The recent budget has allocated the highest-ever proportion in the budget towards capex. This includes creating long-term assets for the nation and giving it a push toward the target of becoming a US$ 5 trillion economy in the coming 25 years. The government of India has introduced many schemes and initiatives that have infused greater confidence in the bright future of the economy and created a strong buzz for the Indian infrastructure sector stocks not only within the country but also globally. Given below are the details of the Indian infrastructure sector and the top stocks in terms of market capitalisation.

The recent budget has allocated the highest-ever proportion in the budget towards capex. This includes creating long-term assets for the nation and giving it a push toward the target of becoming a US$ 5 trillion economy in the coming 25 years. The government of India has introduced many schemes and initiatives that have infused greater confidence in the bright future of the economy and created a strong buzz for the Indian infrastructure sector stocks not only within the country but also globally. Given below are the details of the Indian infrastructure sector and the top stocks in terms of market capitalisation.

Infrastructure development is the key element or ingredient in the success of a nation. The seamless connectivity and strategic assets contribute largely to the smooth flow of operations and also attract foreign investment in the country. Many decades ago, US President Mr. John F Kennady said that America is successful as they have better facilities and better infrastructure to support their industries and ultimately the progress of the nation. This is the golden truth and taking a cue from the same, the Indian government has been pushing for infrastructure development in the nation since many past budgets. The Union Budget of 2023-24 also reflected the same and had an allocation of Rs. 10 lakh crores towards infrastructure development in the country. This allocation is a steep rise of 33% and approximately 3 times the outlay in 2019-20. This includes developing strategic assets like ports, airports, national highways, state highways, dams, power projects, roads, etc. The government has also included urban developmental projects, housing projects, sanitation, etc.

Infrastructure development is the key element or ingredient in the success of a nation. The seamless connectivity and strategic assets contribute largely to the smooth flow of operations and also attract foreign investment in the country. Many decades ago, US President Mr. John F Kennady said that America is successful as they have better facilities and better infrastructure to support their industries and ultimately the progress of the nation. This is the golden truth and taking a cue from the same, the Indian government has been pushing for infrastructure development in the nation since many past budgets. The Union Budget of 2023-24 also reflected the same and had an allocation of Rs. 10 lakh crores towards infrastructure development in the country. This allocation is a steep rise of 33% and approximately 3 times the outlay in 2019-20. This includes developing strategic assets like ports, airports, national highways, state highways, dams, power projects, roads, etc. The government has also included urban developmental projects, housing projects, sanitation, etc.

The overall infrastructure capex in the country is expected to grow at a CAGR of 11.4% in the period of FY 21- FY 26. From April 2000 to December 2021, the infrastructure sector in the country grew at a CAGR of 7%. The government has introduced many initiatives like the PLI Scheme, National Infrastructure Pipeline (NIP), PM Awas Yojana, development of smart cities, etc.

The overall infrastructure capex in the country is expected to grow at a CAGR of 11.4% in the period of FY 21- FY 26. From April 2000 to December 2021, the infrastructure sector in the country grew at a CAGR of 7%. The government has introduced many initiatives like the PLI Scheme, National Infrastructure Pipeline (NIP), PM Awas Yojana, development of smart cities, etc.

As part of the groundwork for Amrit Kaal, there have been significant investments in the infrastructure sector. This includes the FDI in this sector as well as the initiatives taken by the government to boost the capex. The government has proposed an investment of US$ 750 billion in railway infrastructure over a period from 2018-2030. The current budget allocation towards Railways was to the tune of Rs. 2.4 lakh cores which is the highest ever since 2013-14. The government has also recognised the need for proper housing which is essential for an average citizen. The government had therefore initiated the PM Awas Yojana Scheme to fulfill this need and has been allotting significant funds in this direction. The in this regard. The current investment in the PM Awas Yojana Scheme is increased by 66% to Rs. 79,000 crores.

