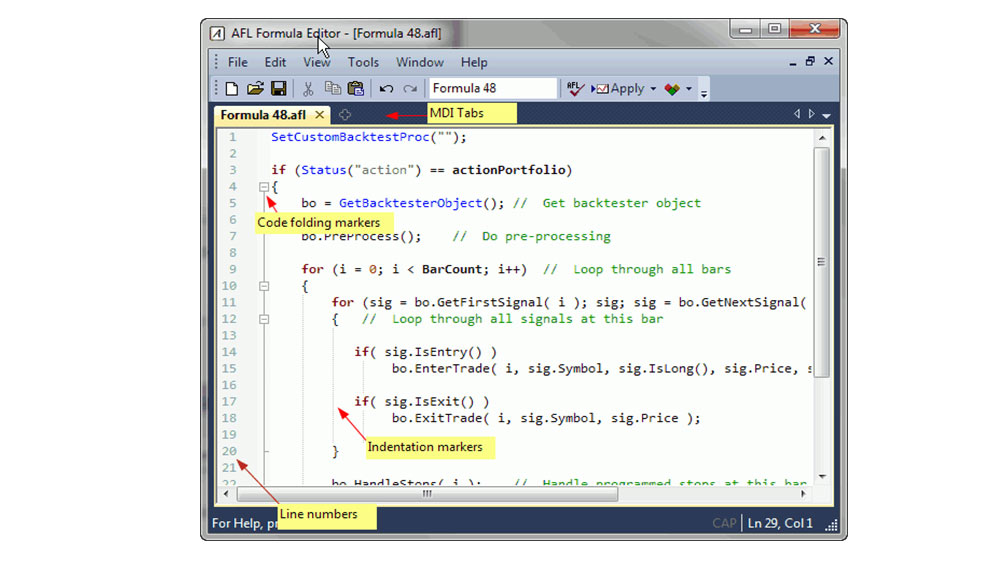

AFL by Amibroker makes the software an all-independent platform. Experienced traders can make quick decisions and come up with new formulas instantly. There is even a useful in-line syntax verifier that helps users to confirm their code before analyzing it. The drop-down list helps in speeding up the coding pace. Even a person from a non-programming background can avoid unwanted expenses by learning AFL from the start.

AFL by Amibroker makes the software an all-independent platform. Experienced traders can make quick decisions and come up with new formulas instantly. There is even a useful in-line syntax verifier that helps users to confirm their code before analyzing it. The drop-down list helps in speeding up the coding pace. Even a person from a non-programming background can avoid unwanted expenses by learning AFL from the start.

The symbol and quotes database by Amibroker contains numerous symbols and quotes, making the tool more resourceful. Users can even find historical information regarding the trading account in this database itself. Moreover, there's also an option of filtering the data based on different criteria.

The symbol and quotes database by Amibroker contains numerous symbols and quotes, making the tool more resourceful. Users can even find historical information regarding the trading account in this database itself. Moreover, there's also an option of filtering the data based on different criteria.

