After the buzz around the general elections in India had just concluded, the stage was set for the 1st Budget in Modi 3.0 government. The world has been saying that India is a shining example of a rising economy amidst the gloom of war and related economic issues. However, a constant criticism this government faced is that this has largely been a jobless growth. The 11th consecutive budget in the Modi government has decided to tackle this issue head-on by launching multiple schemes and measures in this budget to boost employment, maintain its focus on infrastructure and agriculture, and implement some major tax rejigs. Check out this blog to learn about Budget 2024 key highlights and how they are going to impact your pockets.

Let us start with the key details that an average taxpayer in India looks forward to in any budget - what does it have for me? This budget saw a few major changes in the direct and indirect taxes and the details of the same are mentioned here.

There are several changes in the direct tax regulations in this Union Budget 2024-25. Let us go through them here.

The previous Budget 2023 had taken measures to give more push to the new tax regime and this budget follows the theme as well. The tax slabs under the new tax regime have been revised as follows and will be in effect from 1st April 2024.

This change is expected to give a tax savings of Rs. 17,500 for salaried taxpayers.

The Standard Deduction for salaried employees is increased from Rs. 50,000 to Rs. 75,000 effective from assessment year 2025-26

Deduction on family pension for pensioners increased from Rs. 15000 to Rs. 25000 effective from assessment year 2025-26.

Section 80CCD deduction limit for the employer's contribution to the pension scheme has been increased from 10% to 14% of the employee's salary during the previous year and will be in effect from 1st April 2024.

The holding period used for the calculation of long-term and short-term capital gains tax has been simplified to 12 months and 24 months. As per the revised rules, the holding period for listed and unlisted securities is,

Listed securities - Long-term if held for more than 12 months.

Other assets - Long-term if held for more than 24 months.

Furthermore, taxation of unlisted bonds and debentures is brought in sync with other debt instruments i.e., debt mutual funds which was earlier revised. Unlisted bonds and debentures will from now on be treated as short-term regardless of the holding period and taxes as per applicable slab rates.

Short-term capital gains on listed equity shares equity-oriented funds, and business trust units have been increased from 15% to 20% in this budget while the STCG on other assets (financial or non-financial) will be taxed at applicable slab rates.

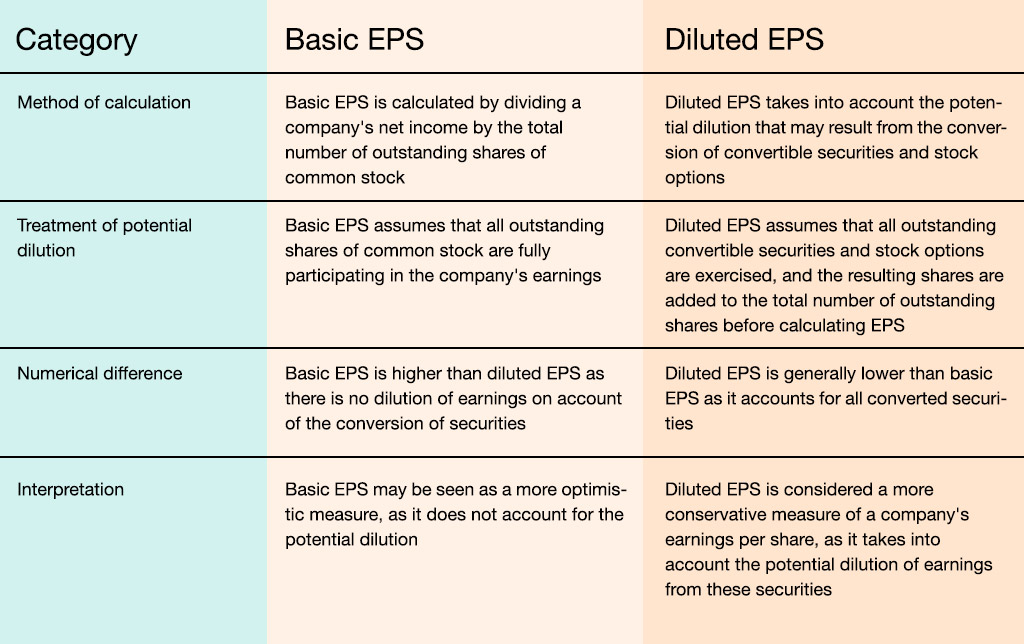

There have been several changes in the Long-term Capital Gains Tax with the aim to simplify the tax structure. These changes include,

Equity shares, equity-oriented units, and business trust units -

The exemption limit increased from Rs. 1,00,000 to Rs. 1,25,000 per year.

The tax rate increased from 10% to 12.5%.

New tax rate effective from 23rd July 2024.

Other financial and non-financial assets -

Tax rate reduced from 20% to 12.5%.

