The defence sector in India holds significant strategic importance, given India's possession of one of the world's largest military forces, boasting more than 1.44 million active personnel and an unparalleled volunteer military force with over 5.1 million personnel. In recent years, India has also achieved the once-seen impossible task of being a prominent exporter of defence equipment which has increased by over 10 times from 2016-17 to 2022-23. This will be seen as a huge boost for defence stocks in India. The list of dominant stocks in the defence sector is mentioned here which can help you benefit from the boom in this sector and help you invest better.

The defence sector in India holds significant strategic importance, given India's possession of one of the world's largest military forces, boasting more than 1.44 million active personnel and an unparalleled volunteer military force with over 5.1 million personnel. In recent years, India has also achieved the once-seen impossible task of being a prominent exporter of defence equipment which has increased by over 10 times from 2016-17 to 2022-23. This will be seen as a huge boost for defence stocks in India. The list of dominant stocks in the defence sector is mentioned here which can help you benefit from the boom in this sector and help you invest better.

Some of the top stocks in the defence sector in terms of market capitalisation are mentioned below.

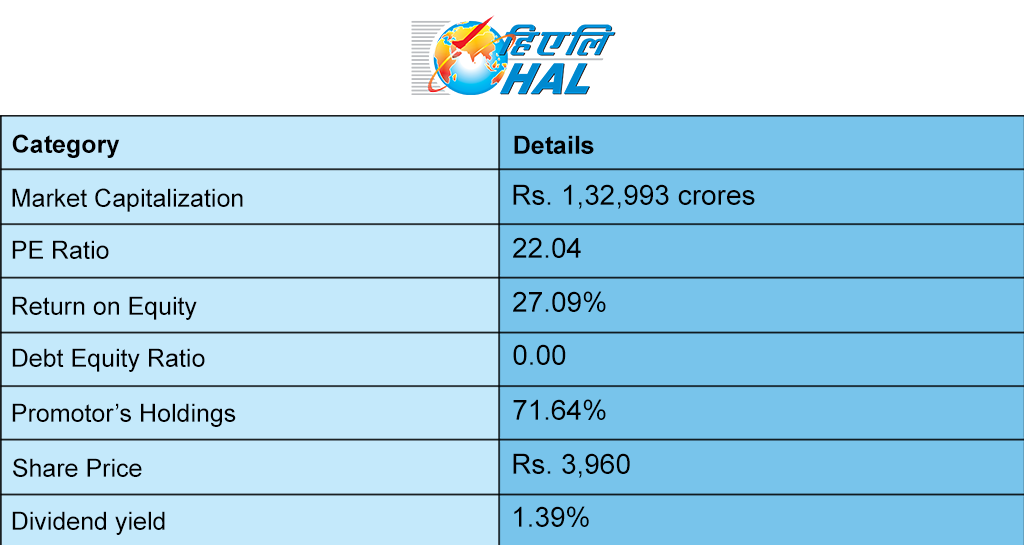

HAL (Hindustan Aeronautics Limited) is a leading name in the defence sector in India and is also responsible for the famous ‘Tejas’ aircraft. This is a public sector company, established in 1963 and is based in Bangalore. The company operates in many sectors other than the defence sector like space, civil industries and more. The financials of the company are as below. Figures as of September 14, 2023  The trailing returns of HAL are,

