India once known as the land of snake charmers is now known as the land of innovation and for its state-of-the-art digital infrastructure. This has given rise to many new startups in various sectors and new-age entrepreneurs. But what is the one pain point of any startup? The constant need for funds to survive and grow till they can stand on their own feet. A stark difference to this scenario is the companies with deep pockets. These are cash-rich companies that do not have to worry about capital or liquidity at all! So what are these companies known as and how to find them? Check out this blog to know all about cash cow companies and why investing in these giants is good for your investment portfolio.

Read More: Is Assessing Management Quality Important while Buying Stocks?

The term cash cow may sound too rudimentary for a business but it is an important feature in identifying the potential of a company. It is a term to describe a business, a unit or a product that has the ability to generate a steady flow of cash. This term is used under the BCG growth-share matrix. This matrix is used to categorise a company’s business unit into four quadrants stars, question marks, dogs, and cash cows.

A cash cow is typically a company with a large market share in a mature industry. It might not be experiencing significant growth, but it continues to generate substantial profits due to its established position and loyal customer base. These profits can be used to support other business units or invest in new opportunities. Cash cow companies are considered stable and reliable in terms of cash flow which can be ‘milked’ for cash to contribute towards the overall financial health of the company.

Identifying cash-cow or cash-rich companies involves looking for a few key factors that represent the strong characteristics of cash-cow companies in general. Here are a few features of cash-cow companies that can help investors identify them or differentiate them from their peers.

Investors should look for companies that have achieved a dominant market share in their respective industries. Cash cow companies often operate in mature markets where competition has more or less stabilised. Investors should analyze the company's position relative to its competitors and assess whether it holds a strong and unchallenged market position.

When evaluating a potential cash cow company, it is crucial to conduct a thorough analysis of key financial ratios and performance metrics. Investors should analyze relevant financial ratios and performance metrics such as return on equity (ROE), return on assets (ROA), and profit margins. These metrics collectively paint a picture of the company's financial health, efficiency, and profitability, all of which are essential attributes for a cash cow. Investors should look for consistently positive and above-average values in these ratios, reflecting the company's ability to generate substantial returns with minimal resource utilisation, reinforcing its status as a reliable source of cash flow.

One key characteristic of a cash cow company is its ability to generate consistent and positive cash flow. Therefore, investors should review the financial statements of the company over the past several years to identify a pattern of strong cash generation. Consistent cash flow is a sign that the company has a mature and well-established product or service with a reliable customer base and can rely on this cash flow for its future investments and consistent profitability.

Another important factor to consider is the industry's maturity and the regulatory environment in which the company operates. Cash cow companies are typically found in mature industries with stable regulations. A company operating in a regulated environment may indicate a level of stability, reducing the likelihood of disruptive changes that could impact its cash cow status.

Cash cows are typically associated with well-known brands and high customer loyalty. They usually have a strong product that is developed and refined after years of thorough research and development and understanding their customers to cater to their needs. Investors should, therefore, evaluate the strength of the company's brand recognition and customer retention strategies. A strong brand and loyal customer base contribute to stable revenues, as consumers continue to choose the company's products or services over competitors.

Cash cows are characterised by low capital expenditure needs because their products or services are well-established, and little investment is required for innovation or expansion. Investors should examine the company's capital expenditure trends to ensure they align with the characteristics of a cash cow, reflecting minimal reinvestment needs for ongoing operations.

Having a cash cow company in your investment portfolio can help boost its overall profitability in more than one way. Here are some of the key benefits or factors highlighting the importance of a cash cow company in your investment portfolio.

Stable and Predictable Returns - Investing in cash cow companies provides investors with stable and predictable returns due to their established market position and consistent cash flow, offering a reliable income stream for future planning.

Dividend Income - Cash cow companies often distribute surplus cash to shareholders in the form of dividends, allowing investors to benefit from regular dividend payments and providing a steady income stream. This is particularly appealing for risk-averse investors looking for stable and low-risk income, including retirees relying on passive income.

Risk Mitigation - Cash cows, operating in mature markets with loyal customer bases, face lower business risks compared to high-growth industries. Their market leadership and stability help mitigate risks associated with economic downturns or industry disruptions, making them a prudent choice for conservative investors seeking capital protection.

Portfolio Diversification - Including cash cow companies in an investment portfolio contributes to diversification, balancing the potential volatility and risk associated with high-growth stocks. Cash cows offer stability and resilience, creating a diversified portfolio that aligns with a balanced risk-return profile.

Long-Term Value Preservation - Cash cows have a proven track record of longevity and value preservation, making them suitable for investors with a long-term strategy. Their resilience to market cycles contributes to sustainable wealth preservation over time.

We have discussed above the importance of cash-cow companies in an investment portfolio. However, it is also necessary to understand their shortcomings to have a sound investment portfolio that aligns with the investment strategy and goals. Here is a list of a few limitations of investing in cash-cow companies for a better understanding of the concept.

Some of the top cash-cow companies from the Indian stock markets and their details are mentioned below.