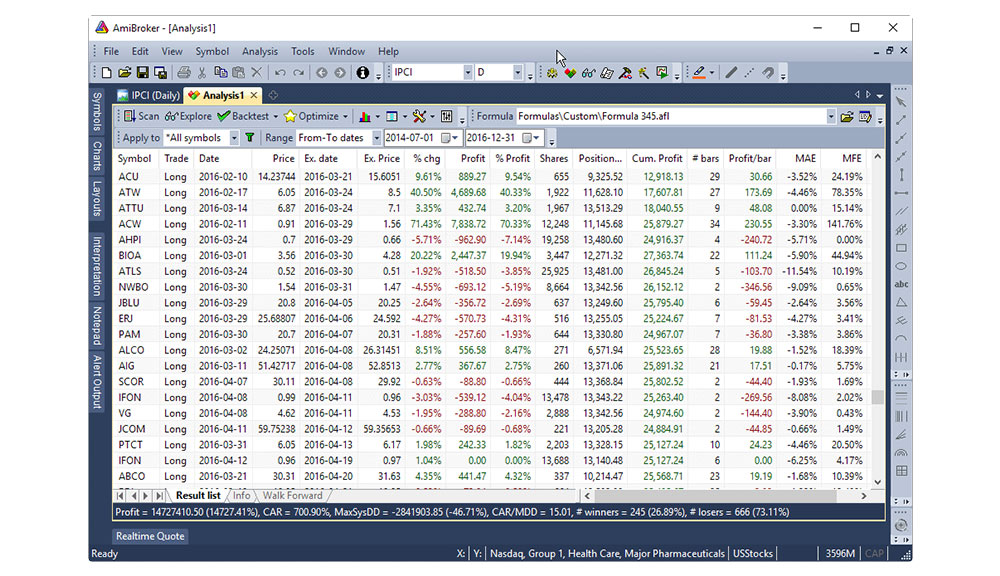

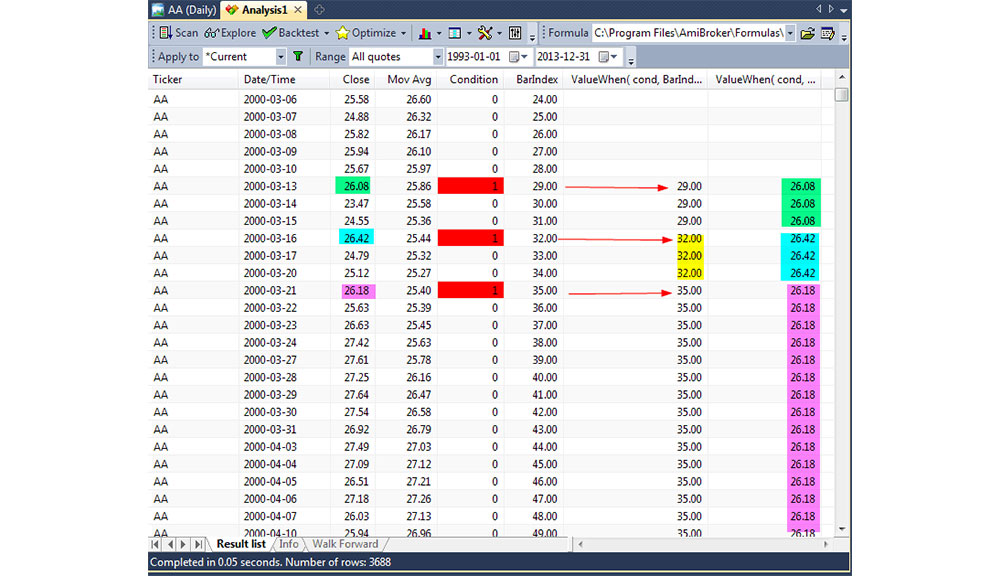

The analysis function is probably the best feature of Amibroker. Users can scan and back-test relatively faster as compared to all other competitor software. All the details thus obtained are listed on the excel table from where one can export the data to a spreadsheet. To get the best out of the software, one can even back-test various strategies. Hence, determining portfolio size and finding shares gets a lot easier. The screener available on the software helps users to identify potential trades, all based on their trading strategy. This feature is best for swing and end-of-day traders because they can quickly identify the shares to buy or sell. Yet another best feature is the parameter optimization feature whereby one can use their formula code to define as many parameters they want with different values. You just have to build up any strategy and then let the software find the best parameter combination for you! Lastly, the walk-forward testing feature helps users to predict different possible outcomes. The outcome hence obtained from here is completely based on a wider range of strategies.

The analysis function is probably the best feature of Amibroker. Users can scan and back-test relatively faster as compared to all other competitor software. All the details thus obtained are listed on the excel table from where one can export the data to a spreadsheet. To get the best out of the software, one can even back-test various strategies. Hence, determining portfolio size and finding shares gets a lot easier. The screener available on the software helps users to identify potential trades, all based on their trading strategy. This feature is best for swing and end-of-day traders because they can quickly identify the shares to buy or sell. Yet another best feature is the parameter optimization feature whereby one can use their formula code to define as many parameters they want with different values. You just have to build up any strategy and then let the software find the best parameter combination for you! Lastly, the walk-forward testing feature helps users to predict different possible outcomes. The outcome hence obtained from here is completely based on a wider range of strategies.