The trailing returns of HAL are,

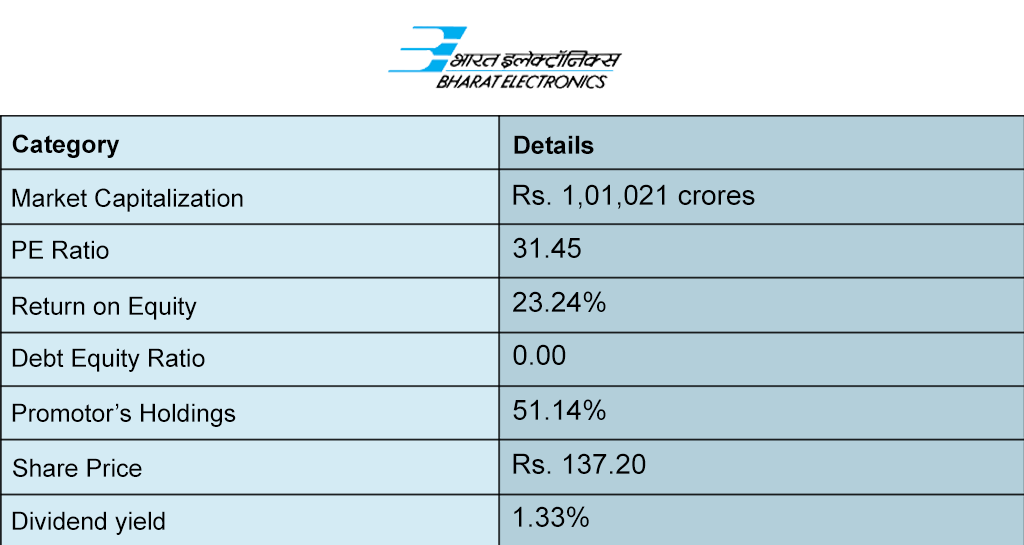

Founded in 1954, Bharat Electronics Limited (BEL) was established in collaboration with CSF, France, which is now known as Thales. Its primary mission was to cater to the specialised electronic equipment needs of the Indian Defense Services. As an Indian state-owned company in the aerospace and defence sector, BEL operates through approximately nine production facilities across the country, complemented by several regional offices strategically positioned throughout India. The financials of the company are as below. Figures as of September 14, 2023  The trailing returns of BEL are,

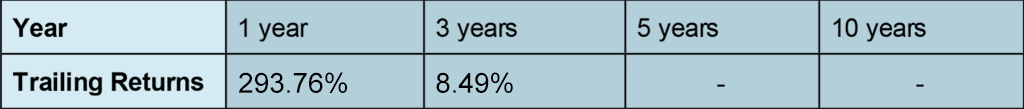

The trailing returns of BEL are,  Bharat Forge This company manufactures and sells forged machine components in the domestic and international markets. Bharat Forge specialises in the production and distribution of forged and machined components intended for use in both the automotive and industrial sectors. The company was incorporated in 1961 and is headquartered in Pune. The financials of the company are as below. Figures as of September 14, 2023

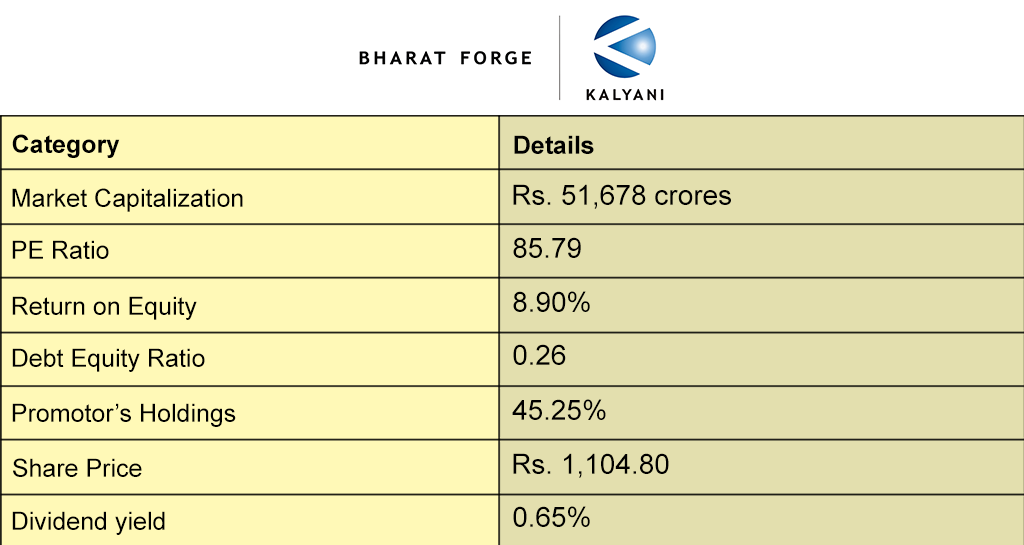

Bharat Forge This company manufactures and sells forged machine components in the domestic and international markets. Bharat Forge specialises in the production and distribution of forged and machined components intended for use in both the automotive and industrial sectors. The company was incorporated in 1961 and is headquartered in Pune. The financials of the company are as below. Figures as of September 14, 2023  The trailing returns of Bharat Forge are,