As part of the groundwork for Amrit Kaal, there have been significant investments in the infrastructure sector. This includes the FDI in this sector as well as the initiatives taken by the government to boost the capex. The government has proposed an investment of US$ 750 billion in railway infrastructure over a period from 2018-2030. The current budget allocation towards Railways was to the tune of Rs. 2.4 lakh cores which is the highest ever since 2013-14. The government has also recognised the need for proper housing which is essential for an average citizen. The government had therefore initiated the PM Awas Yojana Scheme to fulfill this need and has been allotting significant funds in this direction. The in this regard. The current investment in the PM Awas Yojana Scheme is increased by 66% to Rs. 79,000 crores.

The push for infrastructure development will help the country to gain strategic benefits through its ports and airports as well as critical infrastructure projects. This will also lead to increased demand for many sectors like cement and steel. The government has also identified 100 critical transport infrastructure projects, for last and first-mile connectivity for ports, coal, steel, fertilizer, and food grains sectors. They will be taken up on priority with an investment of Rs. 75,000 crores which will also have private participation of approximately Rs. 15,000 crores. The past budgets have set the trend of spending on infrastructure and the government had set a target investment of approximately US$ 1.4 trillion on infrastructure during 2019-23. This investment is instrumental in having sustainable development in the country and ensuring that the country will reap the benefits from these investments in the coming decades.

The push for infrastructure development will help the country to gain strategic benefits through its ports and airports as well as critical infrastructure projects. This will also lead to increased demand for many sectors like cement and steel. The government has also identified 100 critical transport infrastructure projects, for last and first-mile connectivity for ports, coal, steel, fertilizer, and food grains sectors. They will be taken up on priority with an investment of Rs. 75,000 crores which will also have private participation of approximately Rs. 15,000 crores. The past budgets have set the trend of spending on infrastructure and the government had set a target investment of approximately US$ 1.4 trillion on infrastructure during 2019-23. This investment is instrumental in having sustainable development in the country and ensuring that the country will reap the benefits from these investments in the coming decades.

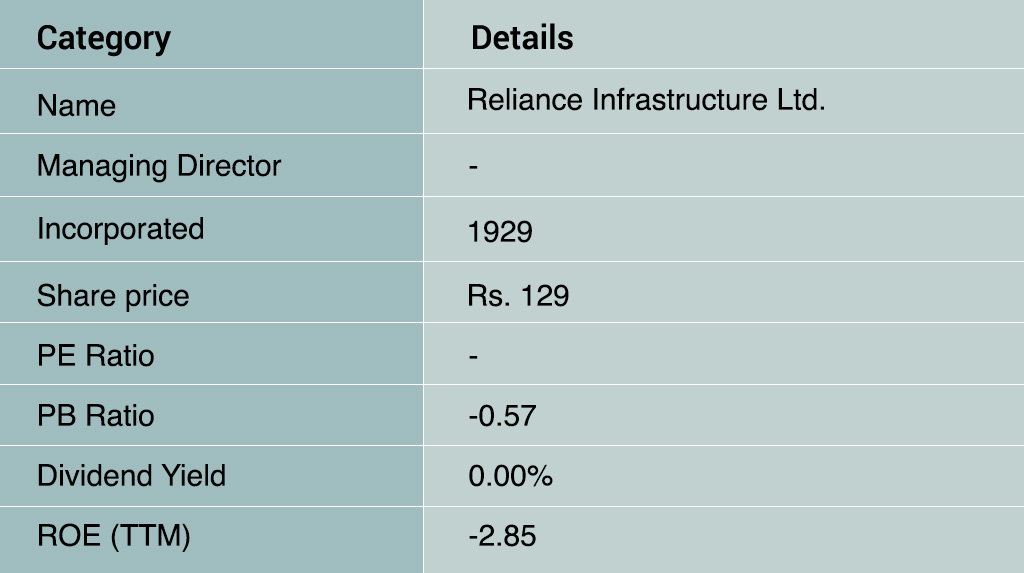

Some of the top stocks in the infrastructure segment in terms of market capitalisation and their details are tabled below.