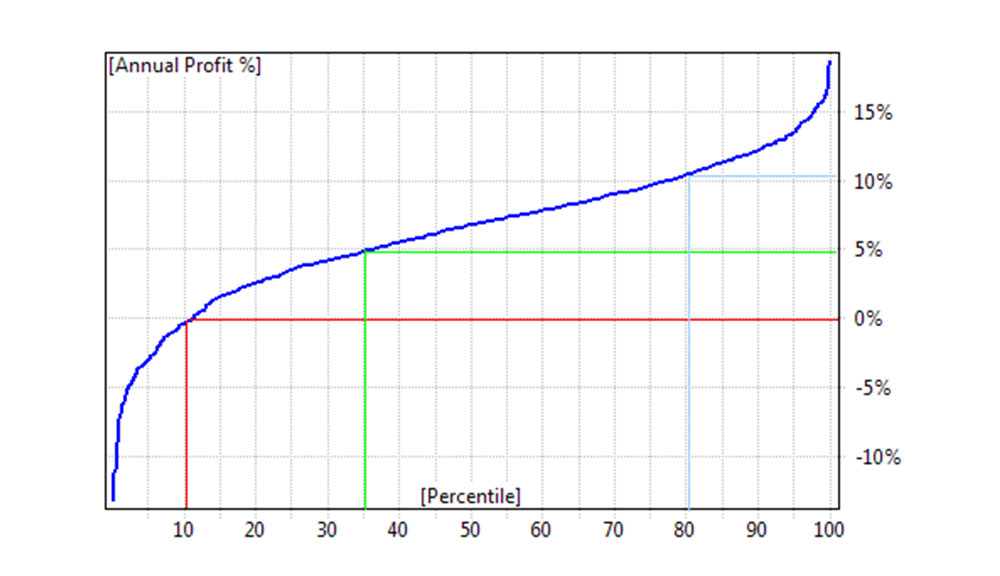

Monte Carlo simulation helps the users to analyze the probabilities of different stocks, despite the uncertainties in the market. This can help the user to understand the impact of risk as well as unpredictability in the forecasting models The simulation defines all the worst-case scenarios to you, which is quite difficult to predict, even in the case of expert traders.

Monte Carlo simulation helps the users to analyze the probabilities of different stocks, despite the uncertainties in the market. This can help the user to understand the impact of risk as well as unpredictability in the forecasting models The simulation defines all the worst-case scenarios to you, which is quite difficult to predict, even in the case of expert traders.

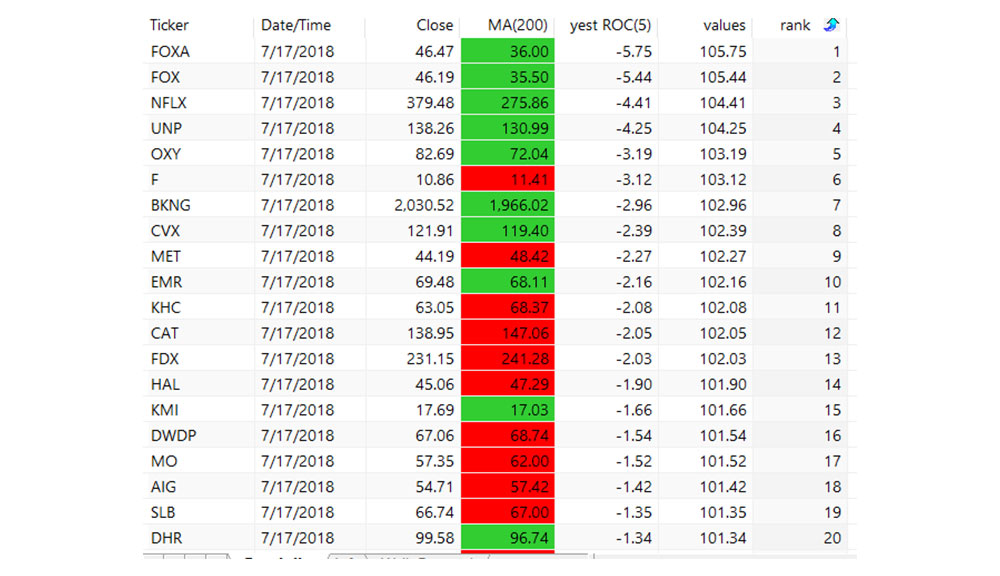

The ranking and scoring feature by Amibroker ranks and scores each stock on a bar basis. Hence, one can find suitable trade within minutes through this tool.

The ranking and scoring feature by Amibroker ranks and scores each stock on a bar basis. Hence, one can find suitable trade within minutes through this tool.