The trailing returns of Bharat Forge are,

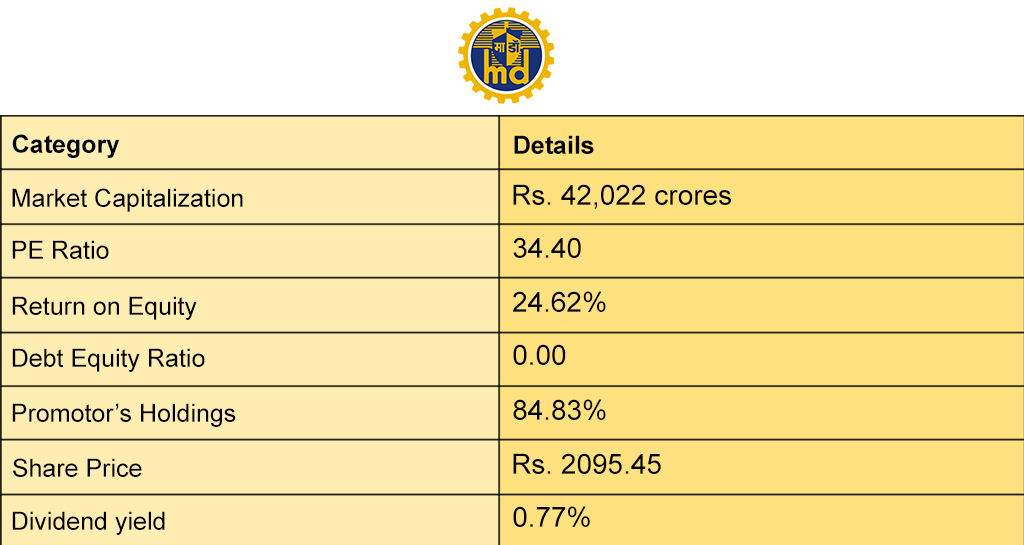

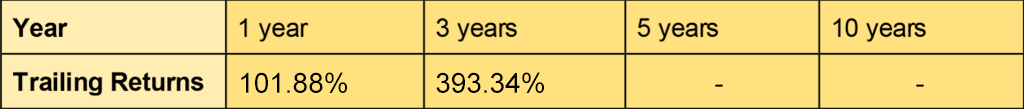

Mazagon Dock Shipbuilders Limited (MDL), located in Mumbai and with its inception dating back to 1774, stands as a prominent shipyard within India. Starting as a modest dry dock, MDL has transformed into a distinguished shipbuilding enterprise. Over the years, MDL has successfully crafted a total of 801 vessels since 1960, encompassing a diverse range including warships, submarines, cargo/passenger ships, and offshore platforms. The financials of the company are as below. Figures as of September 14, 2023  The trailing returns of Mazgaon Dock Shipyard are,