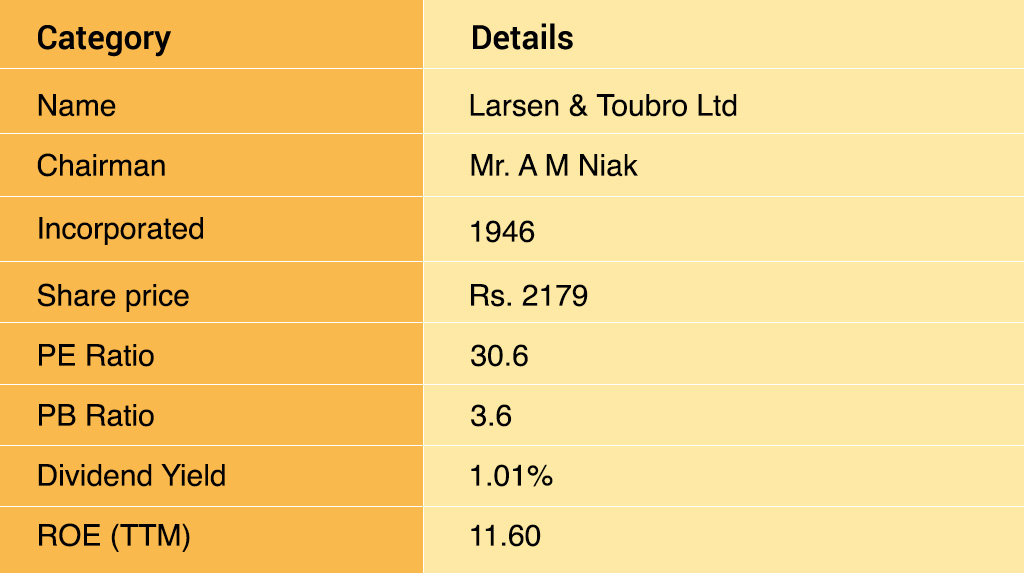

L&T is primarily engaged in providing solutions in the engineering, procurement, and construction (EPC) side in key sectors such as Infrastructure, Power, Hydrocarbon, Process Industries, and Defence, Information Technology, and Financial Services. The company has a huge presence in domestic and international markets. The key details of the company are tabled below.

L&T is primarily engaged in providing solutions in the engineering, procurement, and construction (EPC) side in key sectors such as Infrastructure, Power, Hydrocarbon, Process Industries, and Defence, Information Technology, and Financial Services. The company has a huge presence in domestic and international markets. The key details of the company are tabled below.