No more indexation benefit for sales from 23rd July 2024.

FMV as of 01.04.2001 can still be used as cost.

The proposed scrapping of Angel Tax provisions under Section 56(2)(viib) in Budget 2024 will be a significant boost for the startup ecosystem. This tax, which was levied on companies issuing fresh shares at prices above their Fair Market Value, created a burden during fundraising. Eliminating this provision, effective from 1st April 2024, will reduce compliance costs and save time, making it easier for startups to raise funds and grow their businesses.

The corporate tax on foreign companies is proposed to be reduced from 40% to 35%.

The STT (Securities Transaction Tax) on Futures and Options has been increased in this budget 2024 to curb overtrading in the F&O segment. The revised rates are given below and will be put in effect from 1st October 2024,

-on-Futures-and-Options.jpg)

Re-opening of Assessments beyond 3 years only if the escaped income is Rs 50,00,000 or more up to a maximum of 5 years. The time limit is reduced from 10 years to 6 years for search cases.

This budget has reintroduced the Vivaad se Vishwas Scheme to facilitate the settlement of income tax disputes and reduce litigation.

The monetary limits for filing tax dispute appeals have been increased to Rs. 60,00,000 for Tax Tribunals, Rs. 1,00,00,000 for High Courts, and Rs. 2,00,00,000 for the Supreme Court.

The Budget has also made a few changes in the TDS rules and the tax rates applicable on specified incomes. Here is a table highlighting these changes

Additional Points

Section 194F - Payment on account of repurchase of units by mutual funds or UTI is proposed to be omitted and will be in effect from 1st October 2024.

Section 194T - New TDS @10% on firm payments to partners, such as salary, remuneration, interest, bonus, or commission, exceeding Rs. 20,000 effective from 1st April 2025.

The indirect tax rules and duties have been revised for a few categories. Here is a comprehensive review of the rate structure to simplify customs duty rates and reduce disputes over the next six months.

The focus of this year’s budget, as mentioned above, was on MSME, infrastructure, boosting employment and upskilling. The interim budget in February 2024 highlighted the pathway for Viksit Bharat and Budget 2024 took it forward by making suitable provisions in the following key areas.

The government plans to transform agricultural research by focusing on productivity and climate resilience, funding projects in a challenge mode overseen by experts. It will release 109 high-yielding, climate-resilient crop varieties and initiate 1 crore farmers into natural farming with certification and branding support. Additionally, 10,000 bio-input resource centres will be established. Missions will target self-sufficiency in pulses and oilseeds, and large-scale vegetable production clusters will be developed near consumption centres, promoting FPOs, cooperatives, and start-ups. A Digital Public Infrastructure for agriculture will cover farmers and their lands within three years, starting with a digital crop survey for Kharif in 400 districts. Support for shrimp production, including breeding centres and financing through NABARD is proposed to be enhanced. A National Cooperation Policy will be drafted to boost the cooperative sector and rural economy, with an allocation of Rs. 1.52 lakh crores for agriculture and allied sectors.

The government will implement three 'Employment Linked Incentive' schemes as part of the Prime Minister's package

Scheme A offers one month's wage (up to Rs. 15,000) for new workforce entrants

Scheme B incentivises job creation in manufacturing

Scheme C supports employers by reimbursing up to Rs. 3,000 per month for two years for additional employees' EPFO contributions.

Efforts to increase women's workforce participation include establishing working women hostels and women-specific skilling programmes. A new centrally sponsored skilling scheme aims to train 20 lakh youth over five years, upgrade 1,000 ITIs, and align courses with industry demands. The Model Skill Loan Scheme will be revised to provide loans up to Rs. 7,50,000, benefiting 25,000 students annually, while education loans up to Rs. 10,00,000 for higher education in domestic institutions will be offered.

The government will adopt a saturation approach to ensure comprehensive social justice by covering all eligible individuals through education, health, and economic support schemes for craftsmen, artisans, self-help groups, and entrepreneurs. The Purvodaya plan will focus on the holistic development of the eastern region, including Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh, with an emphasis on human resources, infrastructure, and economic opportunities. Key initiatives include developing an industrial node at Gaya, enhancing road and power infrastructure, and building new airports, medical colleges, and sports facilities in Bihar. Additionally, over Rs. 3 lakh crore will be allocated to schemes promoting women-led development.

The government is introducing a comprehensive support package for MSMEs, focusing on financing, regulatory changes, and technology. Key measures include a Credit Guarantee Scheme for term loans without collateral, a new MSME credit assessment model based on digital footprints, and a mechanism to continue credit support during stress periods. Mudra loan limits will be increased to Rs. 20 lakh for successful previous borrowers, and mandatory TReDS onboarding thresholds will be reduced to Rs. 250 crores to improve working capital access. SIDBI will open new branches in MSME clusters, and financial support will be provided for food irradiation units and quality testing labs. E-Commerce Export Hubs will be established to facilitate international trade for MSMEs and artisans.