The trailing returns of Mazgaon Dock Shipyard are,

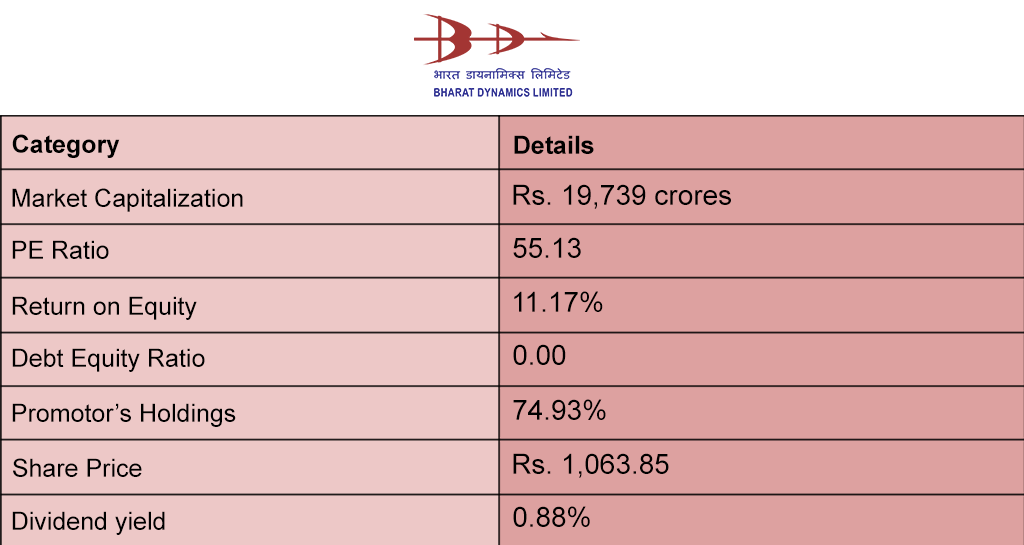

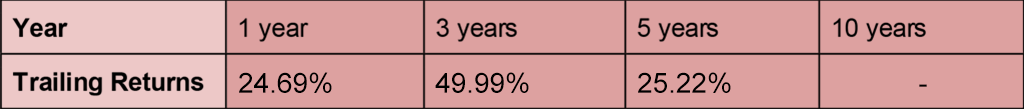

Bharat Dynamics is actively involved in the production and marketing of guided missiles and related equipment within India. The company supplies its products to the Indian armed forces and the Government of India while also holding a prominent position as a key exporter. Established in the year 1970, the company's headquarters are located in Hyderabad, India. The financials of the company are as below. Figures as of September 14, 2023  The trailing returns of Bharat Dynamics are,

The trailing returns of Bharat Dynamics are,

The defence sector boom in India is being talked about a lot especially in the wake of the prestigious G20 meetings being held in the country. Some of the prime reasons that make investing in the defence sector attractive are mentioned below.

India has established crucial partnerships and collaborations in the defence sector with countries like the US, Russia, France, Israel, Japan, Australia, and NATO. These agreements grant India access to advanced technologies and enhance its defence capabilities and interoperability. For instance, the Basic Exchange and Cooperation Agreement (BECA) with the US enables India to utilise US geospatial intelligence, improving weapon accuracy and automation. India and Russia are jointly producing over 200 Ka-226T helicopters under the Make in India initiative.

India is venturing into new defence domains such as space, cyber, artificial intelligence, robotics, biotechnology, nanotechnology, and quantum computing. These areas offer substantial opportunities for innovation, research, development, and investment. Initiatives like the Defence Space Agency (DSA) and Cyber Defence Agency (CDA) strengthen India's capabilities in space and cyber defence. Various projects and challenges, like the Defence Artificial Intelligence Project Agency (DAIPA) and iDEX-AIM Grand Challenge, promote AI in defence.

India provides incentives like tax exemptions, subsidies, grants, loans, offsets, and preferential market access to defence sector investors. For example, a 100% tax exemption for ten years is offered to units manufacturing defence equipment in Special Economic Zones (SEZs). A capital subsidy of up to 25% for ten years is available for units in Defence Industrial Corridors. A new offset policy permits foreign vendors to fulfil obligations through direct purchases from Indian entities.

India boasts a substantial and expanding defence market, with a significant budget of ?5.6 trillion (approximately US$70 billion in 2023). It ranks as the world's third-largest military spender after the USA and China.

The Indian defence industry is robust, with 80% government ownership. Key entities include DRDO with its 50 labs, four defence shipyards, and 12 defence PSUs. The government is actively promoting domestic manufacturing to reduce imports.

India aims to achieve a turnover of ?1.75 lakh crore in aerospace and defence manufacturing by 2025, with exports targeted at ?35,000 crore. In FY 2022-2023, India's defence exports reached an all-time high of ?15,920 crore.

India welcomes defence investments, with FDI in the sector now allowed up to 74% through the automatic route and 100% via government approval. The government has identified 310 defence equipment items for local production and established dedicated Defense Industrial Corridors in Tamil Nadu and Uttar Pradesh.

India boasts a vibrant innovation ecosystem for defence technology, supporting MSMEs and startups through initiatives like iDEX and DTIS. The DRDO's Technology Development Fund (TDF) has allocated $30.8 million to 164 technologies, engaging 1886 experts and 5270 companies in the indigenization of cutting-edge defence technologies.

The defence sector is one of the strongest pillars of our economy and with the growing importance of this sector in recent years in terms of exports, the future of this sector seems quite bright. Investors, however, have to focus on the core fundamentals of the company and compare it to the industry standards for effective evaluation of the stocks for investment purposes. This article talks about the top defence stocks in terms of market capitalisation and their core financials. Let us know if you want more details about these stocks or the sector in general. Watch out this space for similar information on top stocks in various sectors and their core analysis. Till then Happy Reading!

Introduction For the longest time, investment in stock markets was thought to b...

Process of Selecting Top Stocks for Investing The first step towards picking a ...

Like starting any new venture, the first step in stock investments is knowing t...