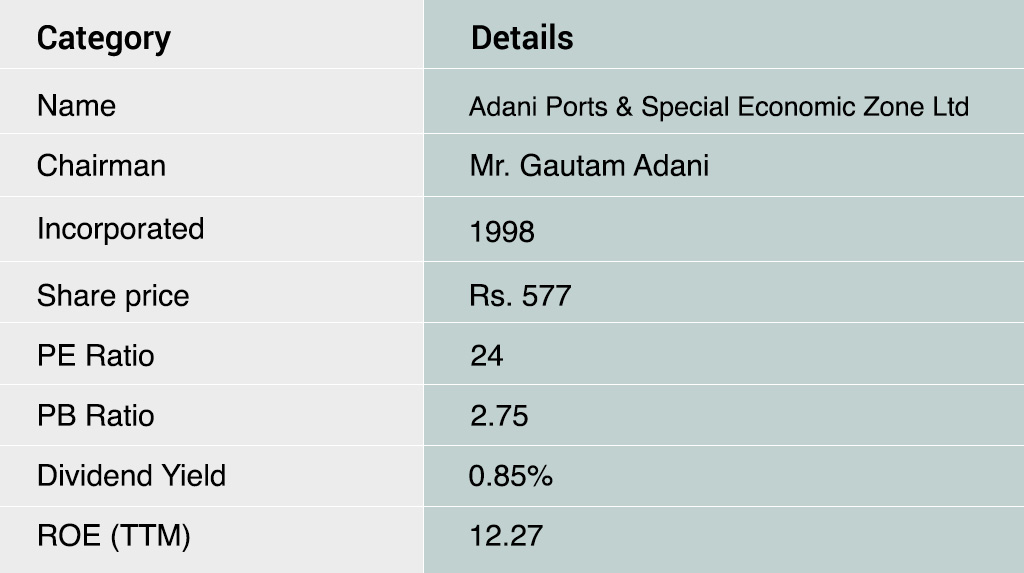

Adani Ports has been a constant name in the stock market recently. The company is in the business of development, operations, and maintenance of port infrastructure (port services and related infrastructure development) and has linked multi-product Special Economic Zone (SEZ) and related infrastructure contiguous to Port at Mundra.

Adani Ports has been a constant name in the stock market recently. The company is in the business of development, operations, and maintenance of port infrastructure (port services and related infrastructure development) and has linked multi-product Special Economic Zone (SEZ) and related infrastructure contiguous to Port at Mundra.

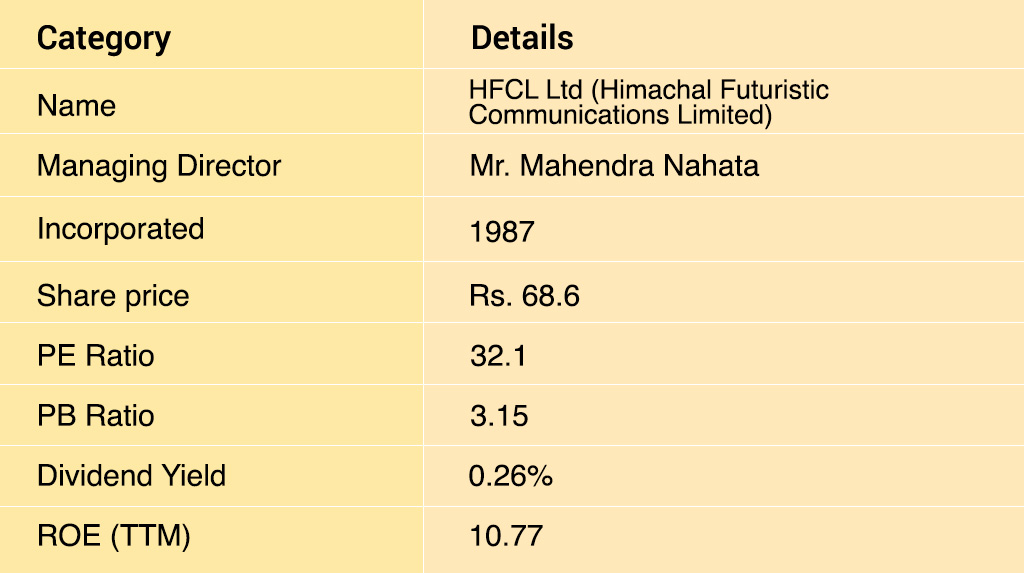

HFCL Limited is engaged in the business of providing diverse telecom infrastructure enablers with active interest spanning telecom infrastructure development, system integration, and manufacture and supply of high-end telecom equipment, Optical Fiber, and Optic Fiber Cable (OFC).

HFCL Limited is engaged in the business of providing diverse telecom infrastructure enablers with active interest spanning telecom infrastructure development, system integration, and manufacture and supply of high-end telecom equipment, Optical Fiber, and Optic Fiber Cable (OFC).

India is considered to be a bright spot amid the growing concerns of recession across the globe. The infrastructure outlay set by the government for the ‘ Amrit Kaal’ will be a key piece in setting the path for accelerated growth and India being a developed nation. We hope this article was able to give you an insight into the future of the infrastructure sector in the country backed by good government initiatives and exceeding investments from domestic as well as international players in this segment. Do let us know if there are any other sectors that you need information on and watch this space for more such information. Till then happy reading!

We often hear Mr. Nitin Gadkariu saying that India will be a hub for electric v...

The IT sector has enjoyed huge growth over the past decades, however, the past ...

The recent Union Budget 2023 had a special focus on renewable energy and the go...