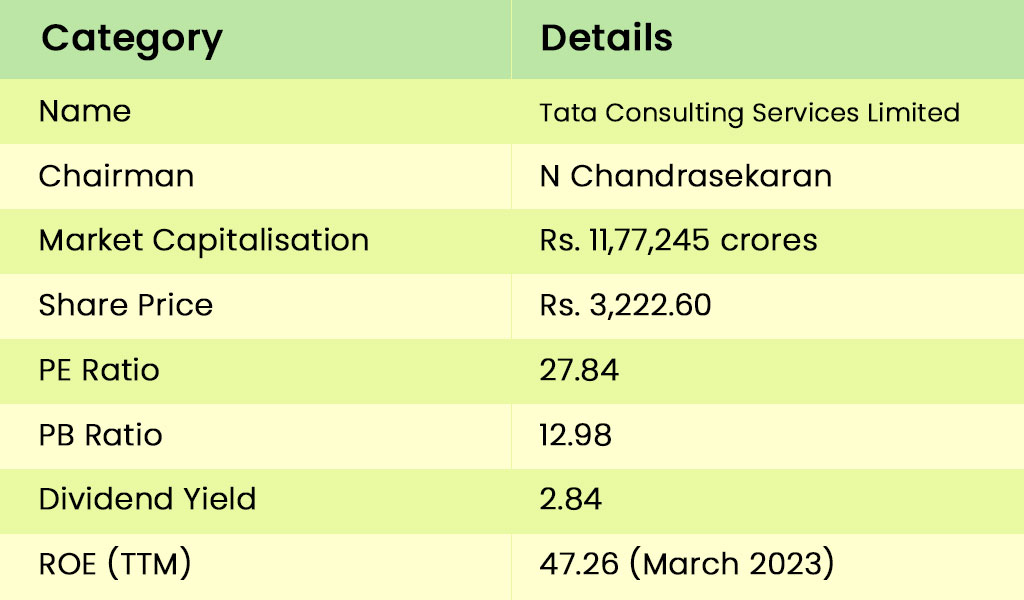

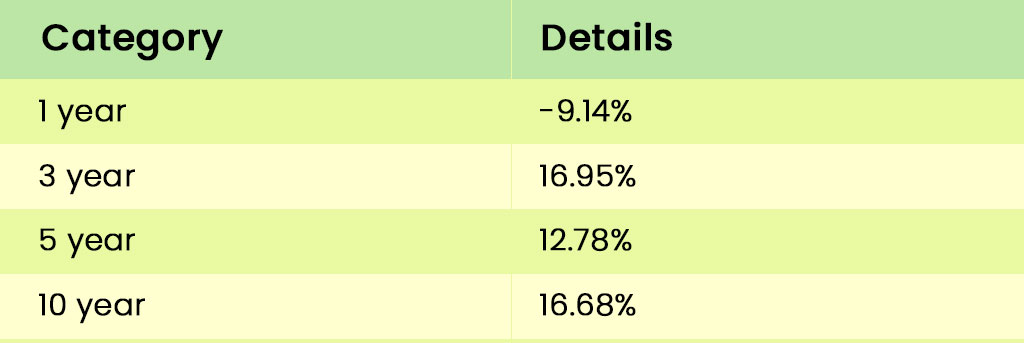

Tata Consultancy Services (TCS) serves as the leading company within the Tata Group, boasting over 50 years of expertise in IT services, consulting, and business solutions. It has been a key partner for major global businesses, guiding them through transformational journeys. TCS provides a comprehensive portfolio of services, including consulting, technology, and engineering solutions, leveraging a consulting-driven and cognitive-powered approach.

The key details of this company as of 18th January 2024 are tabled below.

The trailing returns of TCS are,

Infosys Ltd is a prominent player in the IT industry, offering consulting, technology, outsourcing, and advanced digital services to assist clients in implementing digital transformation strategies. As the second-largest Information Technology company in India, it plays a significant role in the sector, supporting businesses in navigating the evolving landscape of technology and innovation.

The key details of this company as of 18th January 2024 are tabled below.

The trailing returns of Infosys are,

Hindustan Unilever is one of the blue-chip companies in India and is in the Fast-Moving Consumer Goods (FMCG) sector, focusing on Home Care, Beauty & Personal Care, and Foods & Refreshment segments. With manufacturing facilities throughout India, the company primarily sells its products within the country.

The key details of this company as of 18th January 2024 are tabled below.

The trailing returns of Hindustan Unilever are,

Founded in the year 1910, ITC has emerged as the leading cigarette manufacturer and distributor in the nation. The company has diversified its operations across five distinct business segments, including FMCG Cigarettes, FMCG Others, Hotels, Paperboards, Paper and Packaging, and Agri Business. This multifaceted approach positions ITC as a significant player not only in the tobacco industry but also in broader segments, contributing to its prominence in the Indian business landscape.

The key details of this company as of 18th January 2024 are tabled below.

The trailing returns of ITC are,

Adani Ports & Special Economic Zone is actively involved in the comprehensive spectrum of port infrastructure development, encompassing the planning, operations, and maintenance aspects. The company's primary focus lies in the provision of port services and the concurrent development of related infrastructure. Notably, Adani Ports & Special Economic Zone has strategically integrated a multi-product Special Economic Zone (SEZ) closely associated with the port operations at Mundra. This entails the creation and management of a contiguous zone, further enhancing the synergy between the port and the SEZ.

The key details of this company as of 18th January 2024 are tabled below.

The trailing returns of Adani Ports are,

Cash-cow companies are companies that have a river of stable and continuously flowing cash flows to nurture the business and help it stay ahead of its competition even in tough markets. Investing in such companies can provide overall stability to the investment portfolio as well as act as a good source of passive income for investors.

This article was a small window into the meaning and importance of cash-cow companies. Let us know if you need more information on this topic or any similar one and we will take it up in our coming blogs.

Till then Happy Reading!

Did you know more than 5000 companies are listed on theBSE and about 2000 on the...

If you are a shareholder of a company, you would have seen its annual reports co...

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...