Lately, several traders have started using Range Bars for their trading systems rather than the standard candlestick charts. By migrating their trading systems from the standard time-based (1min, 5 min, etc..) candlestick charts to Range Bars, traders are looking to overcome the losses they encounter during sideways markets. The best part is that it is easily possible to Display and Work with these Range Bars in Amibroker.

Each range bar must:

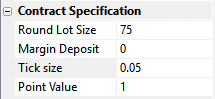

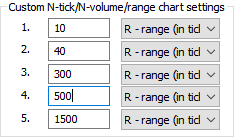

Amibroker fully supports Range Bar charting and the bar size is based on the Tick Size of a given symbol. This allows us to define symbol-specific tick sizes individually. You can then display a chart that, for example, shows 10R or 40R bars. 10R / 40R meaning bars using a range of 10-ticks / 40 ticks for each symbol respectively. To display range charts, you will need to follow the following steps:-

Specify the Tick Size

Specify the Tick Size

Range Bar Chart in Amibroker

Range Bar Chart in Amibroker... that for best results, your database should use Tick as Base Time Interval. This will ensure that each trade is represented by an individual record in the database and can be consistently compressed to range bars. Using higher-interval data (such as 1 minute) may produce bars that are not perfect. This is especially so if, for a 1-minute bar, the high-low difference is comparable with the selected range.

Do you still get daunted by the feeling of facing losses while trading in stock...

Do you still get daunted by the feeling of facing losses while trading in stock...

Backtesting in AmiBroker Before getting into any technicalities or know-how, we...