For broader manufacturing and services development, the government will create investment-ready industrial parks, support rental housing for workers, and implement shipping industry reforms. The Critical Mineral Mission will focus on domestic production, recycling, and acquisition of critical minerals. Additionally, offshore mineral mining will begin with the auction of exploration blocks. The Digital Public Infrastructure (DPI) applications will be developed to enhance productivity and innovation, and reforms will be made to improve the Insolvency and Bankruptcy Code (IBC) process, including establishing new tribunals and strengthening debt recovery systems.

The government plans to develop cities as growth hubs through strategic economic and transit planning, focusing on orderly peri-urban expansion. A framework for transformative brownfield redevelopment will be established, and Transit Oriented Development plans will be formulated for 14 large cities. Under PM Awas Yojana Urban 2.0, Rs. 10 lakh crore will be invested to address housing needs for 1 crore urban poor and middle-class families, with Rs. 2.2 lakh crore in central assistance over 5 years. Additionally, policies for transparent rental housing markets will be implemented, and partnerships will promote water supply, sewage treatment, and solid waste management projects in 100 large cities, including the use of treated water for irrigation and tank replenishment.

The government will draft a policy document to balance employment, growth, and environmental sustainability in energy transition. The PM Surya Ghar Muft Bijli Yojana, with over 1.28 crore registrations, will be further encouraged. A new policy for pumped storage projects will enhance the integration of renewable energy. Research and development of small modular nuclear reactors will be advanced in collaboration with the private sector. The NTPC-BHEL joint venture will establish an 800 MW plant using Advanced Ultra Super Critical technology, supported by fiscal incentives. A roadmap will be created to transition 'hard to abate' industries from energy efficiency to emission targets. Additionally, investment-grade energy audits and financial support will be provided to traditional micro and small industries for cleaner energy and efficiency improvements, with plans to expand this support to 100 more clusters.

The central government will allocate Rs. 11,11,111 crore for infrastructure capital expenditure this year, representing 3.4% of GDP, and will maintain strong fiscal support for infrastructure over the next five years. States are encouraged to match this scale of investment, with Rs. 1.5 lakh crore provided in long-term interest-free loans. Private infrastructure investment will be boosted through viability gap funding and new financing frameworks. Phase IV of Pradhan Mantri Gram Sadak Yojana (PMGSY) will enhance all-weather connectivity to 25,000 rural habitations. Additionally, the government will support the development of key tourism sites, including Vishnupad Temple, Mahabodhi Temple, Rajgir, Nalanda, and Odisha’s scenic and cultural attractions, to promote India as a global tourist destination.

The government will operationalise the Anusandhan National Research Fund to support basic research and prototype development and establish a mechanism to foster private sector-driven research and innovation with an Rs. 1 lakh crore financing pool. To expand the space economy fivefold over the next decade, a venture capital fund of Rs. 1,000 crore will be created.

The government will develop an Economic Policy Framework to guide next-generation reforms aimed at enhancing productivity and efficiency across land, labour, capital, and technology. This includes incentivising state-level land reforms, digitisation of land records, and integrating labor services with e-shram and other portals. The financial sector will receive strategic guidance to meet future needs, and a taxonomy for climate finance will be developed to support green transition goals. Reforms will also simplify FDI regulations, introduce a variable capital company structure for leasing and private equity, and promote technology adoption. The Jan Vishwas Bill 2.0 and state-based business reforms will improve the ease of doing business, while data governance will be enhanced through better use of technology and existing databases.

Read More: What is Financial Planning?

This budget also highlights that the fiscal deficit is expected to be 4.9% of the GDP for the current fiscal year and the target is to reduce it to 4.5% by the end of the next fiscal year. Budget 2024 is seen as one of the major budgets in the tenure of the Modi government especially for its revised regulations in taxation as well as major allocation of resources to key areas of the economy like MSME, manufacturing, infrastructure, agriculture, new energy, etc. These allocations are part of the government’s commitment to move towards being the third-largest economy and their vision of a developed India by 2047.

You can check out more budget insights in a brief snapshot in a presentation provided by the government.

What do you think of this budget, especially the tax reforms? Are they a welcome change or not? How will it affect your portfolio? Let us know your thoughts and reach out to us if you have any queries on this budget or the changes proposed and their short-term or long-term impact on stock markets.

Till then Happy Reading!

Read More: LIVE Stock Data Feed API for NSE, BSE, NIFTY & SENSEX

The Budget Day in India is celebrated as a national event that every citizen awa...

The year 2023 is about to end in a month and it is almost time to set your new ...

On February 1st, 2023, the Honourable Finance Minister Mrs. Nirmala Sitharaman ...