The built-in debugger scans all the bugs and debugs them beforehand. This feature is best for interactive traders. Through IB controller brokers can connect to all other brokers easily and work together.

The built-in debugger scans all the bugs and debugs them beforehand. This feature is best for interactive traders. Through IB controller brokers can connect to all other brokers easily and work together.

Amibroker offers an online support system where users can mention any queries they have related to the platform. The officials usually respond to these queries in 1-3 business days. The customer support team never fails to resolve any issues raised by customers!

Through the member's area section of Amibroker, users can directly interact with other traders and share information from just being on the site.

Amibroker offers three pricing plans to its users and a free trial period for 30 days. The one-time fee of the standard plan is just INR 19000. Through this package, the user will get access to one-minute charting intervals, plus they can only look at ten stocks in real-time. The one-time cost of the professional package is INR 23000, and it provides more advanced features as compared to the basic plan. With this plan, the user will get access to advanced features like intraday charging intervals, unlimited real-time data, and much more! The cost of the Ultimate Pro Pack is just INR 35000 and includes all the features of Amibroker Professional and the basic plan. All three packages by Amibroker come with 24 months of free upgrades and unlimited customer support.

Many users still argue that Amibroker is best suited for experienced traders, but the truth is a lot more different. Beginners can even use Amibroker but they have to invest more time into learning, and testing trading strategies. It's suggested to have some patience throughout the process, and a little bit of technical knowledge to use this software. If you are a Day-trader then Amibroker is the best tool for you because of the function-based scans. Even long-term traders can find this software beneficial because of its back-testing and walk-forward testing features. Thus, Amibroker is a flexible software that anyone can use over multiple timescales.

Many users still argue that Amibroker is best suited for experienced traders, but the truth is a lot more different. Beginners can even use Amibroker but they have to invest more time into learning, and testing trading strategies. It's suggested to have some patience throughout the process, and a little bit of technical knowledge to use this software. If you are a Day-trader then Amibroker is the best tool for you because of the function-based scans. Even long-term traders can find this software beneficial because of its back-testing and walk-forward testing features. Thus, Amibroker is a flexible software that anyone can use over multiple timescales.

MetaTrader has been a popular alternative to Amibroker used by several technical analysts and algorithmic traders over the years. Both the software have similar features but the approach is a bit different. Many traders still rely on Amibroker because it's an old tool. Also, Amibroker is a robust, lightweight software as compared to MetaTrader with a minimum learning curve.

MetaTrader has been a popular alternative to Amibroker used by several technical analysts and algorithmic traders over the years. Both the software have similar features but the approach is a bit different. Many traders still rely on Amibroker because it's an old tool. Also, Amibroker is a robust, lightweight software as compared to MetaTrader with a minimum learning curve.

MetaStock is yet another superior alternative to Amibroker. However, the price of this software is far more than Amibroker, and just offers limited access to features in the trial version. MetaStock formula language is relatively easier than AFL, but Amibroker’s backtest engine is faster and robust. Amibroker even has a more user-friendly interface, on the other hand, Metastock can only analyze Metastock formatted data.

MetaStock is yet another superior alternative to Amibroker. However, the price of this software is far more than Amibroker, and just offers limited access to features in the trial version. MetaStock formula language is relatively easier than AFL, but Amibroker’s backtest engine is faster and robust. Amibroker even has a more user-friendly interface, on the other hand, Metastock can only analyze Metastock formatted data.

Whether you are a beginner or a professional trader, Amibroker will help you get the safest trading experience to date. If you have a wealthy technical background, it would be an added benefit. However, if you aren't aware of how trading works there are a lot of self-help guides provided by the tool to its users.

Conclusively, there are several useful features of Amibroker which most competitor software lacks. These features separate Amibroker from other software available in the market. Simply by dissecting the software in the best way, you can grab a plethora of profits. Those investors who are looking for faster scanning using Amibroker for real-time as well as historic data can check out Truedata’s products. Our tools and plugins are designed to work with multiple technical analysis applications simultaneously. If you have been using Amibroker for quite a while now, do let us know your experience in the comments below! Happy Investing!

Introduction Lately, several traders have started using Range Bars for their tr...

Introduction Lately, several traders have started using Range Bars for their tr...

Backtesting in AmiBroker Before getting into any technicalities or know-how, we...